Can financial analysis predict the outcome of the Champions League quarter-finals?

By financial metrics, the ties are the most evenly pitted that they could be.

For those who bemoan the predictability of European football, this week’s Champions League quarter-finals should provide a counter argument.

Should – because by financial metrics the four ties are the most evenly pitted that they could be.

That is the assessment of Football Benchmark, an independent consultancy that was spun out of KPMG and specialises in financial analysis of elite football.

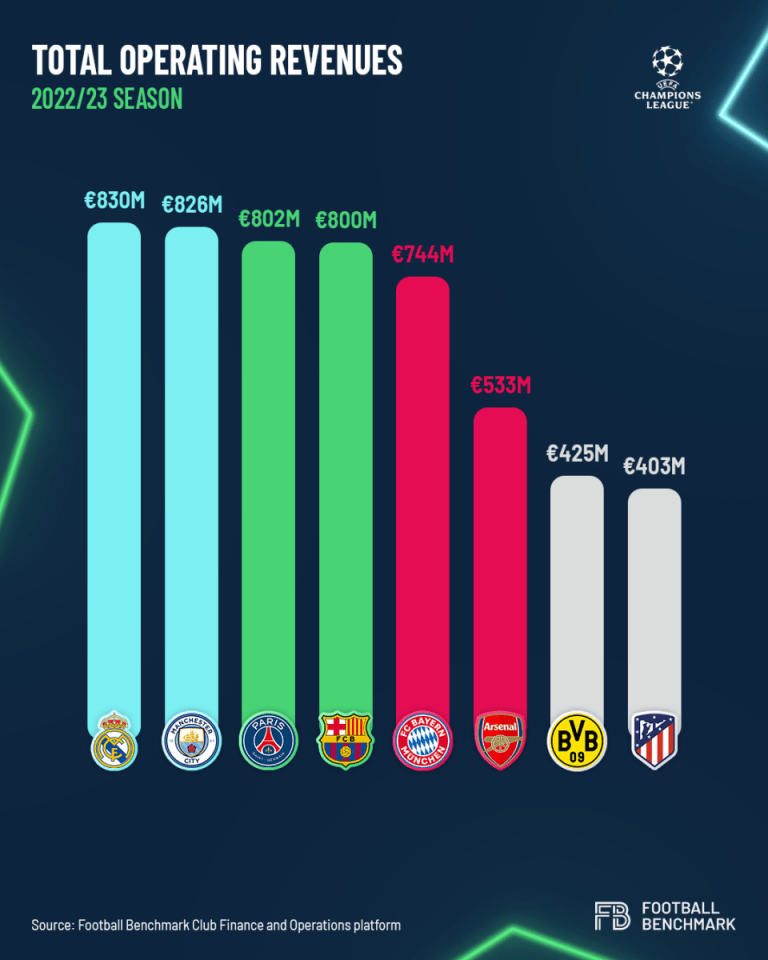

According to a Football Benchmark report published last week, the four Champions League quarter-finals represent first versus second, third versus fourth, fifth versus sixth and seventh versus eighth when the remaining teams are ranked for operating revenue.

For example, the two sides with the highest operating revenue – Real Madrid (€830m) and Manchester City (€826m) – will meet each other, as will the two with the lowest – Borussia Dortmund (€425m) and Atletico Madrid (€403m).

So it goes with Paris Saint-Germain (€802m) and Barcelona (€800m), and Bayern Munich (€744m) and Arsenal (€533m). The teams are also paired with their closest match when it comes to wage bill, too, albeit the order is different, with PSG and Barca first and second.

If all of this is borne out on the pitch on Tuesday and Wednesday then we should be in for a gripping, or at least hard to call, set of return legs next week.

Of course, this is an imperfect analysis as it is based only on financial data. While spending power does correlate closely with performance it is by no means a guarantee, as fans of Manchester United and Chelsea can currently attest.

Furthermore, the figures used by Football Benchmark relate to last season, as they are the most up-to-date available. But they therefore do not account for any changes to, for example, wage bill in the current campaign.

So how else can we objectively assess the teams’ relative strength? Two options are Uefa’s club coefficient for this season, which is updated after each round of European competition, and betting markets.

Uefa’s coefficient score reflects which teams have performed best in the 2023-24 Champions League. As with operating revenue, Manchester City (26.0) and Real Madrid (25.0) occupy the top two places, underlining that – in theory – they are well matched.

But elsewhere there are discrepancies. Bayern (23.0) have the third best coefficient, but their opponents, Arsenal (21.0), are joint fifth, suggesting a mismatch in favour of the Germans. Atletico Madrid (22.0) and Dortmund (21.0) are closer, as are Barca (21.0) and PSG (20.0).

The odds tell another story. Despite Bayern’s financial and coefficient advantage, Arsenal are firmly odds-on to eliminate the Bavarians. Holders City are the shortest price of any team to progress, while Atleti are also strongly fancied. PSG just shade Barca in the betting.

So, money is not the only determinant of Champions League success and the closeness of these ties remains to be seen. But the fact that all eight teams belong to the top 15 of Deloitte’s Football Money League underlines that cash clearly goes a very long way.