Interest rate cuts edge closer after ‘very encouraging’ inflation news

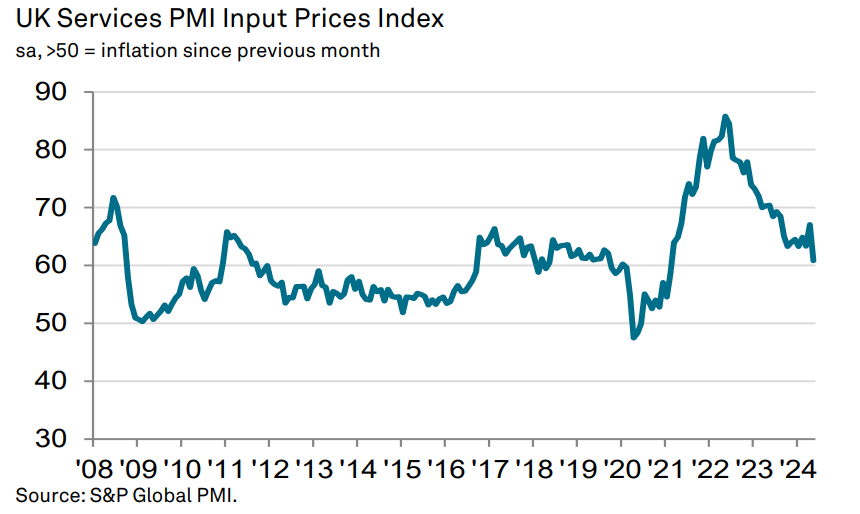

The Bank of England received encouraging news on the persistence of inflation today after a closely watched business survey showed cost pressures were decisively easing. S&P’s closely watched purchasing managers’ index (PMI) showed that the rate of input cost inflation faced by UK services companies increased at its slowest pace since February 2021. This also [...]

The Bank of England received encouraging news on the persistence of inflation today after a closely watched business survey showed cost pressures were decisively easing.

S&P’s closely watched purchasing managers’ index (PMI) showed that the rate of input cost inflation faced by UK services companies increased at its slowest pace since February 2021.

This also fed through into weaker output price inflation, which eased to its weakest level in over three years. Inflation in the services sector, which is still hanging around six per cent, is a major concern for the Bank of England.

April’s inflation figures, released last month, showed services inflation coming in well above expectations, raising concerns about the persistence of inflation.

Following today’s release, Rob Wood, chief UK economist at Pantheon Macroeconomics, said April’s worryingly high inflation figures were a “flash in the pan”.

Joe Hayes, principal economist at S&P Global Market Intelligence, said the survey was “very encouraging to the Monetary Policy Committee and suggests the trajectory of services prices is moving in the right direction.”

However, Hayes still warned that services inflation was well above its pre-pandemic trend, “which may give more weight to those suggesting the Bank of England hold out until August to loosen policy.”

The Bank of England is widely expected to leave interest rates on hold this month, but many economists think it could start cutting the Bank Rate in August.

“Slowing services inflation can keep the MPC on track to cut rates in August,” Wood said.

Alongside weaker inflationary pressures, the survey also pointed to slowing growth, with output falling from 55.0 in April to 52.9 in May. Although this was still above the 50 no-change mark, the survey showed the softest rate in expansion since November last year.

New business volumes rose again in May, with firms noting “greater client confidence” and successful marketing campaigns as key reasons for the increase.

However, some firms noted difficulties in carrying out business with customers in the EU, leading to weaker growth in exports.

Services firms were “strongly optimistic” about the year-ahead with growth expectations above the long-run average. This largely reflected hopes of lower interest rates and improving domestic economy.