Coutts: Prime London property prices to rebound as inflation subsides

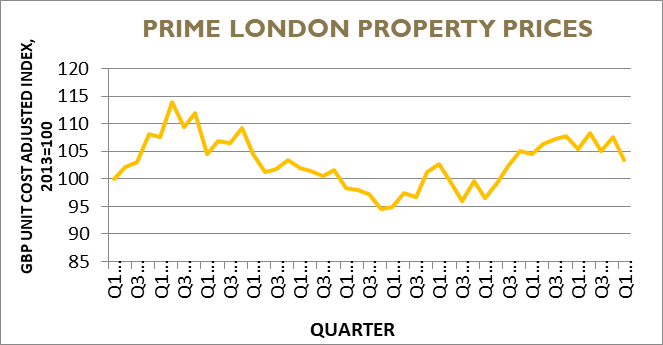

A cocktail of macroeconomic factors meant there was a 3.9 per cent drop in prime London prices in the last quarter.

Coutts Bank has said it expects a rebound in the London prime property market as pressures from high inflation and interest rates wear off.

The Natwest-owned bank released fresh figures this week showing prices had fallen in this quarter – but there were reasons to be positive also.

A cocktail of macroeconomic factors meant there was a 3.9 per cent drop in prime London prices in the last quarter.

Coutts said house prices were 1.6 per cent lower than the same period last year and still 9.3 per cent below the height of the market in 2014.

The first quarter of the year proved to be difficult with sales volumes: down seven per cent compared to last year.

London’s prime property market has not been immune from the economic challenges associated with higher inflation. As interest rates have gone up, borrowing costs have stayed high, meaning demand in the market has been pegged back.

A mixture of a pandemic exodus, as wealthier individuals left the capital for country pads and an exodus of some Russian oligarchs after the war in Ukraine, also helped to bring down prices.

In March it was reported that prime property prices in the capital remained at 2014 levels, but a recent slew of sales show jitters may be ending as the market gets moving again.

With rates due to come down, inflation falling and economic conditions set to improve this summer, some experts are optimistic.

Reasons to be cheerful

There were reasons to look up, however. New listing increased by 3.7 per cent compared to last year, and up a staggering 31.5 per cent compared to the previous quarter.

With the prospects of interest rates falling this summer, many prime property sellers are preparing to go to market. Coutts said selling time for prime properties was happening much faster, within an average of 161 days, the quickest Coutts has seen in the last 12 quarters.

In addition to an indication that there are willing buyers, the high net-worth lender also said that the average discount buyers are negotiating for in London is around eight to nine per cent, down from 9.2 per cent last quarter. It said that in the first quarter of the year, almost 45 per cent of sales had their asking price reduced, while 80 per cent were discounted.

Coutts also said that properties worth over £10m, the so-called super prime market was also performing strongly, with transaction volumes up 9.1 per cent compared to last year.

Where is hot, where is not

- Kings Cross, Islington: Coutts said sales volumes are down 81 per cent on last year. Prices were at a peak of £1,278 per square foot however, with very limited discounts compared to the rest of London.

- Hammersmith and Chiswick: More than half of the properties (52 per cent) were discounted, with buyers on average negotiating 4.5 per cent off the asking price.

- Mayfair & St James: Probably London’s swankiest area, Coutts said that for at least the last two quarters in a row, average prices had dropped below £2,000 per square foot. Prices are are around 18.6 per cent below peak.

- Central prime locations: Marylebone, Fitzrovia and Soho prices are 21.7 per cent below peak.

- Knightsbridge and Belgravia: Prices are 17.6 per cent. below peak levels.

The only way is up for London property?

Katherine O’Shea, director of Coutts real estate investment team, said: “There are some strong indicators here that 2024 will be a better year for prime London property than 2023, with prime central London long overdue a rebound.

“We’ve seen increased demand from those that wanted to move in 2023 but waited due to rising inflation and interest rates. Whilst general consensus is that price growth will be flat this year, prime central London should outperform the rest of the market over the next five years as price growth has been subdued over the last 10 years.

“Our data shows that some parts of the capital such as Mayfair and St James look extremely ‘cheap’ relative to historic prices.

“That said, there is high demand for and low supply of ‘best-in-class turn-key’ properties, meaning that buyers could have to pay asking or above asking price to purchase their dream home.”

Despite Coutts’s optimism, there are plenty of challenges, too.

Changes to planning laws made by Westminster Council could see the current boom in super-prime developments shut off and bring a scarcity value to expensive central pads in the next few years.

The local authority’s new restrictions, which were adopted in 2021 as part of the borough’s 2019-2040 ‘City Plan’, mean that no new residences or properties can be greater than 200 square metres in size, ‘except where it is necessary to protect a heritage asset’.