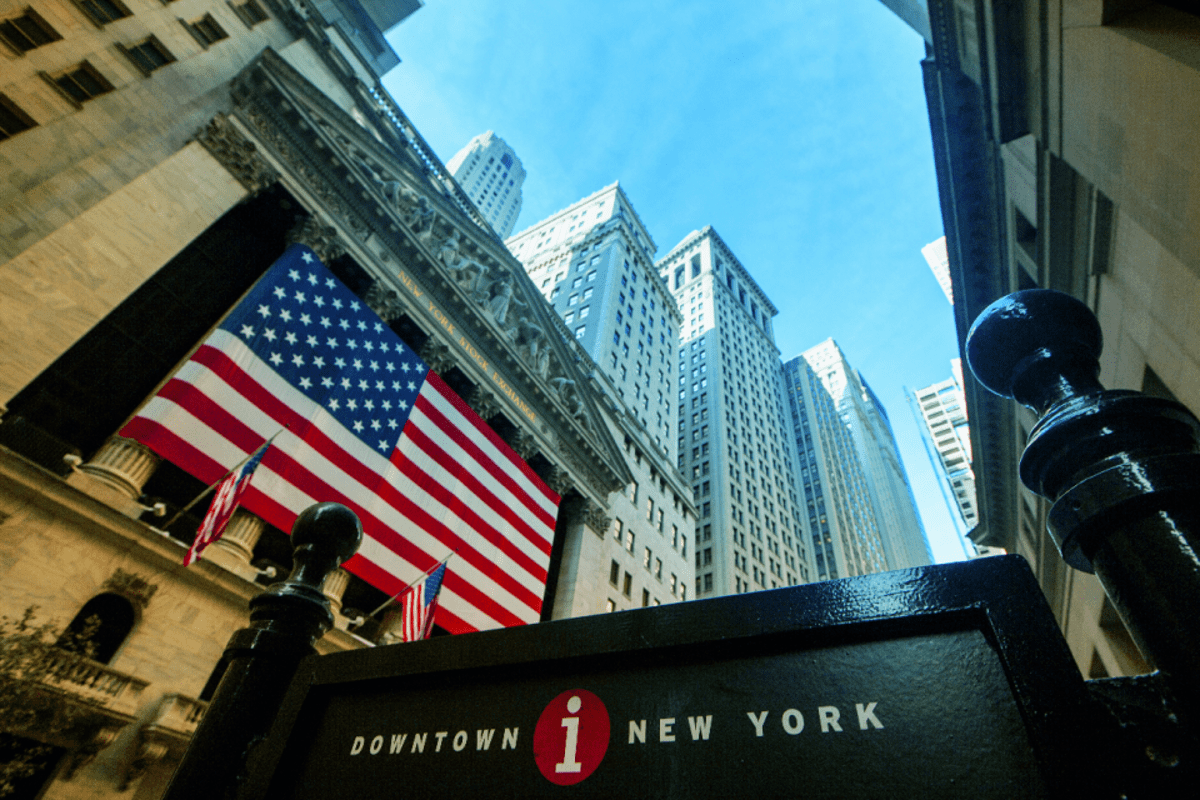

European banks’ US deal fee share nearly halves in a decade

European banks' share of US dealmaking fees has almost halved in a decade, new data has shown, as EU lenders push to grow their presence in the world's biggest market for investment banking.

European banks’ share of US dealmaking fees has almost halved in a decade, new data has shown despite EU lenders’ push to grow their presence in the world’s biggest market for investment banking.

Investment banks based in Europe currently represent 12.6 per cent of the dealmaking fee pool in the US so far this year, up from 11.1 per cent in 2023, according to data provider Dealogic.

However, their market share has tumbled from roughly a quarter in 2013 and nearly 30 per cent in the years before the 2008 financial crisis.

Over this period, US players have become increasingly dominant in their home territory. Wall Street banks’ market share grew to 78 per cent last year from 67 per cent in 2013.

In the US, Wall Street banks are especially dominant in the M&A space. European lenders took 7.8 per cent of that market last year, compared to 88 per cent for their US rivals.

A similar trend has been seen worldwide, with US banks claiming 53 per cent of the global fee pool last year, while their European rivals sunk to a record low of 21 per cent.

Wall Street investment banks, including boutiques, have cashed in on a pickup in dealmaking so far this year as a peak in interest rates has encouraged more risk-taking by investors.

Even in the UK, JPMorgan recently dethroned Barclays to take the top spot in a separate Dealogic fee league table for the first half of 2024.

But European banks have also benefited from signs of a rebound, with some setting ambitious targets to displace big US names.

UBS, which boosted staff numbers in its US investment bank by 60 per cent after acquiring Credit Suisse last year, is aiming to displace Wells Fargo from sixth in the Wall Street fee ranking.

UBS currently sits at 13th with a two per cent share, while Wells Fargo has 4.4 per cent.

Financial News first reported the figures.