Firms blame Budget uncertainty as economy slows sharply in third quarter

The UK grew at a slower pace than expected in the third quarter, according to new figures, with business groups pointing to the impact of uncertainty ahead of last month’s Budget. New figures from the Office for National Statistics (ONS) showed that the economy grew 0.1 per cent in the third quarter, after contracting 0.1 [...]

The UK grew at a slower pace than expected in the third quarter, according to new figures, with business groups pointing to the impact of uncertainty ahead of last month’s Budget.

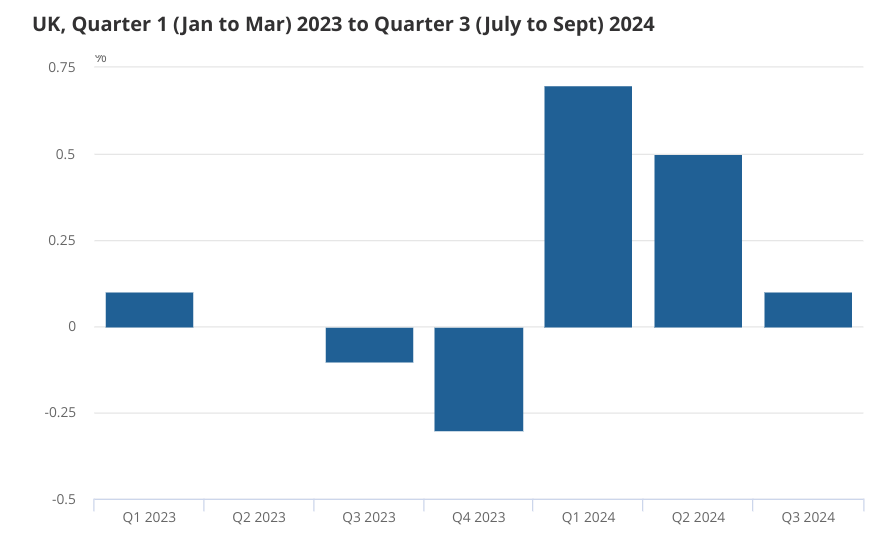

New figures from the Office for National Statistics (ONS) showed that the economy grew 0.1 per cent in the third quarter, after contracting 0.1 per cent in September.

Economists had expected both the quarterly and monthly figures to show a 0.2 per cent expansion.

The figures confirm that the economy has slowed significantly compared to the first half, when the UK was among the fastest growing G7 economies in the world.

“The economy grew a little in the latest quarter overall as the recent slowdown in growth continued,” Liz McKeown, director of economic statistics at the ONS said. “Generally, growth was subdued across most industries”.

Suren Thiru, ICAEW economics director, said “the third quarter outturn paints a more realistic picture of the UK’s underlying growth trajectory given longstanding challenges over poor productivity and persistent supply side constraints,”

The all-important services sector grew 0.1 per cent in the quarter while construction rose 0.8 per cent. However, production – which includes the manufacturing sector – slipped 0.2 per cent, weighing on overall performance.

Chancellor Rachel Reeves said she was “not satisfied” with the figures, pledging to deliver growth through “investment and reform”.

But business groups suggested that all of the speculation ahead of last month’s Budget probably helped to push the economy into contraction in September.

Ben Jones, lead economist at the Confederation for British Industry (CBI), said uncertainty ahead of the Budget “probably played a big part” in the growth slowdown.

Similarly, David Bharier, head of research at the British Chambers of Commerce said (BCC) said business confidence had fallen due to “a spike in anxiety over tax and employment policy”.

Businesses also warned that the measures actually announced in last month’s Budget would likely stifle rather than support growth.

Reeves announced that taxes would go up by around £40bn, with a hike to employers’ national insurance the single largest measure.

Businesses, particularly in the retail and hospitality sector, have warned that they will have to cut jobs or pass on higher costs to consumers as a result of higher taxes.

“The Budget has set off warning lights for business. The hike in National Insurance Contributions alongside other increases to employers’ cost base will add to the burden on business,” Jones said.

Sanjay Raja, chief UK economist at Deutsche Bank, said the path ahead was “bumpy”, suggesting Budget measures could “start to hit business sentiment” in the final quarter of the year.

Official forecasters seem a little less concerned about the Budget’s potential impact on growth, because an expansion in public sector activity will likely offset the hit to the private sector.

Alongside higher taxes, the Chancellor announced a big increase in public investment as well as higher spending on day-to-day public services.

The Office for Budget Responsibility (OBR) reckons that the Budget will “temporarily boost” output in the near term, although GDP will be “largely unchanged” in five years.

It expects the UK to grow 1.1 per cent this year and 2.0 per cent next year, before easing to 1.5 per cent in 2027.

The Bank of England’s latest forecasts have a similar profile for economic growth. The Bank expects the UK to expand 1.75 per cent next year before falling back to 1.1 per cent in 2026.