Kamalanomics: Way Better Than Trump—but Not as Good as Biden

Assessing Kamala Harris’s economic plan, released last week to little fanfare, in the context of her campaign against Donald Trump reminds me how Alan Bennett answered the actor Ian McKellen when McKellen asked the famously solitary playwright whether he was straight or gay. “That’s a bit,” Bennett protested, “like asking a man crawling across the Sahara whether he would prefer Perrier or Malvern water.” You, dear reader, might answer the same when I state that I prefer President Joe Biden’s economic policies to those of candidate Kamala Harris’s.The Sahara, in this construct, is the blustery nonsense about the economy that Trump is making up as he goes along. Before we consider Harris’s economic proposals, then—making subtle and perhaps irrelevant distinctions between Perrier (Harris’s policies) and Malvern water (Biden’s)—let’s take an extended tour of Trump’s sun-blasted, desolate wasteland.Bloomberg’s Eric Wasson and Enda Curran estimated last month that Trump’s promised tax cuts added up to $10.5 trillion over the next decade. And that was before Trump pledged to eliminate a $10,000 cap on deducting state and local taxes (tax nerds call this this “SALT cap”) that Trump himself imposed in 2017, in a halfhearted attempt to limit revenue losses from his 2017 tax giveaway to corporations and rich people. Reversing the SALT cap—a rare instance of progressivity in that 2017 tax bill—would increase Trump’s total revenue losses to nearly $12 trillion. Writing in The American Prospect, David Dayen calculates a more modest tally for Trump revenue losses: $9.75 trillion. For comparison’s sake, the cost of running every agency except the Pentagon over the next 10 years, Wasson and Curran noted, is $9.8 trillion. To pay for all his tax cuts, then, Trump would either have to dismantle the entire federal government (except the Pentagon)—and, if Bloomberg’s calculations are correct, would still come up $2 trillion short!—or increase deficit projections over the next decade by 50 percent. (Trump would of course do the latter.)Believe it or not, Bloomberg’s estimate, even with cancellation of the SALT cap added in, is a lowball figure. Dayen says his estimate’s a lowball as well. As I observed last month, Project 2025’s tax proposals—in a Mandate for Leadership chapter coauthored by Stephen Moore (whom Trump tried unsuccessfully to elevate to the Federal Reserve’s Board of Governors, and who is now advising Trump’s campaign)—would drop the top marginal income-tax rate from 37 percent to 30 percent; drop the corporate tax rate (“the most damaging tax in the U.S. tax system”) from 21 percent to 18 percent; and lower the capital gains tax from 20 percent to 15 percent (something Trump himself called for when president). Also, Trump wants to create a sovereign wealth fund. In principle, that isn’t an awful idea, but we can’t afford one (especially if Trump becomes president).When asked how he would pay for all this, Trump says one of two things: His tax cuts will stimulate the economy so much that the result will be a net increase in revenue. This is a magical promise that supply-siders have failed to deliver on for more than 40 years.His across-the-board 10 percent tariffs on all imports and 60 percent tariff on Chinese imports will bring in enough revenue to cover any revenue shortfalls. The nonprofit Tax Policy Center says the tariffs would generate $3.7 trillion in gross revenues over 10 years, but would net only $2.8 trillion because the economic calamity they’d cause would reduce revenues from other federal taxes. Obviously $2.8 trillion would not come close to recouping either $12 trillion or Dayan’s $9.75 trillion.Given all this, it’s no surprise that economists are lining up to criticize Trump’s economic program. This tally includes 16 Nobel laureates in economics (“Donald Trump will reignite this inflation, with his fiscally irresponsible budgets”); 400 economists and former government officials; (“It is a choice between inequity, economic injustice, and uncertainty with Donald Trump or prosperity, opportunity, and stability with Kamala Harris”); Moody’s; Goldman Sachs; and even Trump’s beloved Wharton School. I’m sure there’s one or two economists who support Trump, if only to get a job in his second term, but when I Google “economists who support Trump” I come up empty.I should further remind you that health care is an economic issue; it’s about as economic an issue as there is; and Trump, along with other Republicans running for office, seldom talk about it because their record is terrible compared to the Democrats. Deep down, they know this. They have no idea how to fix health care. (They do have one or two ideas how to make it worse, but they offer these desultorily.)Far removed from this parched landscape lies the leafy oasis of Harris’s 81-page survey of her economic policies. This begins with a tour d’horizon of the aforementioned independent economic analyses. If economics doesn’t interest you, that’s al

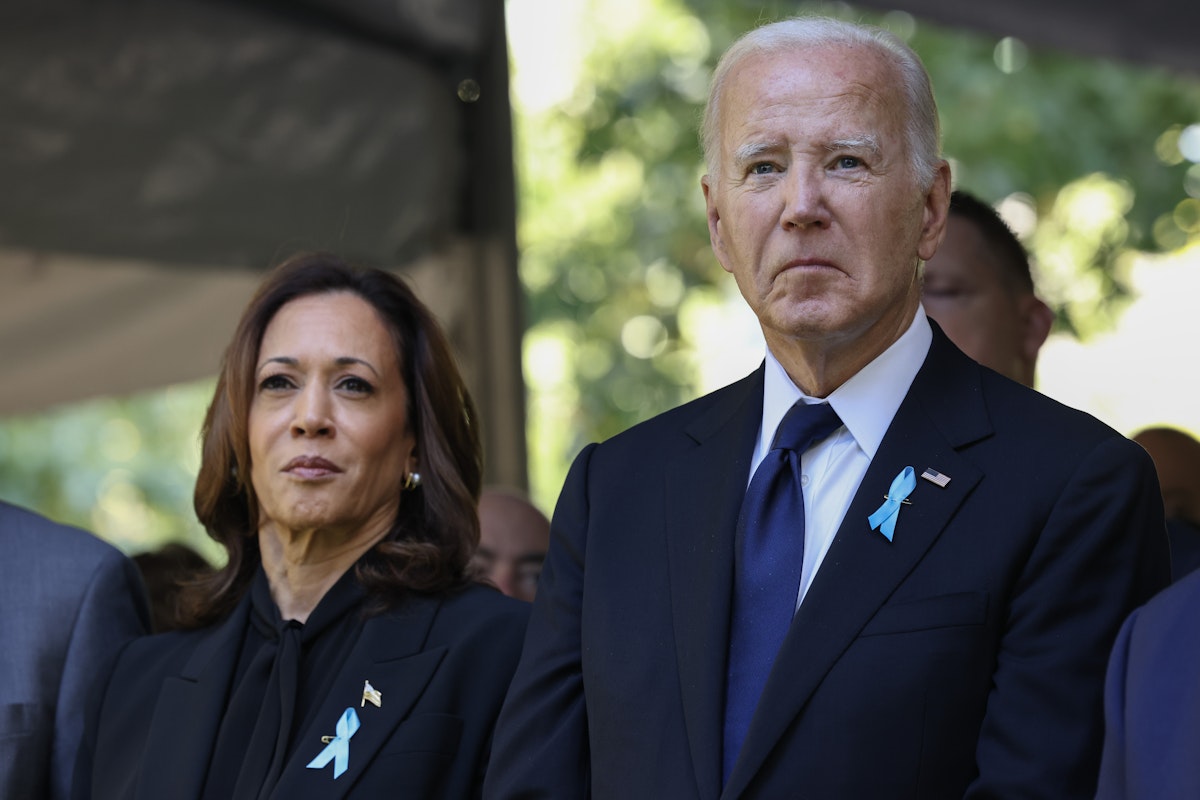

Assessing Kamala Harris’s economic plan, released last week to little fanfare, in the context of her campaign against Donald Trump reminds me how Alan Bennett answered the actor Ian McKellen when McKellen asked the famously solitary playwright whether he was straight or gay. “That’s a bit,” Bennett protested, “like asking a man crawling across the Sahara whether he would prefer Perrier or Malvern water.” You, dear reader, might answer the same when I state that I prefer President Joe Biden’s economic policies to those of candidate Kamala Harris’s.

The Sahara, in this construct, is the blustery nonsense about the economy that Trump is making up as he goes along. Before we consider Harris’s economic proposals, then—making subtle and perhaps irrelevant distinctions between Perrier (Harris’s policies) and Malvern water (Biden’s)—let’s take an extended tour of Trump’s sun-blasted, desolate wasteland.

Bloomberg’s Eric Wasson and Enda Curran estimated last month that Trump’s promised tax cuts added up to $10.5 trillion over the next decade. And that was before Trump pledged to eliminate a $10,000 cap on deducting state and local taxes (tax nerds call this this “SALT cap”) that Trump himself imposed in 2017, in a halfhearted attempt to limit revenue losses from his 2017 tax giveaway to corporations and rich people. Reversing the SALT cap—a rare instance of progressivity in that 2017 tax bill—would increase Trump’s total revenue losses to nearly $12 trillion.

Writing in The American Prospect, David Dayen calculates a more modest tally for Trump revenue losses: $9.75 trillion. For comparison’s sake, the cost of running every agency except the Pentagon over the next 10 years, Wasson and Curran noted, is $9.8 trillion. To pay for all his tax cuts, then, Trump would either have to dismantle the entire federal government (except the Pentagon)—and, if Bloomberg’s calculations are correct, would still come up $2 trillion short!—or increase deficit projections over the next decade by 50 percent. (Trump would of course do the latter.)

Believe it or not, Bloomberg’s estimate, even with cancellation of the SALT cap added in, is a lowball figure. Dayen says his estimate’s a lowball as well. As I observed last month, Project 2025’s tax proposals—in a Mandate for Leadership chapter coauthored by Stephen Moore (whom Trump tried unsuccessfully to elevate to the Federal Reserve’s Board of Governors, and who is now advising Trump’s campaign)—would drop the top marginal income-tax rate from 37 percent to 30 percent; drop the corporate tax rate (“the most damaging tax in the U.S. tax system”) from 21 percent to 18 percent; and lower the capital gains tax from 20 percent to 15 percent (something Trump himself called for when president). Also, Trump wants to create a sovereign wealth fund. In principle, that isn’t an awful idea, but we can’t afford one (especially if Trump becomes president).

When asked how he would pay for all this, Trump says one of two things:

- His tax cuts will stimulate the economy so much that the result will be a net increase in revenue. This is a magical promise that supply-siders have failed to deliver on for more than 40 years.

- His across-the-board 10 percent tariffs on all imports and 60 percent tariff on Chinese imports will bring in enough revenue to cover any revenue shortfalls. The nonprofit Tax Policy Center says the tariffs would generate $3.7 trillion in gross revenues over 10 years, but would net only $2.8 trillion because the economic calamity they’d cause would reduce revenues from other federal taxes. Obviously $2.8 trillion would not come close to recouping either $12 trillion or Dayan’s $9.75 trillion.

Given all this, it’s no surprise that economists are lining up to criticize Trump’s economic program. This tally includes 16 Nobel laureates in economics (“Donald Trump will reignite this inflation, with his fiscally irresponsible budgets”); 400 economists and former government officials; (“It is a choice between inequity, economic injustice, and uncertainty with Donald Trump or prosperity, opportunity, and stability with Kamala Harris”); Moody’s; Goldman Sachs; and even Trump’s beloved Wharton School. I’m sure there’s one or two economists who support Trump, if only to get a job in his second term, but when I Google “economists who support Trump” I come up empty.

I should further remind you that health care is an economic issue; it’s about as economic an issue as there is; and Trump, along with other Republicans running for office, seldom talk about it because their record is terrible compared to the Democrats. Deep down, they know this. They have no idea how to fix health care. (They do have one or two ideas how to make it worse, but they offer these desultorily.)

Far removed from this parched landscape lies the leafy oasis of Harris’s 81-page survey of her economic policies. This begins with a tour d’horizon of the aforementioned independent economic analyses. If economics doesn’t interest you, that’s all you really need to read. People who understand this subject—even many conservatives who understand this subject—think Trump’s economic plan would be terrible for the country, bringing more inflation, more unemployment, and more deficit spending. Now go vote.

If your interest in the subject runs deeper, however, I invite you to consider my mild discontent with Harris’s policies, as compared to Biden’s.

Restoration of child tax credit. Biden expanded the child tax credit from $1,000 to $3000 ($3,600 for children under six); he made the tax credit fully refundable for people whose incomes weren’t high enough to receive the credit (previously it was only partly refundable); and he delivered these payments monthly rather than annually. After one year Congress didn’t let Biden renew this expansion, which was passed to address the Covid crisis. Harris would restore the expanded credit and add a second $6000 tax credit for a child’s first year of life. That would cost about $2 trillion over ten years, according to Penn Wharton’s budget model, of which the newborn credit is only $132 billion.

Advantage: Harris.

Grocery prices. The Federal Trade Commission is suing to block a merger between the Kroger and Albertson’s chains, mainly because it would reduce employment and lower wages. This is what the brochure refers to when it says Harris will “crack down on unfair mergers and acquisitions that give big food corporations the power to jack up food and grocery prices.” The merger is at least as likely to lower price increases as it is to jack them up, but the hot political issue right now is grocery prices, not monopsony. The real question here is whether Harris would re-appoint Lina Khan, the aggressive chair of the Federal Trade Commission who is breathing some life into antitrust enforcement. Harris’s wealthier contributors really don’t want Khan to stay. Harris hasn’t committed either way, and it’s reasonable to wonder whether she’d ever have appointed Khan in the first place. At the very least, Biden would not be so timorous about playing up the wage angle.

Advantage: Biden.

Ban on price-gouging. Harris doesn’t explain how her proposed ban would work, but the brochure cites existing state laws in Texas, North Carolina, New York, and Florida that have been used to punish corporations that profiteered during local emergencies. None of these statutes imposes price controls, as Trump has accused Harris of wanting. Even Michael Strain of National Review says that accusation is bullshit. I’m skeptical that such a law can work at the federal level (localized shortages being easier to identify than national ones), but it certainly wouldn’t do any harm.

Advantage: Harris.

Extend the $35 per month cap on insulin prices beyond Medicare to all insurers. This is Biden’s position, and it’s a good one. Harris doesn’t build on this except with a vague promise to accelerate the speed of drug-price negotiations (made possible by the Biden administration). Advantage: Biden.

Expand a fund to assist low-income housing from $20 billion to $60 billion. In general, increasing low-income housing should be the principal goal of anything government does about housing. Harris’s brochure does not do a great job explaining how this works; there’s better detail here. But I’m for it.

Advantage: Harris.

$25,000 in down-payment assistance for first-time home buyers. The affluent don’t need another tax subsidy; they already get to deduct their mortgage interest. Harris’s brochure suggests there will be some sort of income eligibility ceiling; elsewhere she has said eligibility will be based on whether your parents owned their home. But that’s not a great metric for need—what about upwardly mobile private-equity tycoons? Harris would also create a $10,000 tax credit for first-time home buyers that appears to be available to anybody. Until Harris can persuade me these subsidies are well-targeted to those who really need them, I’m against them.

Advantage: Biden.

Expand the startup small business deduction from $5000 to $50,000. See above.

Advantage: Biden.

“Invest in American Innovation and Industrial Strength Powered by American Workers.”There is nothing under this heading about either labor unions or the Protecting the Right to Organize (PRO) Act, which would make it easier to organize. Yes, Harris supports the PRO Act, but why not mention it here? Biden would.

Advantage: Biden.

“Create Security and Opportunity for Workers and Build A Care Economy.” OK, the PRO Act get mentioned here. Harris also would sign into law a bill to overturn the Supreme Court’s 2018 Janus decision limiting the operation of public employee unions. There’s some discussion here of the problems of worker misclassification (i.e., making employees gig or temp workers so you don’t have to pay benefits) and right-to-work laws. This is all excellent material. But why wait until page 61 out of 81 pages to bring all this up? Is she hoping Mark Cuban won’t see it? Biden wouldn’t bury this stuff.

Advantage: Biden.

Raise the top capital gains rate to 28 percent. It’s 20 percent now. It should match the top marginal income-tax rate, which is 37 percent. For people who earn in excess of $1 million, Biden wants to raise it to 37 percent (and, later, to 39 percent, if he’s able to raise the top marginal income-tax rate). Harris would raise it only to 28 percent—a sop to her wealthy donors.

Advantage: Biden.

Look, I don’t mean to be a spoilsport. Democrats were absolutely right to pressure Biden into withdrawing. He is too old to stand for re-election. And for multiple reasons, including a shortage of time, Harris was the right person to step into his shoes But even as most political reporters clamor for Harris to differentiate herself from Biden, I wish she wouldn’t. I crave reassurance that Harris will continue to govern in the same spirit that Biden—make that Biden and Harris—did. Mostly Harris will (especially when compared to Trump). But I’d be lying if I said I thought Harris’s economic policies, as articulated thus far, are an improvement on Biden’s. Mostly they aren’t. If anything, they’re a small and mildly discouraging step backward.