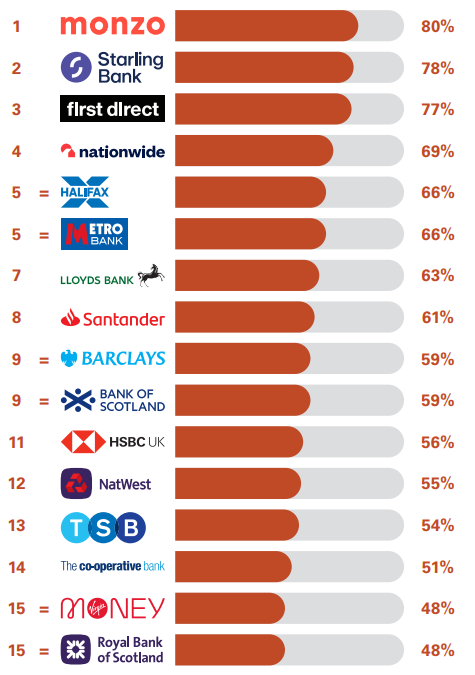

Challenger banks pip high street rivals again as Monzo tops league table

The UK's digital challenger banks have once again outperformed their high street rivals in a league table on customer satisfaction from the competition watchdog.

The UK’s digital challenger banks have once again outperformed their high street rivals in a league table on customer satisfaction from the competition watchdog, with Monzo coming out on top.

The Competition and Markets Authority’s (CMA) latest ranking of personal banking service quality found that Monzo, Starling and First Direct were the top three firms respectively for overall service quality, online and mobile banking services, and overdraft services.

Digital banks have boomed in both popularity and innovation in recent years to become a serious threat to the incumbent firms.

Meanwhile, high street lenders have faced high numbers of complaints related to “debanking” and branch closures. British lenders closed 645 branches last year, according to Which?.

Monzo yesterday announced that it had hit nine million customers, two million of which joined last year alone. It also claims to bank one in 16 UK businesses.

Lyndsey Edgar, vice president of Operations at Monzo, said on today’s ranking: “This is testament to the dedication of our employees, who continue to put our customers at the heart of everything we do.”

Virgin Money and Royal Bank of Scotland (RBS) came in joint bottom place overall, below TSB and Co-op Bank, although the latter two were in the middle of the pack for branch service.

A Virgin Money spokesperson acknowledged that it had “more work to do” on its personal current accounts.

They added: “The latest CMA survey recognises the enhancements for our business current account holders, where Virgin Money has moved three places up the rankings.”

An RBS spokesperson said: “We continue to work hard to improve all aspects of our customer experience.”

For those banks with physical locations, Nationwide and Metro Bank came joint top in the ranking of branch service.

The CMA’s ranking is rolled out biannually as part of the Retail Banking Order designed to boost competition in the sector.

It used data from a survey carried out by Ipsos between January 2023 and December 2023, asking around 1,000 customers from each bank to rate their provider.

The results show the percentage of participants who said they were either “extremely likely” or “very likely” to recommend their provider.

Named and shamed: Banks by overall service quality