Can Europe fill in the gap if Trump abandons Ukraine?

Nearly half of Ukraine’s air defense systems and reconnaissance capabilities come from the US—assets that Europe, with its fragmented defense industry, cannot quickly replicate, experts warn.

As Donald Trump’s return to the White House raises questions about continued US support for Ukraine, Europe faces a critical challenge. Some propose freezing the war along current battle lines, with Western security guarantees and European troops monitoring the front to prevent another Russian attack.

While analysis shows European nations cannot quickly replace key US military assistance for Ukraine – particularly in reconnaissance, air defense, and long-range capabilities – the situation is not hopeless. Both European and Ukrainian defense industries are adapting rapidly, developing new capabilities and expanding production to meet these growing challenges.

EU and US aid gap

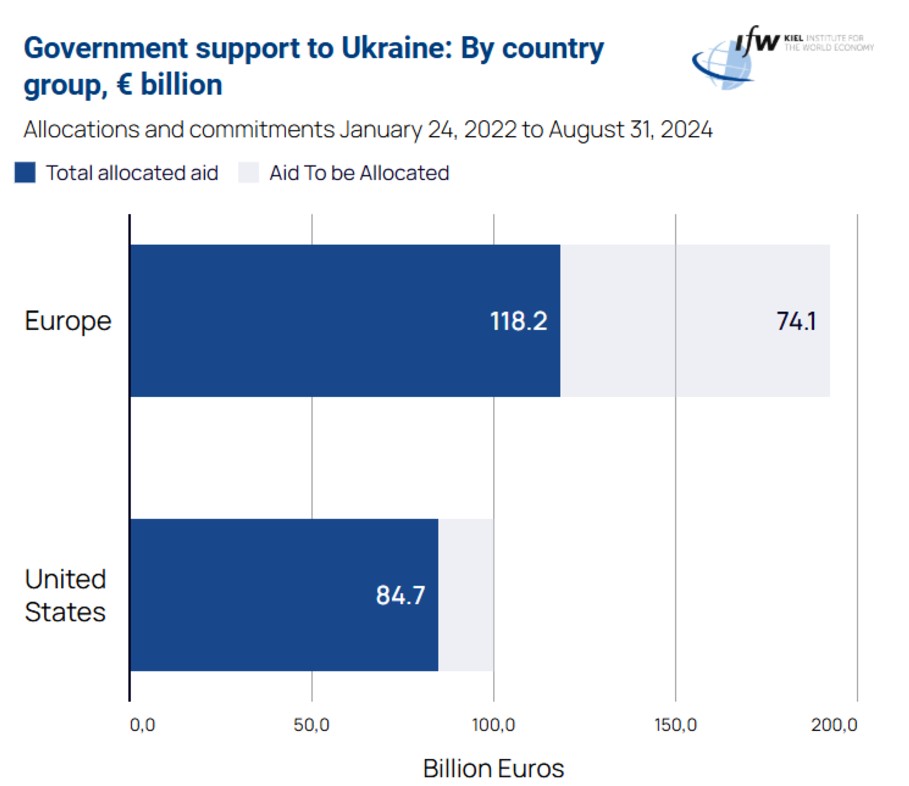

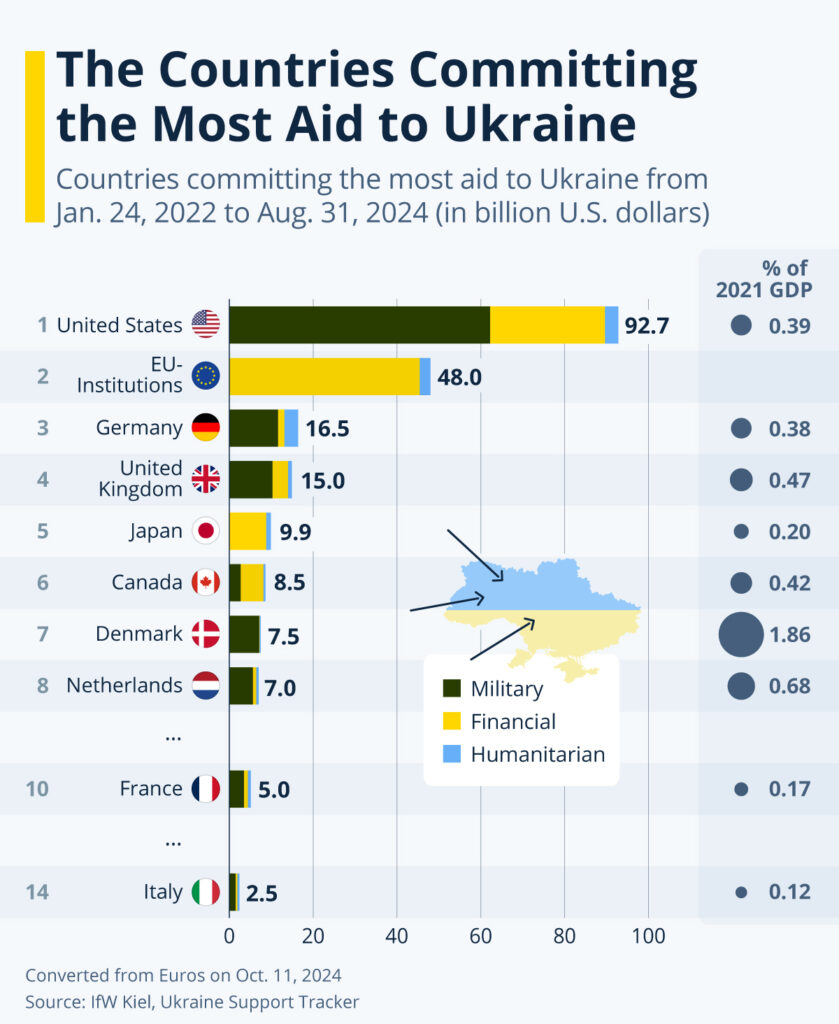

According to recent data from the Ukraine Support Tracker, Europe is the leading supporter of Ukraine, significantly outpacing US contributions. European nations have pledged €192 billion in total aid, with €118 billion already delivered, compared to the United States’ €100 billion pledge and €84 billion in delivered assistance.

However, a crucial distinction lies in the nature of this support. While the US package comprises over 67% of military aid, European assistance includes less than half of military components. This disparity has raised concerns about Europe’s capability to fill potential gaps should US military support falter.

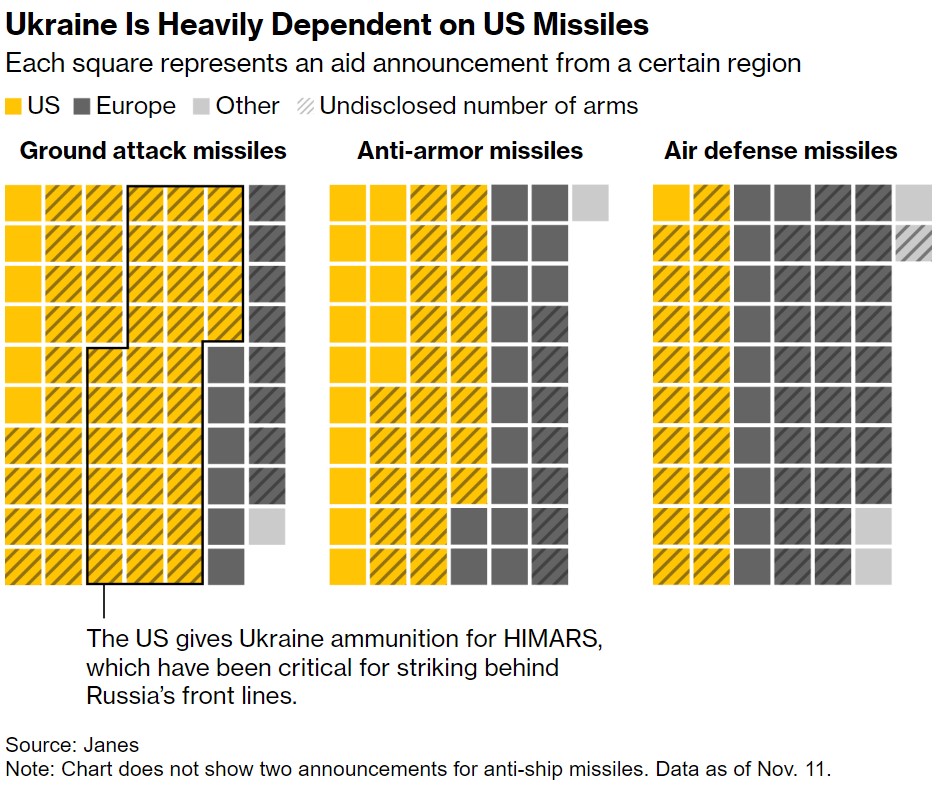

According to the Ukraine Support Tracker, the US leads in providing Ukraine with several types of military equipment.

- 352 of 1,189 Infantry Fighting Vehicles

- 201 of 661 howitzers

- 39 of 82 Multiple Launch Rocket Systems

- 18 of 77 air defense systems

- Ranks behind Poland, Netherlands, and Denmark in tank deliveries.

It would be hard for Europe to replace substantial US contributions in the mentioned areas, though it may find necessary equipment reserves. However, as noted by defense analysts Fabian Hoffmann and Ivan Kyrychevskyi, there are several critical areas where Europe is significantly dependent on US capabilities and won’t be able to replace them at all shortly:

- Advanced surveillance and reconnaissance systems

- Air defense and missile defense interceptors

- GMLRS ammunition for HIMARS systems

- Satellite reconnaissance

- Long-range strike capabilities.

Regarding the mentioned systems, Europe either doesn’t produce them at all or produces them in very small quantities, which also require American components.

According to Hoffmann, artillery ammunition production is the most promising sector. The EU has already achieved an annual production capacity of one million 155mm shells, with member states continuously investing in expanding both shell production and critical components like explosives. Hoffmann says that producing two million shells annually by mid-2025 appears realistic. Therefore, the EU could partially compensate for Ukraine’s military needs in this domain if US military supplies were to cease.

“No country in Europe, or European countries as a whole, will be able to replace the military assistance the US has provided Ukraine fully,” Defense Express military expert Ivan Kyrychevskyi stated.

The UK’s recent need for US approval to allow Ukraine to use Storm Shadow missiles on Russian territory demonstrates the challenges the EU might face if the US reduces support and sets conditions for the use of its components and technology for Europe.

“All precision weapon systems today depend on this technology, and no industry matches the United States in this field,” said Christian Mölling, deputy director of the German Council on Foreign Relations.

Six key hurdles of Europe’s military industry

European defense manufacturing is expanding but struggling to meet demands. While the EU delivered its promised 1 million artillery shells to Ukraine, this came almost a year late. Former ECB President Mario Draghi’s report identifies the core issue: insufficient investment for rapid production scaling, coupled with member states favoring domestic producers over an integrated European defense sector that could benefit from economies of scale.

The six major challenges that prevent Europe from quickly replacing US military assistance for Ukraine include:

- Insufficient Spending: European defense spending is still only about one-third of US spending ($313 billion vs. $916 billion in 2023), following decades of reduced military investments under the US security umbrella.

- Fragmentation: Defense companies operate in small domestic markets with limited production volumes, unlike the US, which consolidated its defense industry from 51 to 5 major companies after the Cold War.

- Lack of Coordination: There is no unified EU vision for weapons production or supply chains. This is evident in Ukraine, where the variety of equipment (e.g., ten different types of howitzers from EU countries) creates logistical challenges. For comparison, the US produces one type of howitzer.

- Foreign Dependency: EU countries heavily rely on foreign defense solutions, particularly from the US. From June 2022 to June 2023, 78% of EU defense spending went to non-EU suppliers, with 63% going to American products.

- Insufficient Innovation: The EU significantly lags behind the US in defense research and innovation investment, while next-generation weapons systems require funding beyond any single European nation’s capabilities.

- Weak Governance: Member states historically lack both political will and effective mechanisms for joint funding, procurement, maintenance, and modernization of defense products.

While Draghi proposes solutions such as prioritizing European defense solutions and improving coordination, some changes could take up to five years to implement. He concludes that even with political will, these systemic problems would prevent Europe from fully compensating for the potential reduction in US support to Ukraine.

EU pledges new defense commitments

Outlined technical limitations make it impossible for Europe to fully replace US military assistance for Ukraine as well as US weapons systems inside the EU in the short term. However, there’s growing consensus among both American and European politicians about the need for Europe to invest more in its defense manufacturing capabilities. Recent statements suggest a shift in European strategy, including readiness to take both a higher share in military aid for Ukraine and more responsibility for the EU’s own defense capabilities.

On 12 November, Kaja Kallas, the EU’s new High Representative for Foreign Affairs and Security Policy, emphasized in the European Parliament that “Ukraine’s victory is a priority for all of us.” She also underlined that China “must feel the higher cost” of supporting Russia’s war. Besides, she stated the priority of maintaining NATO unity, implicitly acknowledging that NATO would always be stronger than Europe or the US acting alone, facing the growing threat from an increasingly cohesive block of authoritarian states, including Russia, North Korea, Iran, and China.

Finally, Kallas indicated that Brussels should utilize nearly €300 billion in frozen Russian Central Bank assets to support Ukraine, including weapons procurement for Ukraine and from Ukrainian manufacturers.

On 22 October, the European Parliament greenlighted a €35 billion loan to Ukraine for both military and civilian needs, to be repaid with future revenues from frozen Russian assets. With 518 votes in favor, 56 against, and 61 abstentions, this mechanism still didn’t allow for confiscating assets and their transfer to Ukraine or, at least, for European defense production.

Ukraine’s defense industry takes center stage

Amid weapons shortages in Europe, the key issue now is who can produce more. Ukrainian manufacturers are taking the lead in certain equipment categories, such as drones, mortar and artillery ammunition, and even some types of armored vehicles.

In particular, Ukraine has manufactured over 2.5 million mortar shells and artillery ammunition since the beginning of 2024, marking an increase from nearly nothing in 2021. This domestic production covers ammunition ranging from 60 mm to 155 mm caliber.

Regarding drones, Ukraine has also achieved its annual drone production targets, surpassing the previously announced goals of 10,000 medium-range strike drones, 1,000 long-range drones (over 1,000 km), and 1 million FPV drones.

The scale of Ukraine’s defense industry has expanded considerably, with 600 domestic enterprises now engaged in defense production. Additionally, over 40 foreign defense companies have established production or equipment maintenance facilities in Ukraine.

Ukrainian companies can produce nearly three times more weapons than the current Ukrainian budget can procure. The capacity of FPV drone producers already exceeds 4 million per year, while the state budget provides money to contract only slightly more than 1 million.

When the full-scale war began, Ukraine banned weapons exports to ensure all production went to its Armed Forces (AFU). As manufacturing capacity grew beyond military budget needs, a debate emerged about lifting the ban. Instead of resuming exports, Ukraine launched the Zbroyari project – a program where European countries could finance Ukrainian weapons production for the AFU. The message was clear: countries lacking manufacturing capacity could fund procurement from Ukrainian producers.

Ukraine lacks USD 10 billion to contract all domestic weapons production capabilities — Minister

Denmark pioneered this approach, investing €695 billion in Ukrainian Bohdana self-propelled artillery, long-range weapons, anti-tank and missile systems, and other armaments. The first equipment reached the front within months of payment. During Danish Prime Minister Mette Frederiksen’s visit marking the 1000th day of the war, Denmark allocated an additional €130 million, expected to deliver results just as quickly.

Following Denmark’s lead, Lithuania allocated EUR 10 million for Ukrainian Palianytsia jet drones, while Canada contributed $2.1 million towards drone production. Sweden and Norway also announced their intention to contribute.

Through joint contracts and shared security interests, the Ukrainian defense industry has evolved into a crucial European arms manufacturer. Ukraine now leads the production of drones, military vehicles, ammunition, and anti-tank weapons, with output data showing significant growth. As Ukraine defends against Russia, European investment in its defense manufacturing serves both parties’ security needs amid equipment shortages.

Speaking at the European Political Community summit, President Zelenskyy emphasized that peace can only be achieved through strength, declaring “there is no alternative to a strong Europe.” He stressed that Ukraine would need firm and clear-cut security guarantees from NATO and Europe in any ceasefire to prevent facing future Russian aggression alone.

Related:

- Peak cynicism: Russia co-hosts UN counter-terror energy meeting while bombing Ukraine’s grid

- Ukraine’s largest FPV drone makes history with first-ever assault rifle combat use

- As Trump readies Ukraine peace push, Europe’s military math doesn’t add up

- Ukraine’s digital forces eclipse NATO arms: defense report reveals war future

- It’s not 1,000 days of Russia’s war. It’s 3,925 — and Western risk aversion is setting up the next thousand