Istories: Russia’s arms industry still importing vital foreign CNC machines despite sanctions

Türkiye, the UAE. and China are acting as key conduits for Western technology feeding Russia's arms production, an investigation has found.

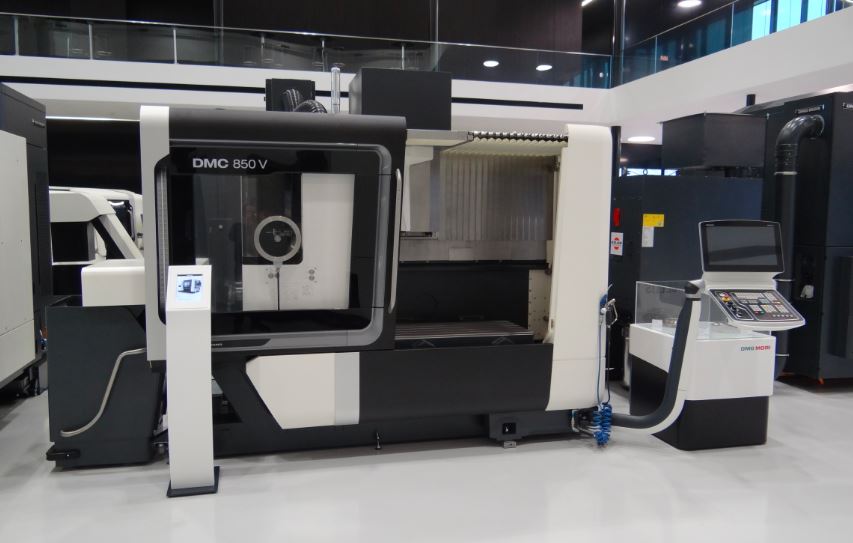

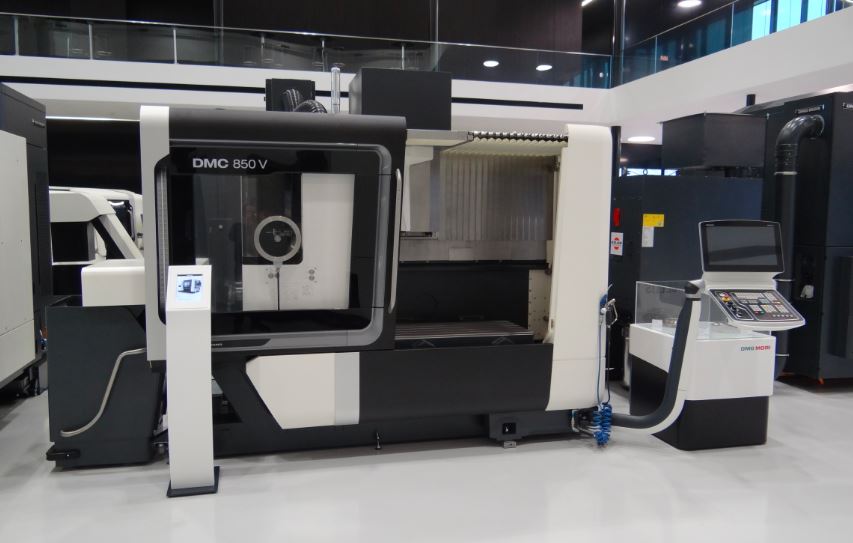

Despite sanctions, Russia imported at least 6.4 billion rubles ($68 million) worth of computer numerical control (CNC) machines and parts in 2023, according to a report by the investigative outlet Istories.

The actual figure is likely much higher due to incomplete documentation and misclassification of imports from countries such as Kyrgyzstan and Kazakhstan.

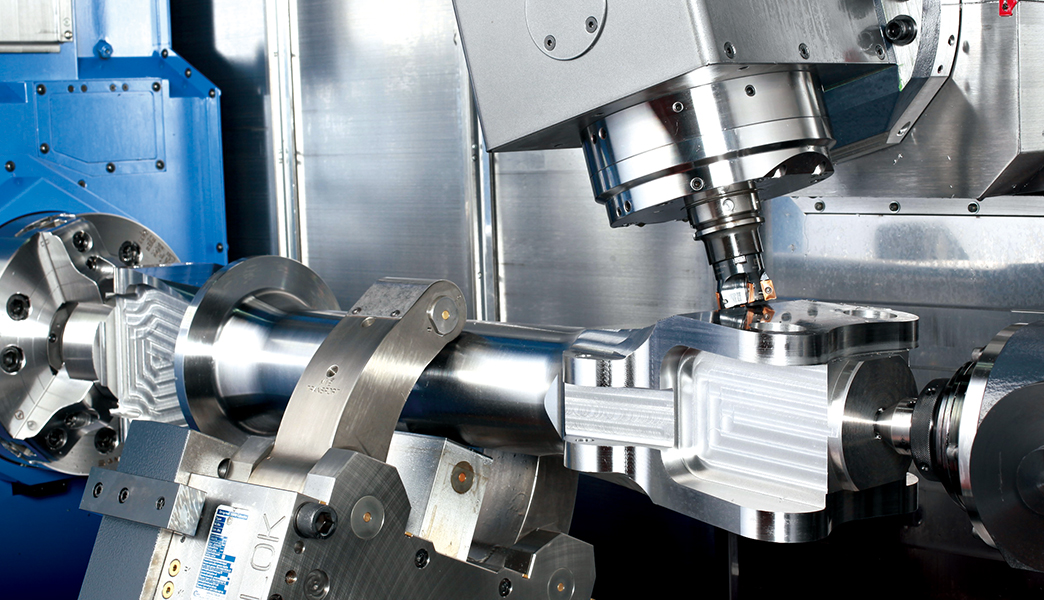

CNC tools are considered to be a hole in the West’s sanctions regime against Russia, as they allow Russia to build precise weapons domestically.

The machines, essential for modern weapons manufacturing, are sourced from leading global producers including Doosan and Hanwha of South Korea, Spinner and Hermle of Germany, Fanuc of Japan, and others, Istories reports.

Türkiye, the UAE and China serve as key intermediaries for the imports, the report found based on customs data.

“The degree of modernization of various Russian military-industrial complex enterprises was uneven before the war began,” Kamil Galeev, an expert at the Rhodus agency, told Istories. “There were poor enterprises, there were rich ones.”

According to Galeev, wealthier firms like the aircraft and missile engine manufacturer UEC Saturn “had everything that money could buy in the world” and did not require extensive upgrades. Poorer factories, however, are now rushing to replace “ancient Soviet machines with new equipment” as orders and funding surge.

The expert also pointed to the emergence of new military industries like drone production and the outsourcing of work from major plants to smaller workshops. “Part of the functions of big factories is being transferred to small workshops, which are now updating their machine stock,” he explained to Istories.

European companies interviewed by Istories gave conflicting responses about exporting to Russia.

Dmitry Kostin, director of Germany’s DK Werkzeuge, said he ships equipment from the EU but is “loyal” if it ends up in military plants. “I think that soon everything [the war] will end and everyone will live in friendship,” Kostin stated.

Others like Spain’s Vanto Machines and Poland’s Soldream Polska claimed their products were falsely declared as Russia-bound by Turkish middlemen. Switzerland’s TL Technology insisted it halted Russian operations in early 2022.

Several major Russian importers of foreign machines are already under sanctions, the report noted. But others like the Engineering Center for Production Equipment from St. Petersburg, which supplied DMG Mori machines to UEC Saturn and other defense firms in 2023, have so far avoided them.

“It seems to me that it would be reasonable to focus attention not on supplies, because each time the manufacturer can say: ‘We didn’t know anything,'” Galeev argued. “But to force all companies that sold machines to Russia to report on the equipment supplied.”

This could include information on monitoring functions, internet connectivity, software, and contract details, he proposed. “Of course, all this should happen under the threat of large fines and criminal prosecution.”

Even if Western imports are cut off, Galeev cautioned that Russia could “last quite a long time” in the war by shifting to Chinese machines with components from US allies. The critical moment will come “if they strike at the software” that modern CNC equipment depends on, he said.

Related:

- Taiwan expands export controls on machine tools to Russia, Belarus

- Insider: Taiwan becomes Russia’s top supplier of precision machine tools

- FT: China ramps up machine tool exports to Russia’s defense industry

- Block Western CNCs, then Russia’s arsenal fails

- StateWatch: German-made shell production machine on its way to Russia

- Insider: GRU officer in Brussels funnels military exports to Russia