Government borrows more than expected in February, but on track for lowest annual total in four years

The borrowing figures are the first since Jeremy Hunt's Spring Budget, in which he cut National Insurance by a further 2p.

The government borrowed more than expected in February, but borrowing in the financial year was still on track to be its lowest for four years, new figures show.

According to figures from the Office for National Statistics (ONS), the government borrowed £8.4bn in February compared to the roughly £6bn expected by economists.

The borrowing overshoot was driven by higher than expected spending on social benefits due to cost-of-living payments and the uprating of benefits in line with inflation.

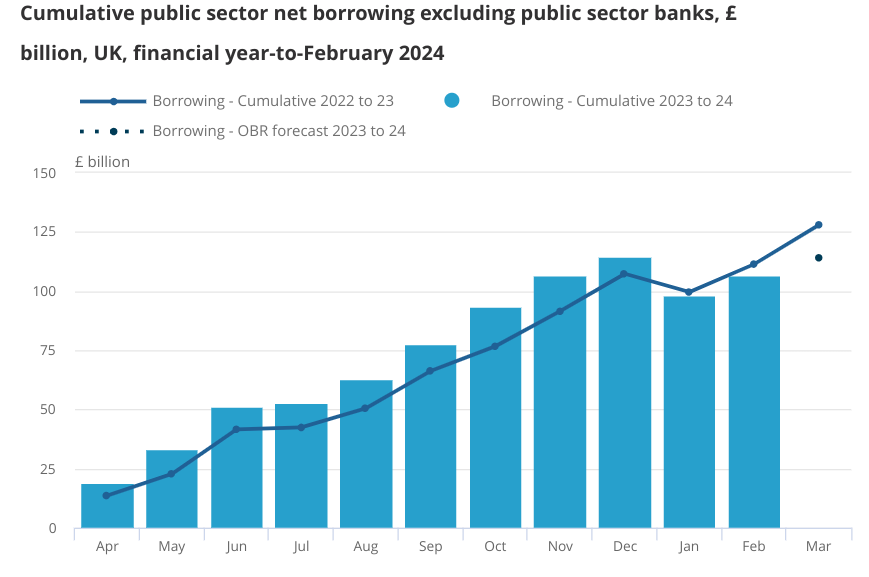

February’s figure was £3.4bn lower than last year’s, making it the fourth consecutive month in which borrowing was lower than the year before. In the financial year to February 2024, borrowing was £106.8bn, the lowest nominal total for four years.

However, annual borrowing still looks likely to overshoot the Office for Budget Responsibility’s annual forecast of £114.1bn.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said this was nothing to worry about for the Chancellor just yet. “The overshoot is small and revisions could easily change that picture next month so it’s not, yet, a big deal for the fiscal outlook,” he argued.

Public sector debt was estimated at around 97.1 per cent of GDP, which was 2.3 percentage points higher than a year earlier. National debt stands at levels last seen in the early 1960s.

The public finances figures are closely watched to assess how much space the Chancellor will have to cut taxes if he announces a pre-election fiscal event.

The government is in a very tight fiscal position. A high debt burden and a growing debt interest bill have put pressure on public spending, with a big fiscal tightening pencilled in for after the election.

After the policies announced in the Spring Budget, Hunt had a buffer of just £8.9bn to meet his key fiscal rule of getting debt to fall in five years. However, he is determined to set the UK on a path to lower taxes.

Ruth Gregory, deputy chief UK economist at Capital Economics, said today’s borrowing figures “may not prevent the government from squeezing in another pre-election tax-cutting fiscal event later this year”.

According to the OECD, the UK’s total tax-to-GDP ratio hit 35.3 per cent in the 2023 financial year, the highest since its records began in 2000.