‘False alarm’: The post-pandemic global travel boom is showing no signs of slowing

Global travel has peaked nearly five years after the pandemic decimated the industry. How long will the boom last?

The Covid-19 pandemic was an unprecedented shock to the global travel industry. With borders shut, airlines began grounding fleets, hotels shuttered their doors and holidaymakers resigned themselves to staying on home soil foreseeable future.

Less than half a decade later and the picture is utterly different.

According to data from Oxford Economics, estimated traveller outlays reached $8.6 trillion (£6.4 trillion) in 2024, equal to nine per cent of global GDP.

In the UK, airlines raked in record profit, airports report record passenger traffic and executives speak of an unprecedented era of travel.

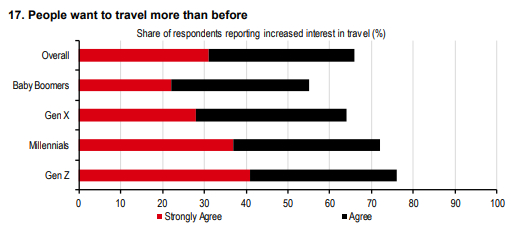

What was initially put down to “pent-up demand,” i.e. travellers desire to get out of the country following years of lockdown, now looks like a longer-term upward trend.

“Higher wealth levels at the richer ends of society, shifts in spending preferences, social media advertising and an abundance of travel options,” according to Bank of America analysts, has conspired to send travel demand into the stratosphere.

The rise is being replicated across the world and comes despite the cost of living crisis squeezing household budgets, and increasing geopolitical tension in a number of regions.

In Asia, a growing middle class has massively influenced its increasing dominance on the global stage.

International passenger demand on the continent grew a whopping 39 per cent to 208m in the first seven months of 2024, according to data from the International Air Transport Association (IATA).

Signs of turbulence

Despite the growth, there have been some signs of turbulence.

Such a huge rise in demand has piled pressure on struggling planemaker’s Boeing and Airbus, which are grappling with supply chain issues tied to pandemic-era staff shortages. Resulting delivery delays have led to complaints from major airlines that they won’t be able to meet capacity requirements.

Corporate travel demand is also slowing. In the UK, there has been no net increase in business aviation since 2006 and a surge in home-working during the pandemic has never really died down.

London City Airport, a hub for City travel, said for the first time that more than 50 per cent of its traffic is being made up of leisure passengers this year. When the peak summer months come to an end, corporate trips are often seen as a safety net for airlines and airports..

The biggest question though is whether the travel industry can find an answer to the ongoing threat soaring flight demand poses to the climate. Biofuels known as Sustainable Aviation Fuel (SAF) have been touted as a possible solution yet supply is desperately short and costs remain a huge barrier to uptake.

Airlines and airports will ultimately be well aware of the industry’s notoriously cyclical nature. Booms are often followed quickly by busts and when Ryanair in July reported a significant dip in profit and warned of “materially lower ticket fares,” it sparked a sell-off in airline stocks on London’s bourse.

There were fears at the time that the two-year boom may finally be coming to end.

But the expected downturn has never materialised, primarily due to the resilience demand has so far shown to wider trends.

London-listed package holiday provider On the Beach announced it had seen its best-ever year for bookings on Wednesday. On Tuesday, Tui said it was looking for at least 25 per cent growth in operating profit this year after a strong summer.

“False alarm,” Bank of America analysts said in a recent note. Forecasts for airlines’ earnings before interest and taxation (EBIT) have instead been revised upward to seven per cent for the full-year, with fares no longer expected to “fall off a cliff.”