94 tankers violated the embargo and brought Russian oil to the EU during the last three months

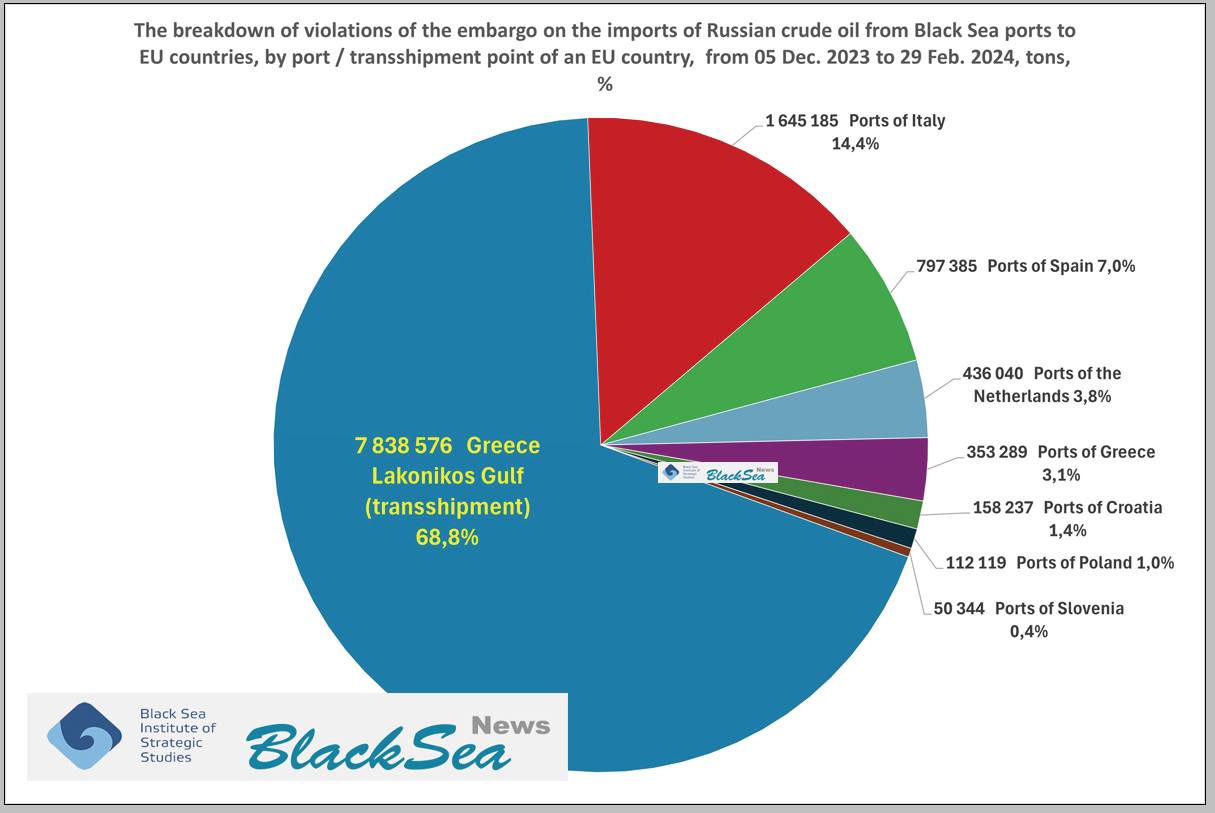

68% of the oil was brought to the Laconian Gulf in Greece for transshipment, while the rest was directly exported to the EU ports amid poor sanctions management.

According to the Black Sea Group monitoring, between 5th December 2023 and 29th February 2024, Russia exported 82.9 million barrels of oil to the EU through Black Sea Ports, using 94 mainly EU-owned tankers.

68.8% of Russian oil exported to the EU through Black Sea ports in December-February were delivered to the raid transshipment in the Gulf of Laconia near the coast of Greece. This transshipment is located within the exclusive maritime economic zone of Greece, where only the Greek authorities have the authority. The other 31.2% were delivered directly to EU ports even though sanctions prohibit it.

Russian tankers delivered crude oil the most frequently to Italian ports, going there directly from the Russian Black Sea ports. The volume of such Italian (mainly Sicilian) violations was 14.4% of all Russian Black Sea exports to the EU, involving ports of MILAZZO, AUGUSTA, TRIESTE, TARANTO, and SANTA PANAGIA. The Spanish ports of CARTAGENA and BILBAO also received Russian oil, as well as the Dutch port of ROTTERDAM, Croatian OMISALJ, Polish GDANSK, and Slovenian KOPER.

A total of 94 tankers brought Russian oil to these EU ports during the mentioned period. 52 of them belong to Greek companies, 11 – to Turkish companies, 4 – to Russian, registered in Dubai, 4 – to Russian, registered in India, while the rest belong to companies from Moldova, Cyprus, China, Denmark, Malta, UK, Latvia, Indonesia, Malaysia.

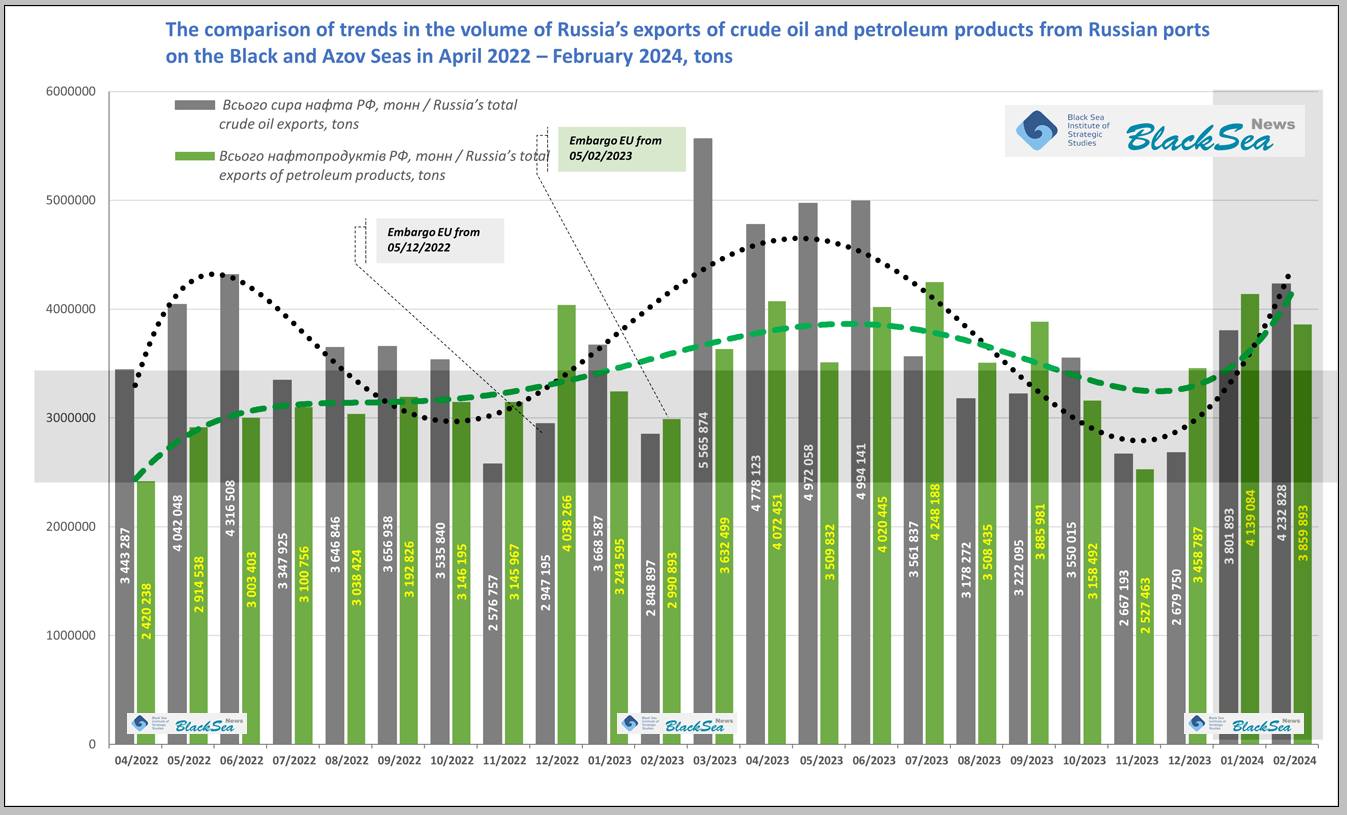

Data regarding total Russian exports of crude oil and petroleum products through Black Sea ports demonstrates that these exports remain stable despite Western sanctions, reaching 4.2 million tons of crude oil exports and 3,9 million tons of petroleum products exports through Black Sea ports in February 2024.

Black Sea remains the main Russian export route, given the EU’s poor management over implementing its own sanctions.

At the same time, Indian refiners have recently decided to stop accepting crude cargoes on tankers owned by Russian state-run Sovcomflot. The shipping giant had carried about one-fifth of Russia’s oil sales to India last year. Now its fleet of over 100 vessels is effectively shut out from that major market as refiners there refuse to take on the sanctions risk.

Amid weak sanctions and in an attempt to disrupt Russia’s petroleum revenues, Ukraine has started its campaign of long-range strikes against Russian oil refineries. Since the beginning of the year, more than ten large refineries have been damaged. The number of major oil refineries in Russia is limited to 32, and Russia has already prohibited the export of petroleum to cover its internal needs.

Read more:

- Frontline report: Long-range Ukrainian drones target Russian fuel depots and airfields

- Ukraine denies FT’s report that US requested to halt strikes on Russia’s oil refineries

- Inside Russia’s “Special liberation operation”: how expat rebels raid Putin’s borderlands

- FPV drone tactics reshape conventional trench warfare in Russo-Ukrainian War

- Bloomberg: Russian oil exports finally facing real sanctions squeeze

- One more Russian oil refinery exploded last night