IMF warns central banks should be wary of leaving interest rates on hold for too long

In a chapter from its latest World Economic Outlook, the IMF noted that different economies have experienced different effects from higher interest rates.

Central banks, including the Bank of England, should be wary of leaving interest rates on hold for too long and risk putting households under unnecessary strain, the International Monetary Fund (IMF) warned today.

In a chapter from its latest World Economic Outlook, the IMF noted that different economies have experienced different effects from higher interest rates.

In general, global growth has performed much better than economists expected at the start of the tightening cycle. This reflects a number of factors in the housing market, including the supply of housing and the level of household debt.

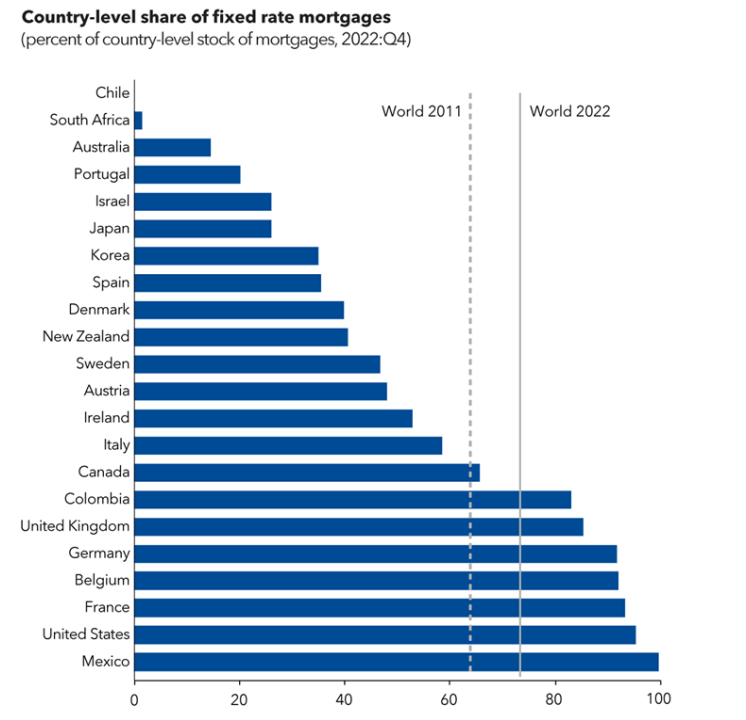

However, the most important factor is the prevalence of fixed-rate mortgages.

Z”Monetary policy has greater effects on activity in countries where the share of fixed-rate mortgages is low,” the Washington-based institution said.

In the UK, the proportion of mortgagors who are on fixed-rate mortgages in the UK has risen from under 30 per cent in the early 2000s to around 85 per cent.

The length of time people are deciding to fix their mortgages has also gotten longer, both of which help to explain why the drag from higher interest rates has been less pronounced than many economists feared.

But the IMF warned that there were still dangers for central banks. “Over-tightening, or leaving rates higher for longer, could nevertheless be a greater risk now,” it said.

“The longer time rates are kept high, the greater the likelihood that households will feel the pinch, even where they have so far been relatively sheltered”.

At the end of last year in the UK, around 45 per cent of fixed-rate mortgage deals agreed pre-2021 were yet to renew.

Although lower interest rates mean they will not face the same shock as those refinancing a year ago, they will still face a sizeable jump in their mortgage costs.

“Over time, and as rates on these mortgages reset, monetary policy transmission could suddenly become more effective and so depress consumption, especially where households are heavily indebted,” the IMF warned.