Amazon says consumers cautious as it forecasts revenue below Wall Street targets

Amazon reported slowing online sales growth in the second quarter and said cautious consumers were seeking out cheaper options for purchases, sending shares down nearly eight per cent.

Amazon reported slowing online sales growth in the second quarter and said cautious consumers were seeking out cheaper options for purchases, sending shares down nearly eight per cent.

The after-hours stock drop came despite second-quarter profit and cloud computing sales that beat analyst estimates.

Amazon shares had gained over 20 per cent this year through the session close on Thursday, and investors were disappointed that the company forecast current-quarter sales below Wall Street estimates.

Amazon’s CFO, Brian Olsavsky, told reporters on a call that consumers “are continuing to be cautious with their spending trading down.”

He added, “They are looking for deals,” and noted that lower priced products were selling briskly.

CEO Andy Jassy agreed, adding on a call with analysts that customers were trading down on price when they could.

Amazon’s online retail business has faced heightened competition from budget retailers like Temu and Shein, which sell a wide variety of goods at bargain-basement prices direct from China.

The comments echoed similar ones from Oreo-maker Mondelez, PepsiCo and Kraft, which in recent days highlighted challenges facing American consumers.

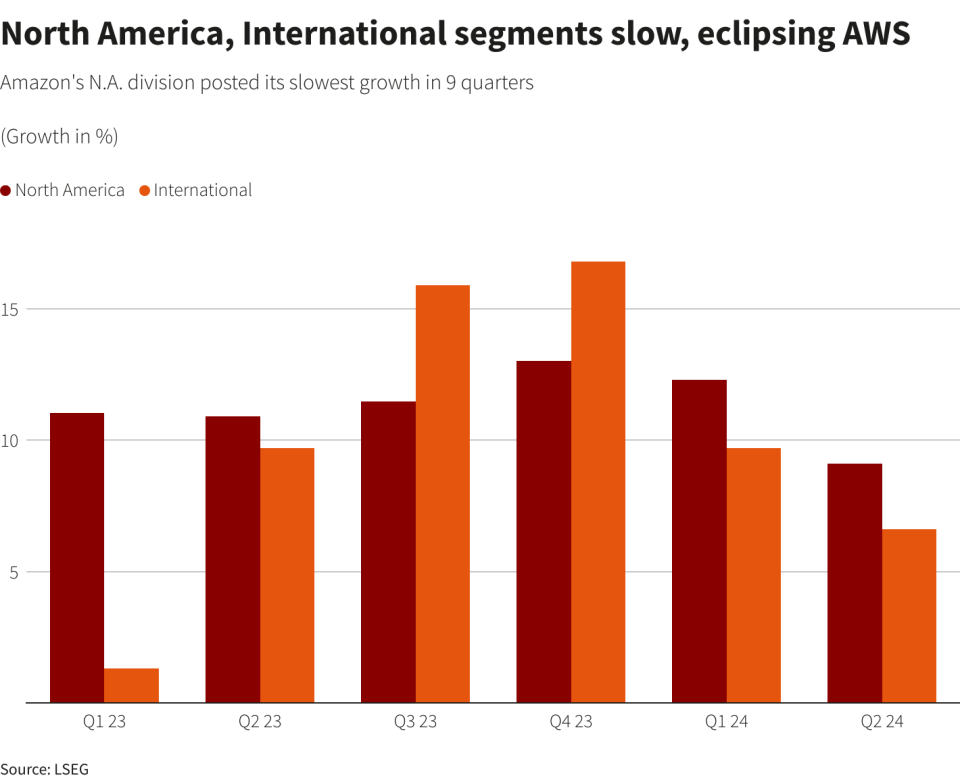

Amazon’s online stores sales rose 5 per cent in the second quarter to $55.4bn, compared with growth of 7 per cent in the first quarter.

One analyst said slowing retail sales growth was driving the post-market shares sell-off.

“They’re showing continued momentum on cloud in terms of re-acceleration and so that’s certainly where I think investors will be more positive, but the retail aspect is definitely what’s weighing on the stock right now,” said Charles Rogers, analyst at M Science.

“We’re continuing to make progress on a number of dimensions, but perhaps none more so than the continued re-acceleration in AWS growth,” Jassy said in a release announcing the results. Amazon Web Services (AWS) is Microsoft’s cloud business.

Olsavsky told reporters it was difficult to make predictions for the third quarter because events like the presidential election and the Olympics in Paris were distracting consumers.

He said Amazon’s two-day discount sales event known as Prime Day in July was its “biggest ever,” without providing specifics.

On Wednesday, Kraft said it has had to offer more entry-level price points, expand its range of Oscar Mayer products at dollar stores and introduce Capri Sun multi-serve bottles because more shoppers were seeking value.

Amazon playing catch-up on AI

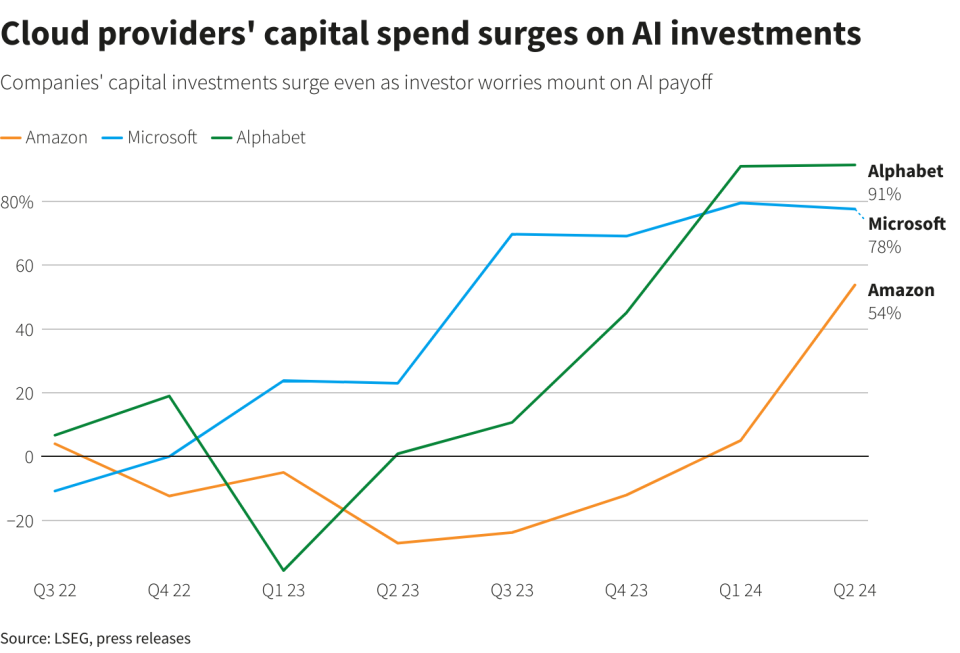

Like other big tech companies, Amazon is boosting capital expenditures to invest in infrastructure for and development of artificial intelligence.

Olsavsky said spending in this year’s first six months was about $30.5bn, suggesting about $16.5bn in the second quarter.

Seattle-based Amazon is playing catch-up with rivals Microsoft, which partners with OpenAI, and Google in developing its own so-called large language models that can respond nearly instantly to complicated queries or prompts.

It has rolled out a chatbot, dubbed Rufus, designed to help customers make purchasing decisions for specific purposes.

Both Google-parent Alphabet and Microsoft cautioned investors last month that expenses would remain elevated throughout the year to support developing pricey AI software and services. Investors took that as a signal that a payoff from the buzzy technology could take longer than originally hoped.

Amazon Web Services reported a 19 per cent increase in revenue to $26.3bn for the second quarter, surpassing market estimates of $25.95bn.

The company expects revenue of $154.0bn to $158.5bn for the third quarter, compared with analysts’ average estimate of $158.24bn, according to LSEG data.

Amazon also missed estimates for advertising sales, a closely watched metric, as it ramps up competition with rivals Meta Platforms and Google.

Sales of $12.8bn in the quarter compare with the average estimate of $13bn, according to LSEG data.

The company earlier this year began placing ads in its Prime Video offering for the first time. Still, Olsavsky said he was pleased with the advertising results. Those sales grew 20 per cent in the quarter.

Reuters – by Deborah Mary Sophia