Investors continue to buy Scottish Mortgage in bet on growth

UK investors continue to be drawn to growth-focused investment trusts like Scottish Mortgage and JP Morgan Global Income & Growth.

UK investors continue to be drawn to growth-focused investment trusts like Scottish Mortgage as the public bets that a comeback for growth companies is on the horizon.

Retail investors hold about 23 per cent of the shares in investment trusts, data from the Association of Investment Companies revealed earlier this year.

However, Numis noted that retail investors are “increasingly significant” in the shareholder ownership of many investment trusts, as some prove to be more attractive to the public than others.

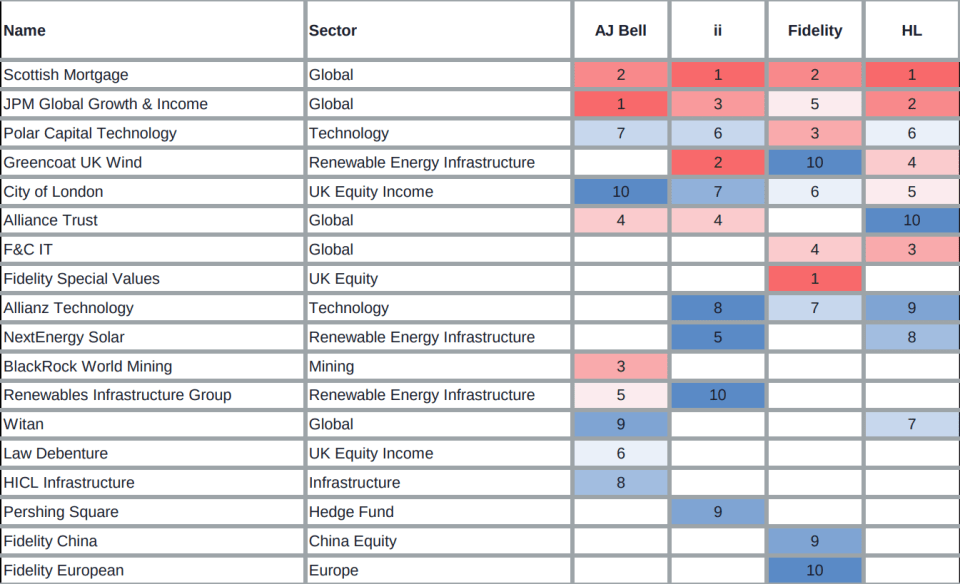

Using the most bought lists from the most popular investment platforms, Numis found that the lists are “dominated” by two global growth trusts, Scottish Mortgage and JP Morgan Global Growth & Income, with both appearing in every top 10 most bought list in the last year.

Both trusts have a long history of investing in fast-growing companies across the world, being each over a hundred years old, with a long track record to compare again.

Socttish Mortgage has seen a 66 per cent jump in share price over the last five years, while JP Morgan’s has surged by a whopping 101 per cent. This compared to a 33 per cent rise in the global investment trust sector over the same period.

Meanwhile, the UK-focused City of London trust came in a close third to the two global trusts, appearing in 38 features in the last year out of a possible 40.

The data used from Numis came from the four of the largest investment platforms in the UK, namely AJ Bell, Interactive Investor, Fidelity and Hargreaves Lansdown.

Most bought investment trusts in June

When looking at only last month, Numis found that tech-focused trusts had made a surprise comeback despite disappearing from the lists in May, as Polar Capital Technology appeared across all four lists and Allianz Tech on three lists.

Two other trusts appeared across three of four lists in June, namely Greencoat UK Wind and Alliance Trust.

Indeed, while the list is often dominated by equity strategies, renewable energy trusts are increasingly popular on the list, as investors use the investment trust vehicle to gain access to tangible assets.

For example, other than Greencoat, NextEnergy Solar and The Renewables Energy Group both featured on two of the lists in June, while Octopus Renewables climbed to the top ten for Hargreaves Lansdown in May.