Bloomberg: Russian oil exports finally facing real sanctions squeeze

Western sanctions have begun to disrupt Russia's oil exports, with recent developments indicating growing challenges for Moscow's efforts to maintain its crucial energy sales.

For the first time since its invasion of Ukraine over two years ago, Russia’s oil export machine is being meaningfully disrupted by western sanctions. Several recent developments signal increasing friction for Moscow’s efforts to keep selling its crucial energy exports despite layers of restrictions imposed by the US, Europe and allies, Bloomberg reports.

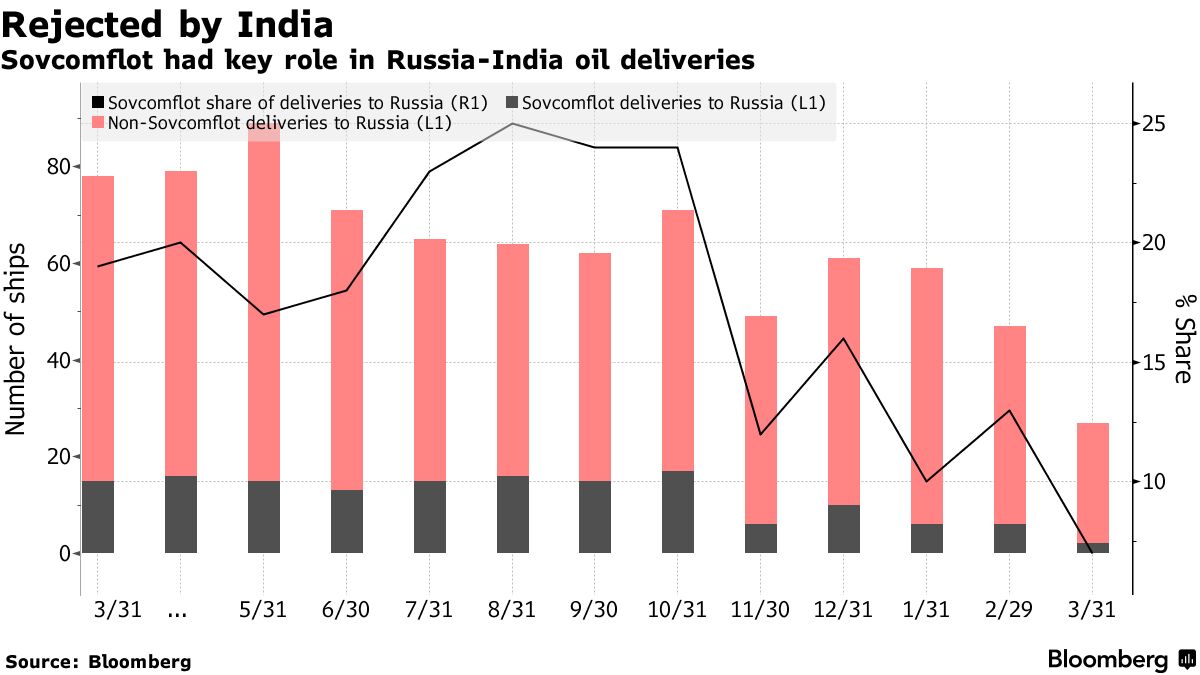

The most symbolic blow came as Indian refiners, Russia’s second biggest oil customer after China, decided to stop accepting crude cargoes on tankers owned by state-run Sovcomflot. The shipping giant had carried about one-fifth of Russia’s oil sales to India last year. Now its fleet of over 100 vessels is effectively shut out from that major market as refiners there refuse to take on the sanctions risk.

Dozens of other Russian tankers recently targeted by US sanctions have failed to load any new cargoes since being blacklisted. At least seven Sovcomflot ships appear to have gone entirely dark, disappearing from tracking systems in the Black Sea. The company itself admitted this week that western penalties have severely disrupted operations.

Meanwhile, Russian diesel cargoes are piling up at sea unable to find buyers. Over 6 million barrels were floating idle as of mid-March, the highest volume since at least 2017, according to data analytics firm Kpler. The apparent diesel glut comes despite Ukraine’s efforts to crimp supplies through drone attacks on Russian refineries.

“We’re definitely seeing stepped up US sanctions pressure on both Russian crude and exports,” said Greg Brew, an analyst at Eurasia Group. “It comes at a time when Ukraine’s fortunes on the battlefield are starting to decline.”

While Russia can still lean on a “shadow fleet” of re-flagged tankers to bypass restrictions, the shipping costs have skyrocketed. Delivering Russian crude to China now incurs around $14.50 per barrel in freight fees, over half of which is directly attributable to sanctions, according to estimates from Argus Media.

The growing supply-chain barriers mark a shift for the Kremlin. For most of the last two years, Russia managed to reroute huge volumes of oil to cooperative nations like India, allowing it to sustain a major revenue stream financing the invasion against Ukraine despite western restrictions. But that picture is changing, gradually tightening the economic vise on Vladimir Putin as the war grinds on.

“Washington still has powerful tools to hurt Russian oil exports, but has used them cautiously, fearing a spike in gas prices in an election year,” said Janis Kluge, a sanctions expert at the German Institute for International and Security Affairs. While the impact remains limited for now, “it will drive up shipping costs and price discounts for Russian oil.”

As the layers of penalties thicken, all eyes are on how far the US and allies will go ahead of a heated 2024 election cycle when high energy costs could enrage American voters.

Since its full-scale invasion in 2022, Moscow has been able to maintain a robust trade, even increasing its oil revenues. This resilience is attributed to the country’s ability to reroute its oil exports to friendly nations like India and China, bypassing the sanctions. As a result, Russia has continued to earn significant revenue from its fossil fuel exports, which has supported its economy and war efforts against Ukraine.

Recently, Ukrainian drone strikes have targeted Russian oil refineries, reducing the country’s refining capacity and forcing a temporary ban on gasoline exports to stabilize domestic prices.

These developments suggest that while Russia has been able to circumvent some of the sanctions, the combined effects of targeted attacks on its oil infrastructure and stricter enforcement of sanctions are beginning to disrupt its oil export machine. This could have significant implications for the Kremlin’s ability to sustain its invasion of Ukraine.

You could close this page. Or you could join our community and help us produce more materials like this.

We keep our reporting open and accessible to everyone because we believe in the power of free information. This is why our small, cost-effective team depends on the support of readers like you to bring deliver timely news, quality analysis, and on-the-ground reports about Russia's war against Ukraine and Ukraine's struggle to build a democratic society.

A little bit goes a long way: for as little as the cost of one cup of coffee a month, you can help build bridges between Ukraine and the rest of the world, plus become a co-creator and vote for topics we should cover next. Become a patron or see other ways to support.