Maersk shares plummet amid ‘high uncertainty’ of Red Sea shipping disruption

Maersk shares plummetted over 14 per cent this morning after the container shipping giant flagged "high uncertainty" in the Red Sea.

Maersk shares plummeted over 14 per cent this morning after the container shipping giant said “high uncertainty” surrounding disruption in the Red Sea would hit full-year earnings.

The Danish firm is forecastasting underlying earnings before interest, tax, depreciation and amortization (EBITDA) of between $1bn and $6bn in 2024, down from $9.6bn the prior year.

Container shipping companies have been re-routing vessels around the Cape of Good Hope since Iran-backed Houthi rebels launched attacks on the Suez Canal, one of the world’s most critical trade routes, in November.

Shipping costs have soared in response as diverting around South Africa can add around two weeks to journey times.

Maersk said that given the “heightened uncertainty,” it had decided to suspend its share buy-back programme until market conditions had settled.

It came as pre-tax earnings for the fourth quarter tumbled to $839m, down from $6.5bn year-on-year. Revenues also fell to $11.7bn, down from $17.8bn.

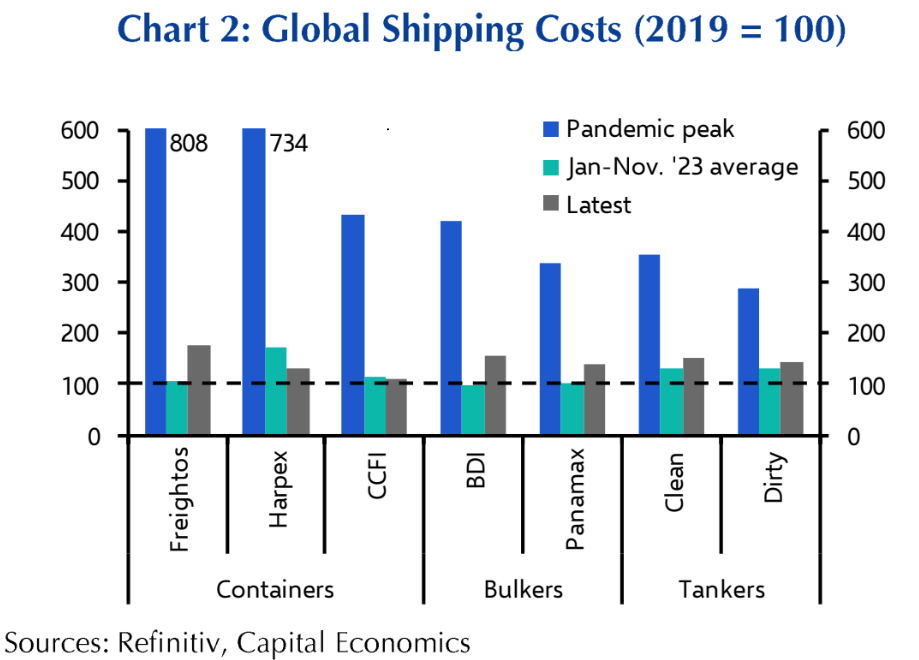

Chaos on the Red Sea has coincided with a wider downturn in the shipping market, following a pandemic-era freight rate boom.

“The current market remains one of robust volumes, but while the Red Sea crisis has caused immediate capacity constraints and a temporary increase in rates, eventually the oversupply in shipping capacity will lead to price pressure and impact our results,” Maersk’s chief executive, Vincent Clerc, said.

“The ongoing disruptions and market volatility emphasize the need for supply chain resilience, further confirming that Maersk’s path toward integrated logistics is the right choice for our customers to effectively manage these challenges.”