Hawkish Bank of England? Don’t be so sure.

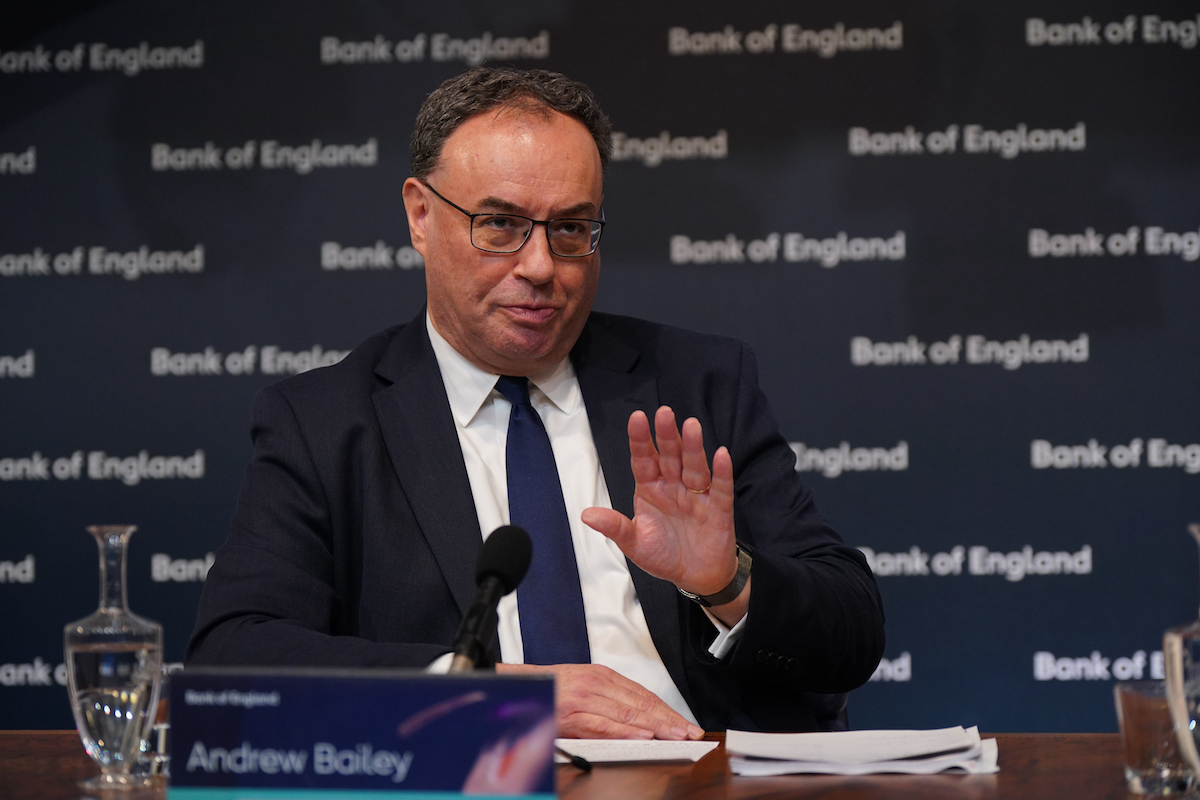

"The economy has been evolving broadly as we expected," Bailey said. "If that continues, we should be able to reduce rates gradually over time".

After the drama of the US Federal Reserve’s interest rate announcement last night, the Bank of England’s decision to hold rates at five per cent was always likely to feel a little flat.

The Bank’s decision was widely interpreted as a hawkish hold, particularly in contrast to the Fed’s 50 basis point cut.

Following the decision, the pound rose, climbing to a two year high against the dollar. Yields rose across the board too, suggesting that markets think there will be a slower pace of easing ahead.

Why this response?

Eight members of the Monetary Policy Committee (MPC) voted to hold rates at five per cent leaving just one dovish dissenter. Markets had thought Dave Ramsden might have joined Swati Dhingra in calling for another rate cut, but alas they were disappointed.

Looking forward the minutes showed that “most members” favoured a “gradual approach” to cutting rates, unless there were any material changes to the outlook.

Governor Andrew Bailey said “we need to be careful not to cut too fast or by too much”, further reinforcing the Bank’s caution.

The Bank of England’s approach stands in marked contrast to the Fed’s. Alongside the 50 basis point cut, Fed officials signalled that there would likely be another two rate cuts in the remainder of the year (or one more bumper cut.)

Even though the Fed’s projected path for rates into the medium term is still more cautious than the market path, the size of the first rate cut suggests policymakers will be willing to move hard and fast if necessary.

The Bank is not in that space yet. One look at this week’s inflation numbers shows why. Although the headline rate remained at 2.2 per cent, services inflation jumped back up to 5.6 per cent.

Services inflation is expected to fall over the remainder of the year, but it is by no means a certainty. Put simply, inflation appears to be a bigger risk in the UK than the US.

As Paul Dales, chief UK economist at Capital Economics, explained: “The contrast between (the Bank’s decision) and the Fed’s jumbo 50bps rate cut last night makes sense as the Bank has yet to shift from worrying less about inflation and worrying more about weak activity.”

But it would be wrong to overplay the hawkishness of the Bank of England’s decision today. Bailey – and the wider MPC – clearly think more rate cuts are on the way.

“The economy has been evolving broadly as we expected,” he said. “If that continues, we should be able to reduce rates gradually over time”.

Bailey was clearly trying to signal that there will be further rate cuts, while also pointing out there’s no need to reduce rates aggressively, at least for the moment.

As Rob Wood, chief UK economist at Pantheon Macroeconomics said: “The broad data flow suggests little need for urgency”.

So what’s the outlook? A November cut looks nailed on, especially as the Bank of England will be releasing its latest forecasts alongside the rate decision.

Beyond that, the Bank will likely pause in December before gradually easing rates further next year. Will it be a slower pace than the Fed? Yes, but that does not mean the Bank is being excessively hawkish.

The last word goes to Lindsay James, investment strategist at Quilter Investors, who points out that “the spectre hanging over all of this, however, is the upcoming Autumn Budget at the end of October.”

“Taxes are guaranteed to rise, but by what extent we are not sure and thus the economic impact cannot be properly gauged. Businesses and consumers are likely to cut back on spending in anticipation of changes to their income and as such growth could slide further.”