European stagnation showing up in company results as continent falls behind US rivals

According to analysis from Liberum, S&P 500 listed firms who have reported results for the fourth quarter have seen revenue growth of 3.7 per cent year-on-year.

European firms are falling further behind competitors across the Atlantic as US firms continue to benefit from the continued strength of the world’s largest economy.

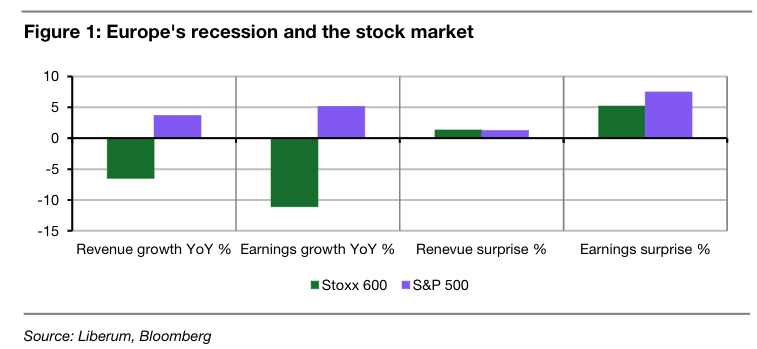

According to analysis from Liberum, S&P 500 listed firms who have reported results for the fourth quarter have seen revenue growth of 3.7 per cent year-on-year.

In contrast, European companies included on the Stoxx 600 have seen revenue drop 6.5 per cent on average.

The analysts said that weakness in Europe has been “broadly expected” by markets given the run of disappointing results in the third quarter. In the third quarter, earnings surprises in Europe fell to the lowest level in over two years.

The divergent fates of the tech sector in the US and Europe was one reason for the difference in performance, with US tech earnings growing three times as much as their European rivals.

European industrial firms meanwhile reported a “sharp decline” in earnings, with earnings down 29 per cent year-on-year. US industrial companies have seen earnings growth, largely due to resilient demand in aerospace and defence.

More than anything else, the analysts argued it reflects the contrasting fortunes of the US and European economies last year. “A big part of Europe is caught in a recession while the US is doing fine, at least in terms of GDP growth,” Susanna Cruz and Joachim Klement said.

“It’s no surprise then that half-way through this earnings season we see European companies reporting weaker results than US peers,” they continued.

The US economy powered ahead of Europe this year, shaking off the impact of the Federal Reserve’s campaign of interest rate hikes. It grew 2.5 per cent in 2023, accelerating from the 1.9 per cent expansion in 2022.

In contrast, European economies have stagnated. Figures out last week confirmed that the UK fell into a recession in the second half of last year.

The eurozone was stagnant in the final quarter of last year, a slight improvement on the 0.1 per cent contraction in the third quarter.