FTSE 100 close: London markets tick higher before Federal Reserve meeting today

The daily London market update: Market moving news from the FTSE 100 and around the world from City A.M.

London’s FTSE 100 closed higher on Wednesday evening in anticipation for the Federal Reserve’s interest rate meeting at 7pm GMT, the last of 2023.

The capital’s premier bluechip index was in the green, up by almost 0.2 per cent by the close, on a relatively quiet day for corporate results.

The FTSE 250 index was also perky, up by 0.3 per cent, to 18,721.60.

London’s biggest riser this morning was Entain, the owner of Ladbrokes and Coral bookmakers, after it was announced its chief executive is to depart following the resolution of a long-running bribery scandal at its former Turkish business.

Investors were buoyed by the news, with the company looking for more stability, as its shares rose by more than 5 per cent by close.

Markets news

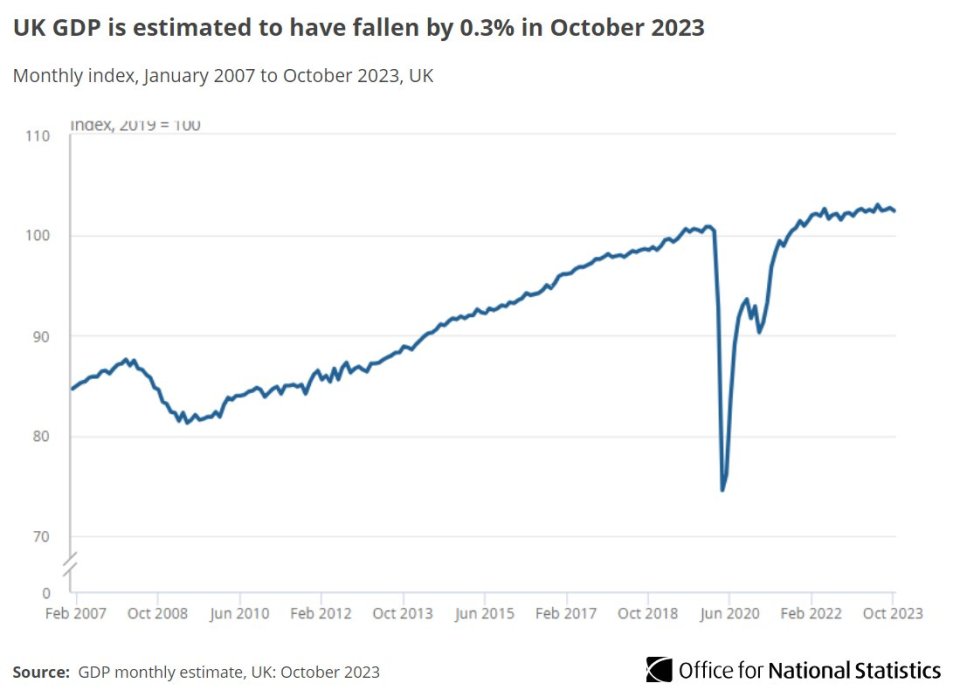

London woke up to some disappointing GDP data this morning, with the Office for National Statistics saying it had fallen sharply, as the UK faced a new recession risk.

GDP fell 0.3 per cent in the month of October, reigniting fears that a wave of interest rate hikes have strangled the UK economy.

The economy was flat over the entirety of the third quarter, according to the latest data from the Office for National Statistics.

But the economy shrank 0.3 per cent in the latest month on record.

Worryingly, services growth fell 0.2 per cent in October, too.

Analysts had expected a 0.1 per cent fall.

The figures set the scene for the Bank of England’s last call on interest rates of the year, to be announced Thursday.

ONS director of economic statistics, Darren Morgan, said: “Our initial estimates suggest that GDP growth was flat across the last three months.

“Increases in services, led by engineering, film production and education – which recovered from the impact of summer strikes – were offset by falls in both manufacturing and housebuilding.

“October, however, saw contractions across all three main sectors. Services were the biggest driver of the fall with drops in IT, legal firms and film production – which fell back after a couple of strong months.

“These were also compounded by widespread falls in manufacturing and construction, which fell partly due to the poor weather.”

Susannah Streeter, head of money and markets at Hargreaves Lansdown, said: “The UK is still mired deep in stagnation territory and a fast rebound looks unlikely, particularly given that interest rates are set to be kept on hold tomorrow, prolonging the pain for borrowers.

“However, it does increase the likelihood that the Bank of England might cut rates earlier than forecast, although it’s still not likely until the second half of next year, given that wage increases, although slowing, are still strong.”

Elsewhere, the American owner of Boots is reviving discussions on selling off the UK pharmacy chain, nearly 18 months after a sale process was shelved.

According to Bloomberg, Walgreens Boots Alliance (WBA) has been holding talks about ways to separate the UK-based pharmacy Boots, in a deal that could be valued at about £7bn.

Danni Hewson, head of financial analysis at AJ Bell, said “Walgreens Alliance seems intent on getting rid of UK high-street chemist Boots from its portfolio. Having tried and failed to sell the business to private equity in 2022, reports suggest it might revive plans to float Boots on the London market.

“Boots used to be a London-listed stock until it became the first FTSE 100 constituent to be taken over by a private equity firm, in 2007. Five years later Walgreens bought a 45 per cent stake in the group and then bought the rest in 2014.

“Putting Boots back on the UK stock market makes sense given the geographic focus of the business. It would also give the UK market a boost given it’s been a long time since we had a household retail name of this scale float on the London Stock Exchange.

Meanwhile, B&M European Value Retail tumbled after SSA investments sold 27.8m shares in the discount retailer in a placing.

The shares were priced at 582.5p each, raising aggregate gross sale proceeds of £162.1m.

B&M was the biggest faller on the FTSE 100 this morning, with its share price down 5.6 per cent.

Awaiting the Fed’s decision

While London digested GDP figures, markets were also keeping an eye on the other side of the pond, before the Federal Reserve’s final interest rate decision this year.

It is widely expected to hold interest rates, especially after yesterday’s labour market statistics, which showed consumer prices rose in November.

On Thursday, it is widely expected the Bank of England will also hold its interest rates, despite today’s rates decision.

“The FTSE 100 ticked higher as investors await the latest decision from the Federal Reserve on interest rates,” said Danni Hewson, head of financial analysis at AJ Bell.

“So far, the market is seeing nothing to disabuse it of the notion that rate cuts are on the way in 2024 as US inflation came in as expected yesterday and UK GDP figures show the economy is weakening faster than anticipated.

“To what extent Fed chair Jerome Powell and his Bank of England counterpart Andrew Bailey seek to dampen these expectations could well determine the trajectory of stocks heading into the end of the year.

“The worse-than-expected 0.3% decline in October GDP may prompt some concern given the lagged impact of interest rate hikes mean the full pain is not yet being felt by individuals or businesses. So far, the UK has managed to avoid recession but many more releases like today’s might put its ability to keep its head above water under question.”