Inflation drops faster than expected ahead of Bank of England’s interest rate decision

The figures come just a day before the Bank of England announces its latest decision on interest rates.

Inflation fell faster than expected last month, dropping to its lowest level in nearly two and a half years, as markets brace for the latest interest rate decision from the Bank of England.

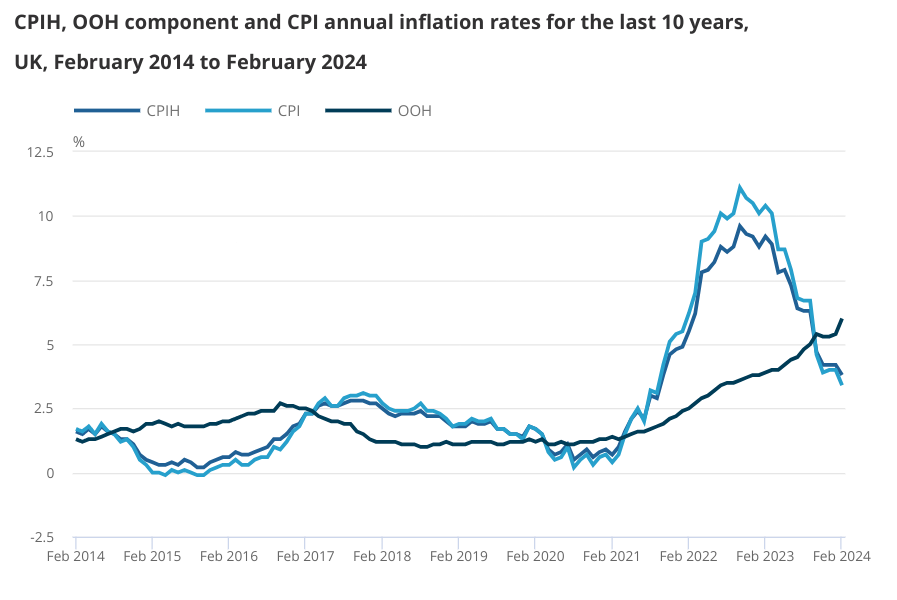

Figures from the Office for National Statistics (ONS) showed that the headline rate of inflation dropped to 3.4 per cent in February, down from four per cent the month before.

Economists had expected a reading of 3.5 per cent.

“Food prices were the main driver of the fall, with prices almost unchanged this year compared with a large rise last year, while restaurant and café price rises also slowed,” Grant Fitzner, chief economist at the ONS said.

Food and alcohol prices rose five per cent in the year to February, the lowest increase since January 2022 and down from a seven per cent increase in January.

Prices for restaurants and hotels fell to six per cent, down from 7.1 per cent. This helped to offset increases in petrol prices and rental costs.

There was good news across the board, with disinflationary pressures looking broad-based. Core inflation – which strips out volatile components such as food and energy – dropped to 4.5 per cent from 5.1 per cent in January.

Services inflation, which the Bank has identified as a key gauge of domestic inflationary pressures, fell to 6.1 per cent from 6.5 per cent in January. While this was a sharp fall, it was largely expected by the Bank.

“This notable decline is further evidence that the UK is fast approaching the finish line in its battle against surging inflation,” Suren Thiru, Economics Director at ICAEW, said.

Chancellor Jeremy Hunt said: “The plan is working. Inflation has not just fallen decisively but is forecast to hit the two per cent target within months.”

The figures come just a day before the Bank of England announces its latest decision on interest rates.

Having peaked at over 11 per cent in October 2022, inflation has fallen much more rapidly than economists expected as the impact of the energy price shock has receded.

Many economists think inflation will return to two per cent in the spring thanks to a sharp fall in Ofgem’s energy price cap. Despite this, the Bank is likely to leave rates on hold when it meets tomorrow.

Alongside progress on inflation, policymakers are looking for further easing in wage pressures. Rate-setters are concerned that stubborn wage growth, which remains at more than twice the level consistent with the Bank’s two per cent inflation target, could prevent inflation returning to target.

Earlier this month, Huw Pill, the Bank’s chief economist, warned that rate cuts were still “some way off,” reflecting the cautious approach taken by central banks around the world.

The European Central Bank left rates on hold at its most recent meeting, with Christine Lagarde saying policymakers were not yet “sufficiently confident” to cut rates. The Fed announces its latest decision later this evening.

Markets think the Bank will start cutting rates in the summer, with June the earliest likely date. However, this morning’s figures could bring forward the start date for rate cuts.