Futures exchange behemoth, CME Group, rumoured to be starting their own spot Bitcoin exchange

When crypto natives think of spot exchanges, Binance, Coinbase and Uniswap are the main ones that come to mind. However, they may now have a major competitor entering the market. This player is a Wall Street-native, and also happens to be the largest futures exchange in the world.

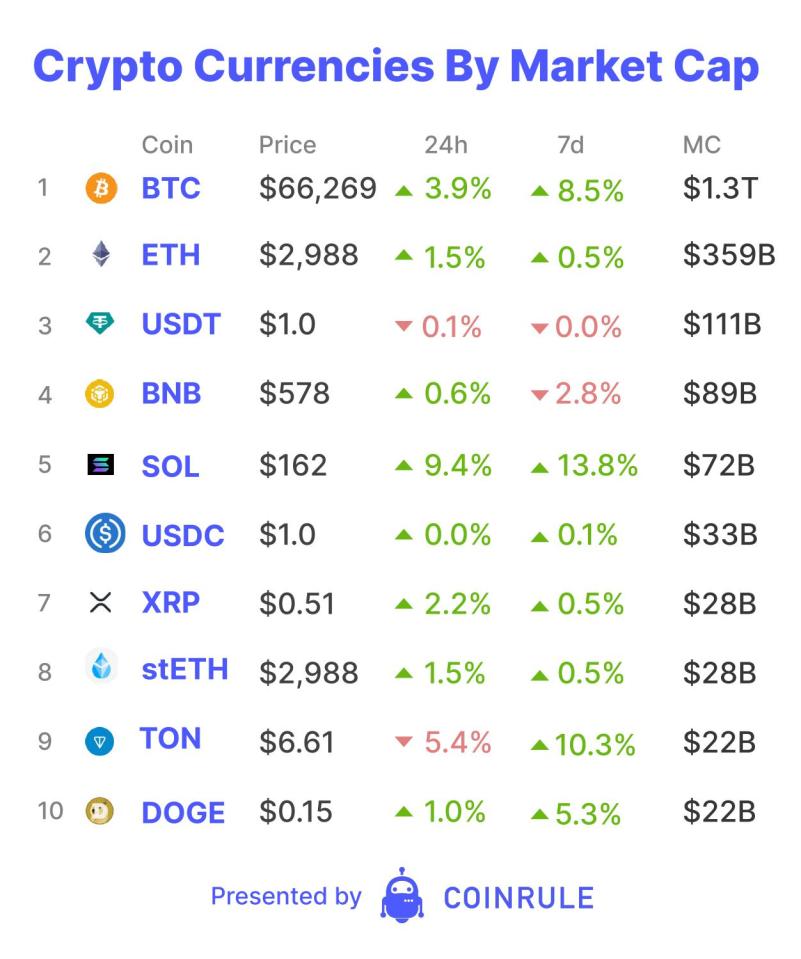

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

When crypto natives think of spot exchanges, Binance, Coinbase and Uniswap are the main ones that come to mind. However, they may now have a major competitor entering the market. This player is a Wall Street-native, and also happens to be the largest futures exchange in the world.

Yesterday, the Financial Times reported that the Chicago Mercantile Exchange (CME) Group is considering enabling spot Bitcoin trading for its users. Currently, CME already facilitates Bitcoin futures trading. According to data from The Block, the total volume of Bitcoin futures trading was $1.97 trillion in April. Binance accounted for approximately 39% of this volume with $759 billion. Comparatively, CME had a total volume of nearly $143 billion during April. However, futures trading open interest for Bitcoin is a different story. By the end of April, total crypto exchange futures open interest for Bitcoin stood at around $24 billion. Binance made up almost $6.9 billion or 28% of this total. In comparison, CME had $9.8 billion.

Spot trading volumes were also around similar levels during April, according to The Block’s data. Total crypto spot volumes reached $1.6 trillion in April. Binance was again the largest with nearly 44% of this volume with almost $700 billion. However, maybe one of the biggest losers of CME’s entry into the spot markets would actually be Coinbase.

The US-based exchange had ‘only’ $90 billion of spot volumes in April, or just over 5% of total crypto trading volumes. Being based in the US, Coinbase is considered one of the most compliant and secure exchanges. Due to its strong reputation, it acts as a custodian for 8 out of the 11 Bitcoin spot ETFs. Coinbase’s institutional arm commonly serves hedge funds, family offices, and corporate entities, handling their trade executions and providing custody for crypto transactions. Considering CME’s status as a fully regulated exchange with closer ties to traditional finance participants, it might appeal more to those coming from Wall Street.

The Financial Times suggests that CME’s spot trading business will operate through its Swiss EBS currency trading venue. This may be more attractive for users due to Switzerland having clear regulations relating to crypto storage and trading. However, one unnamed crypto executive suggested that running CME Group’s spot and futures markets in two separate markets by different groups might lead to a lack of cohesion.

At this stage, these developments are just rumours. However, it is becoming clearer each day that traditional finance is no longer scared of being associated with crypto, and wants to grab their share of the action.