Global aviation is shifting East and Europe must adapt

The likes of Heathrow and Amsterdam's Schipol airport have been at the top-level for decades. But demand is shifting to the Far East.

Heathrow is among a group of European airports facing an unprecedented challenge from the East. The question is, will they adapt, asks Guy Taylor.

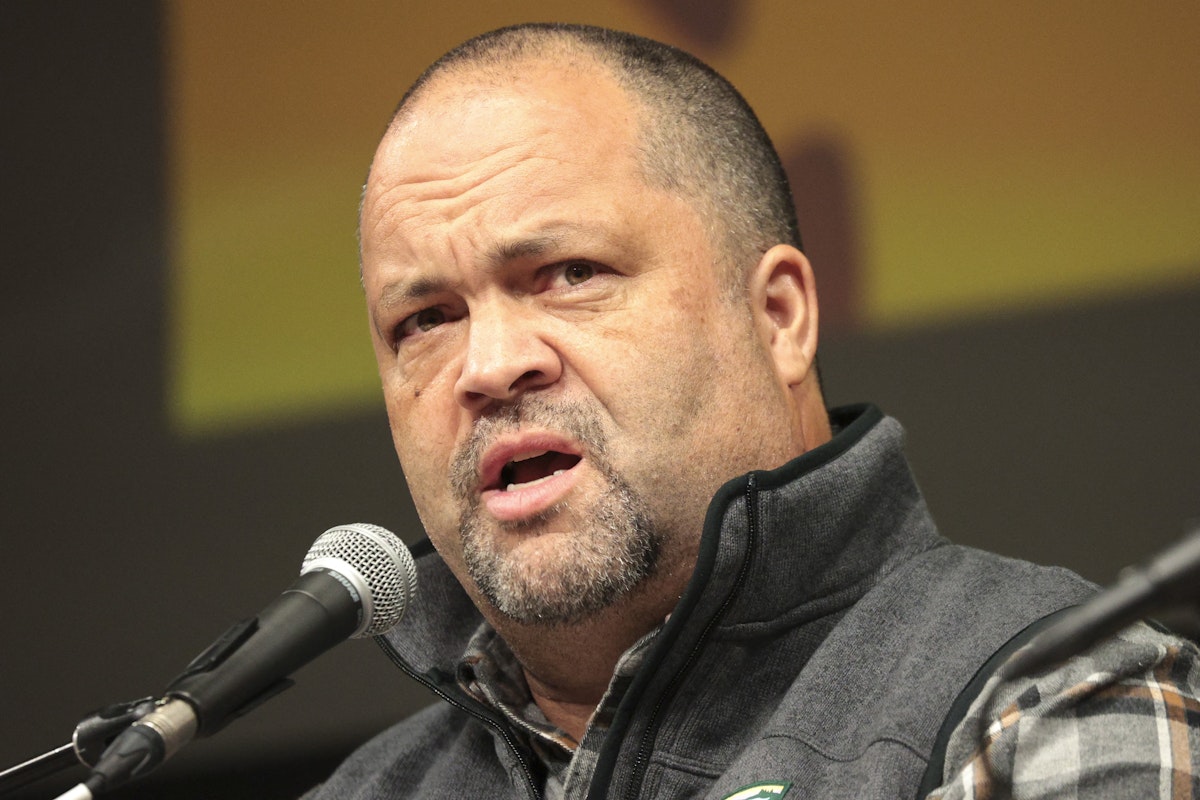

Chatting over coffee at London’s Ned Hotel with Istanbul Airport’s chief executive Selahattin Bilgen, one thing is clear; Western Europe is slowly losing its status as a hub for global aviation.

The likes of Heathrow, Charles De Gaulle and Amsterdam’s Schipol airport have been at the top-level for decades. But the figures are clear that demand is shifting increasingly towards the Far East.

The latest data from IATA, covering March, revealed Asia-Pacific airlines saw a 38.5 per cent year-on-year increase in demand. That’s compared with only 11.6 and 14.6 per cent for North American and European carriers, respectively.

In 2023, Asia-Pacific airlines posted a 126.1 per cent rise in full-year international traffic, according to IATA, compared with a a 22 per cent climb for European carriers.

For Bilgen, the shift of aviation’s “centre of gravity” eastwards is a huge opportunity for Istanbul airport, which is geographically poised to take advantage and potentially supplant Heathrow as the busiest hub in Europe. It is aiming to hit an annual passenger target of 85m after expanding capcity dramatically, a figure that would take it ahead of Heathrow’s 82m.

We discussed the changes as part of a recent article, in which the Turkish executive was also clear the impact would be felt by European airlines. Western Europe’s hubs cannot ignore the Asia-Pacific region and many are now looking to sign deals with key local airlines, muscling in on the likes of Easyjet, the IAG and Lufthansa.

Take Gatwick, for example, which has expanded routes from Singapore Airlines, Air India and Air China within the last year. On Thursday, Air India announced major upgrades to its flight offerings from London Heathrow to Delhi.

Industry data from Cirium reveals European airlines have massively cut back on routes to Asia since the pandemic, bowing out to competition from Middle Eastern carriers offering cheaper fares. The Financial Times reported airlines flew 22m seats between Europe and Asia last year, down 26 per cent on 2019 and the lowest number in 14 years.

The issue is greater than people would like to admit. Airports and airlines are absolutely central to most countries’ economies, providing the connectivity needed for business travel while boosting tourism and the travel sector.

Prior to the pandemic in 2019, passengers who entered the UK through Heathrow spent an estimated £16.6bn, while the value of trade stood at approximately £188bn, according to research from CEBR. Modelling expects the Hounslow hub to contribute approximately £4.7bn to the UK economy and support more than 140,000 jobs by 2025.

Should it fall behind rivals in the Middle East and Asia, the impact would be felt significantly across the UK and it would be the same with Schipol in the Netherlands and France’s Charles De Gaulle.

Heathrow is already in trouble due to a combination of high debt, poor investment in its infrastructure and ongoing delays to its embattled third runway proposals. It has relied on transatlantic traffic to prop up passenger numbers in recent years and that is no bad strategy.

But at some point, Heathrow and its European rivals will need to solve the dilemma of how to beat the bullish competition growing in the East.