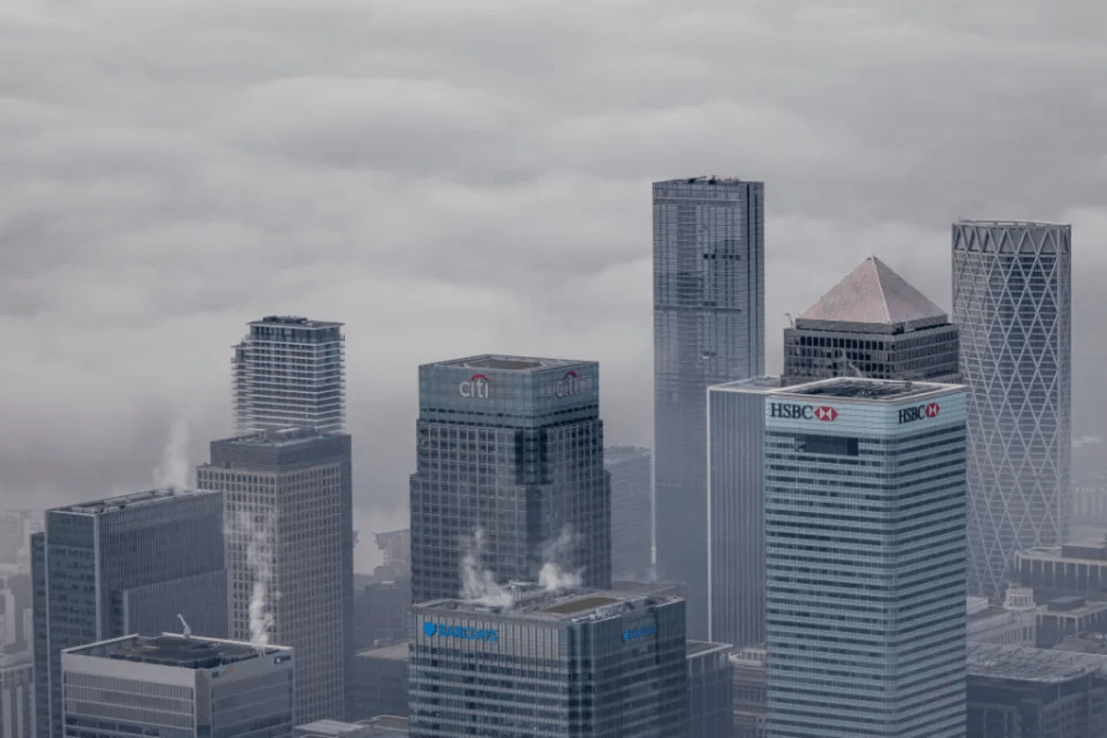

Lloyds, HSBC, Barclays and Natwest set for profit boost as interest rate cuts thrown into doubt

The UK's biggest banks are set to report lower profits and narrower margins in the coming weeks as the interest rate tailwind which pushed their earnings to a record high last year dies down.

The UK’s biggest banks are set to report lower profits and narrower margins in the coming weeks, but uncertainty over the Bank of England cutting interest rates could revive the tailwind from higher borrowing costs.

Reporting for the first three months of 2024 will kick off with Lloyds Banking Group next Wednesday, followed by Barclays on Thursday and Natwest on Friday.

The following week will see HSBC and Santander’s results on the Tuesday and Standard Chartered’s earnings on the Thursday.

Higher borrowing costs from the Bank of England pushed lenders’ net interest income to record highs last year, but their margins have narrowed into 2024 amid intense competition for mortgages and deposits, and the expectation that rate-setters will make multiple cuts this year.

However, in recent weeks, concern over the US economy and stickier-than-expected UK inflation has caused traders to slash their bets on rate cuts from the Bank of England. Markets are currently pricing in just two cuts, down from seven at the start of the year.

Benjamin Toms, an analyst at RBC Capital Markets, told City A.M.: “The impact of higher-than-expected rates on existing FY24 guidance will be a key topic of discussion on results calls, especially any potential boost for net interest margins.

“Whilst the top line may be a beneficiary of macroeconomic developments, it could present a headwind for loan growth, cost control and asset quality.”

Investors will also be monitoring any changes in loan defaults as the resilience of borrowers is tested by the tough economic backdrop. Analysts at S&P Global Ratings project that UK banks’ domestic credit losses will inch higher to £4.4bn this year, mostly driven by unsecured lending.

They also forecast a modest 2.1 per cent rebound in lending this year, driven by higher mortgage market activity and signs of improving business sentiment.

Peter Rothwell, head of banking at KPMG UK, told City A.M.: “Potential delays to rate cuts should continue to support net interest income. Although it will be interesting to see the extent to which higher rates and the continued cost of living challenges are impacting credit quality, which has proven robust thus far.”

According to a company-complied analyst consensus, Lloyds is expected to post a pretax profit of £1.66bn for the first quarter, down from £1.78bn in the previous three-month period and £2.26bn in the first quarter of last year.

The bank’s net interest margin – measuring of the gap between interest received on loans and rates paid for deposits – is expected to fall to 2.93 per cent, from 3.22 per cent last year.

Analysts are also paying attention to the Financial Conduct Authority’s review into historic commission arrangements for motor finance, which analysts say could cost the auto lending industry up to £16bn in compensation fees.

Lloyds, considered the most exposed UK bank in absolute terms, took a £450m provision in February to cover potential costs. Questions loom over whether it might raise this figure as RBC analysts forecast a potential hit to the bank of roughly £2.5bn, with a worst-case estimate of up to £3.5bn.

Barclays and Santander UK are also facing potential payouts tied to the regulator’s probe.

Barclays is expected to post a pretax profit of £2.20bn for the quarter, down from £2.60bn in the same period last year. The bank has embarked on its biggest restructuring since the financial crisis, designed to save £2bn in costs and return £10bn to shareholders by 2026.

It reported £927m in operating costs tied to this process last quarter and slashed 5,000 jobs globally in 2023.

Barclays’ earnings last year were dragged down by a weaker performance from its global investment bank, which is seen by critics as a volatile revenue stream and subscale compared to the Wall Street giants.

However, investors now have reason to be more optimistic about the business’ prospects. The biggest US banks’ earnings recently beat estimates due to an uptick in investment banking and trading operations amid a rebound in deals activity.

Following a turbulent 2023 marked by a “debanking” row with former Ukip leader Nigel Farage, Natwest’s stock price has outperformed all of its high street peers so far this year with a new management team and improving economic picture.

The bank is expected to post a pretax operating profit of £1.25bn in the first quarter, down from £1.82bn in the same period last year but little changed from £1.26bn in the previous quarter.

HSBC will book a $1bn loss in the first quarter from the sale of its Argentinian business, which came as part of its pivot to focus more on India, Singapore and China. Meanwhile, it has estimated a $4.9bn gain from the sale of its Canadian division.

The lender, which is the largest bank on the FTSE 100, stands out from the rest of the Big Four in its exposure to China, which is grappling with an economic slowdown. Investors will be hoping for no more surprises, after HSBC revealed a $3bn writedown on a Chinese bank last quarter.

Tomasz Noetzel, an analyst at Bloomberg Intelligence, told City A.M.: “About £700bn of structural hedges remain a significant net interest income headwind for the three largest domestic lenders through 2026, with a near-50-basis point gap in 2024 UK rate expectations offering a potential source of earnings surprises at Lloyds and peers this year.”

Structural hedging is a risk management tool used by banks to reduce the sensitivity of earnings to interest rate shocks. Banks use some assets to build a fixed-income cash flow that protects overall earnings from interest rate volatility.