Manufacturing remains in expansion but confidence plummets ahead of budget

The fall in confidence was the largest since March 2020, just before the Covid lockdown.

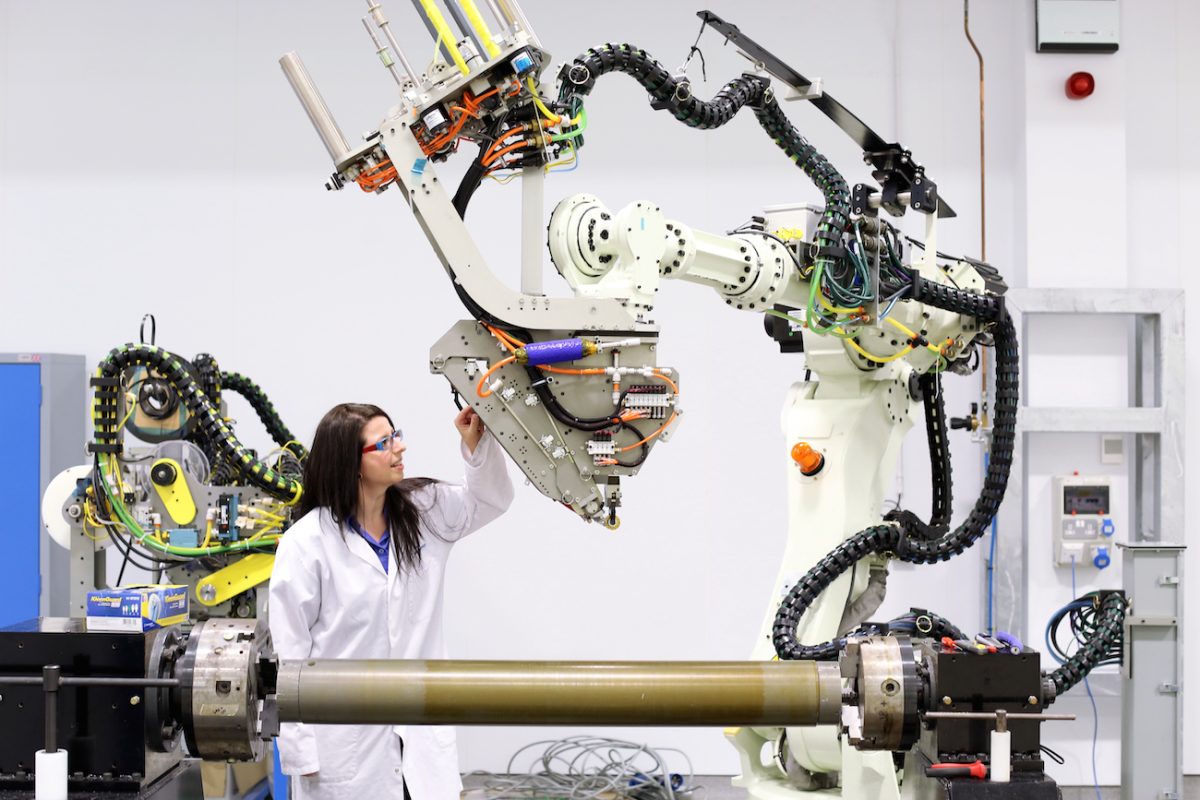

The recovery of the manufacturing sector looks set to fade, according to a closely watched survey, as rising costs and fears about the budget hit business sentiment.

Optimism about the year-ahead slumped to a nine-month low in September, according to S&P’s purchasing managers’ index (PMI) for the manufacturing sector.

The fall in confidence was the second-largest on record, only beaten by the slump seen in March 2020, just before the Covid lockdown.

A range of factors were attributed for the fall in business confidence, including fears about how government policy might change in the budget.

Rob Dobson, director at S&P Global Market Intelligence, said: “Uncertainty about the direction of government policy ahead of the coming Autumn Budget was a clear cause of the loss of confidence, especially given recent gloomy messaging”.

S&P’s survey chimes with a number of recent surveys which have pointed to deteriorating business confidence in the weeks before the budget. But firms were also dealing with the fastest increase in input prices since January 2023, largely as a result of increased freight prices.

“Part of this was due to the re-routing of supply chains away from the Red Sea, which also led to a lengthening of lead times from suppliers for the ninth month in a row,” the survey said.

Dobson said the increase in price pressures was a “reminder that the inflation genie is not yet back in the bottle”.

As a result of the fall in confidence, the survey showed that firms had cut back on headcount and reduced purchasing activity.

Despite the fall in confidence, the survey reported that output remained in expansionary territory in September for the fifth consecutive month.

The PMI stood at 51.5, unchanged from the earlier ‘flash’ estimate, but lower than August’s 26-month high of 52.5. Any measure above 50 indicates expansion.

The increase was driven by strong domestic demand, with overseas business falling for the 32nd consecutive month. Demand remained weak in France and Germany as well as the US, the survey showed.

“The main drivers of the latest expansion were the consumer and intermediate goods sectors, both of which registered stronger increases in output and new business,” the survey said.

Investment goods, meanwhile, slipped into contraction for the first time in five months, having been the best performing sub-industry in recent months.