Hopes of a summer interest rate cut fade ahead of crunch wage data (and it’s partially due to Taylor Swift)

There are two particular causes of concern for the Bank, services inflation and wage growth. The two are closely linked.

With the Bank of England’s latest interest rate decision just two weeks away, today’s inflation figures for June were always going to be important.

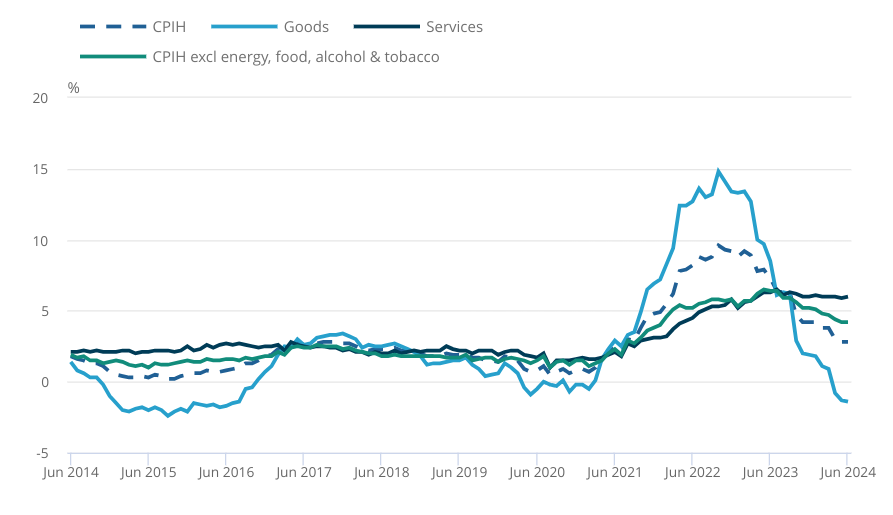

The figures showed that inflation came in at two per cent for the second month in a row, which was marginally higher than the 1.9 per cent expected by economists.

In response, the pound jumped above $1.30 for the first time in a year while traders slashed bets on an August interest rate cut.

This might seem a little extreme.

After all, inflation is at the target – what’s not to like?

The concern for policymakers is the same as it has been for the entire year, that domestic inflationary pressures remain worryingly high.

There are two particular causes of concern for the Bank, services inflation and wage growth. The two are closely linked.

Strong wage growth means firms face higher cost pressures. The services sector, which includes hospitality and recreation, is fairly labour intensive so higher wages can force firms to raise prices. Higher wages also means consumers simply have more money to spend, which can also generate some inflationary pressures.

Today’s figures showed that prices in the services sector rose 5.7 per cent in the year to June, unchanged on the month before and ahead of expectations.

Before June’s inflation figures were released, a number of economists had warned that Taylor Swift could contribute to sticky services prices, and so it proved.

Prices for hotels rose 8.8 per cent month-on-month while live music prices were also up around 7.5 per cent. “It’s certainly very possible that some Taylor Swift effects were at play here,” Sanjay Raja, Deutsche Bank’s chief UK economist said.

Given the likely impact of Swift’s Eras tour, Raja suggested that the Monetary Policy Committee (MPC) could “potentially be minded to look past some of the upside in services inflation”.

But the longer term trend is also worrying. After falling to 6.1 per cent in February, services inflation has barely budged. Back in May, the Bank projected that services inflation would have fallen to 5.3 per cent by the end of the quarter.

Paul Dales, chief UK economist at Capital Economics, said that “only some of the stickiness of services inflation in June may be due to the influence of Taylor Swift’s concerts”.

He suggested that some of the stickiness in inflation was likely driven by demand rather than supply pressures, which would be “worrying” for the Bank.

Minutes from the last meeting showed that the decision was “finely balanced,” suggesting a few more rate-setters were considering voting for a cut alongside the two that did. It would not be unreasonable if those members wanted to see some more evidence that domestic pressures are fading before cutting rates

Tomorrow’s labour market figures will be key, potentially even more important than inflation.

Simon French, head of research at Panmure Liberum, noted that “for all the attention paid to today’s inflation data it will arguably be tomorrow’s wages data that will carry more weight for any floating voters”.

Wage growth has remained around six per cent for most of the year even as unemployment has increased, which is a worrying reflection on the health of the labour market.