Klarna in discussions with big US banks on potential New York IPO

Klarna has approached a number of top Wall Street banks about a possible New York listing which could come as soon the first half of next year, according to reports.

Klarna is in conversation with a number of top Wall Street banks about a possible New York listing which could come as soon the first half of next year, according to reports.

The FT reported that Morgan Stanley, JP Morgan and Goldman Sachs were all in lead positions to secure top roles on the potential listing of the Swedish ‘buy-now pay-later’ firm. Other banks could also join the underwriting group.

Klarna was once one of Europe’s most valuable tech groups, but its valuation has plummeted in recent years amid higher interest rates and economic instability. At its most recent valuation in July 2022, Klarna was valued at $6.7bn, down from a peak of $46bn in June 2021

Its unclear what valuation Klarna would seek in a listing, although an IPO has been on the cards for a while.

Earlier this year, the firm told investors that it ditched rights held by large shareholders to block smaller investors’ share trades, a source of tension for many investors. Klarna said it had “listened to” shareholders and that large investors no longer “have the right to interfere” in future share transactions.

Last year, Sebastian Siemiatkowski, Klarna’s co-founder and chief executive, said: “From an IPO perspective, the requirements have been met. So now its more market conditions.”

With interest rate cuts on the horizon and a soft landing likely, the IPO market has picked up in recent months.

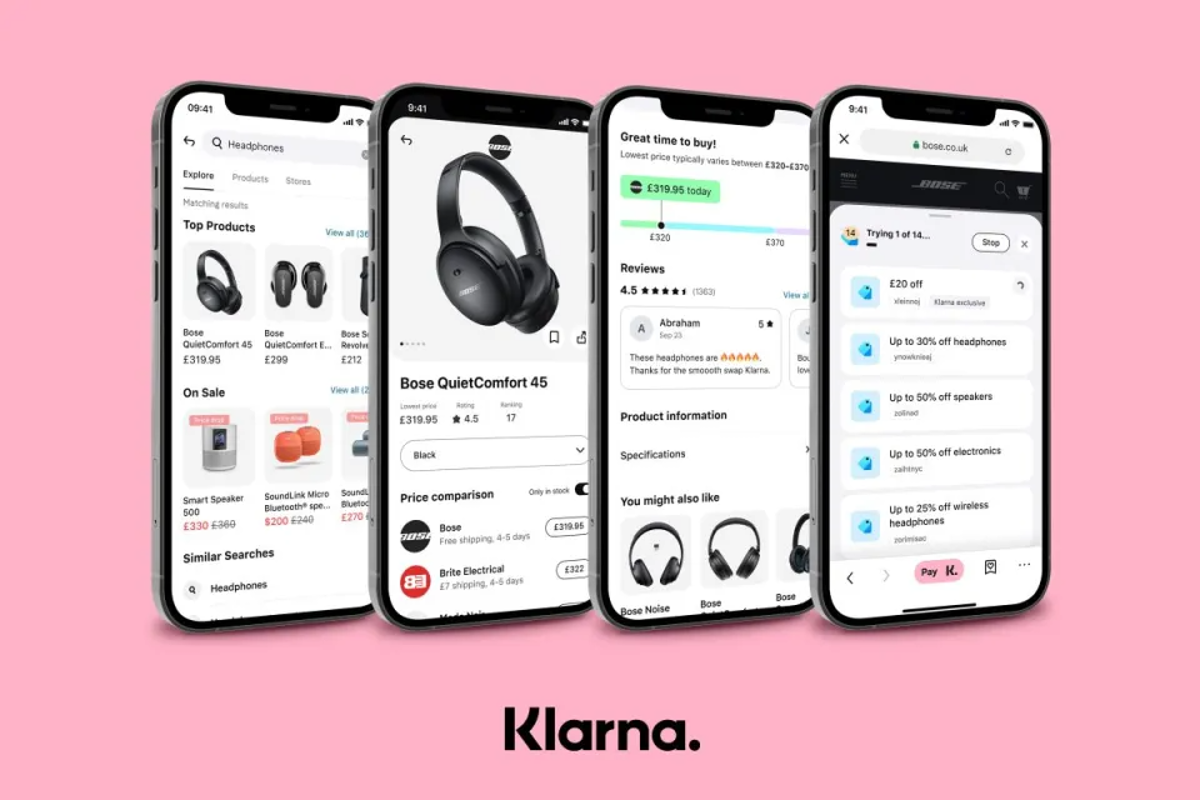

Klarna offers around 150m active users the ability to delay or spread the cost of their purchases. The value of these purchases increased 17 per cent last year, while credit losses fell 32 per cent despite inflationary pressures on consumers.

The Swedish firm, posted a net loss of 2.5bn kronor (£191m) last year, an improvement from its 10.4bn kronor (£794m) loss in 2022. Revenue for the full year jumped 22 per cent to 23.5bn kronor (£1.8bn).

Klarna did not comment.