Mapping North Korea’s discreet artillery ammo route to Russia

Detailed tracking shows North Korea exported enough ammunition to enable Russia's fivefold edge in daily artillery use against Ukraine The post Mapping North Korea’s discreet artillery ammo route to Russia appeared first on Euromaidan Press.

Both Russia and Ukraine are reliant on artillery on the battlefield, and both faced shortages of artillery ammunition after heavy use, fueling a race for rounds.

In 2022 and the first half of 2023, Ukraine seemed to be winning: the West provided more artillery ammunition to Ukraine than Russia received from its partners.

However, by January 2024, the dynamics shifted: Russia is now getting more rounds than the West sends to Ukraine, thanks to continuous ammunition shipments from North Korea that went into full swing in the fall of 2023.

This poses great danger to the Ukrainian forces, as in a battlefield where neither side can achieve air dominance, artillery is a key factor that shapes the outcome of offensive or defensive operations.

After identifying this key factor in the war, the OSINT group Frontelligence Insight monitored ammo shipments from North Korea to Russia, aiming to track logistical routes, calculate delivery numbers, and identify storage points. Today, we are disclosing North Korea’s ammo transport ecosystem – and revealing some of its crucial nodes for the first time.

How much ammo?

According to recent statements by Vadym Skibitskyi, a representative of Ukraine’s Military Intelligence (HUR), in 2023, North Korea supplied Russia with approximately one million rounds of ammunition, predominantly consisting of 122 mm and 152 mm artillery shells. In October 2023, my OSINT group Frontelligence Insight tracked and estimated that, from September to the end of October, Russia received approximately 2,000 cargo containers from North Korea, containing around 500,000 rounds of 152mm and 122mm ammunition.

On 11 January, in an exclusive interview with Yonhap, a major South Korean news agency, South Korean Defense Minister Shin Won-sik stated that North Korea is estimated to have provided around 5,000 containers of weapons to Russia as of the end of December. These containers can accommodate some 2.3 million rounds of 152mm shells or around 400,000 rounds of 122mm artillery shells.

Given that Russia consistently received ammunition without disruptions, as we in Frontelligence Insight have visually observed, we believe that the number provided by South Korean officials of 5,000 cargo containers between September and January is likely accurate.

Applying our methodology, which has been consistent in past estimations of ammunition deliveries from North Korea, assuming the accuracy of the information about 5,000 containers, the estimated number of ammunition deliveries between September and the end of December would be approximately 1.57 million shells, combining 152mm and 122mm (see footnote for the calculations). This figure falls in the middle between the estimates provided by HUR and the South Korean Defense Minister.

Logistical routes: North Korean ammo deliveries to Russia

As previously identified by researchers from the Royal United Services Institute, the predominant method for delivering ammunition to Russia is through sea shipments. Evident from recent imagery, since October 2023, 20 ft shipping containers filled with ammunition are loaded onto sea vessels at Raijin port (Rason) and shipped to Dunai port near Vladivostok in Russia’s far east.

Our analysis based on January imagery reveals ongoing ammunition shipments from North Korea in 2024. After being offloaded at Dunai port, the containers are transported by trucks to the railroad branch at the port. This allows Russians to load the delivered containers onto trains, facilitating transportation across Russia to various locations closer to Ukraine.

Upon arrival in Russia, the artillery ammo in containers is directed to at least three identified locations where Russians store and distribute it. The details of these locations are as follows:

Tikhoretsk ammunition storage

The Tikhoretsk ammunition depot, previously known as the 719th Artillery Ammunition Base in Rostov Oblast, has been utilized as an artillery ammo depot throughout the war. Satellite imagery reveals that Russians began excavating and preparing multiple revetments for ammo storage in mid-August 2023. By September, the arrival of 20 ft cargo containers via trains had been well-documented.

Mozdok ammunition storage

Unlike the Tikhoretsk ammo depot, Mozdok is situated over 600 km away from the border with Ukraine, making it improbable for immediate delivery of ammo to the frontlines. Possibly, it may serve as storage for ballistic missiles delivered to Russia, used against Ukraine on 30 December 2023 and 2 January 2024. However, there is currently no visible evidence indicating the transportation of these missiles to Mozdok.

The Frontelligence Insight team analyzed satellite imagery of the area, determining that the initial shipments arrived at Mozdok in early October 2023. Like the Tikhoretsk ammo depot, containers are transported via trains and subsequently unloaded near the ammunition storage site.

Yegorlykskaya airfield

Yegorlykskaya, a small rural town in Rostov Oblast, situated approximately 90 km from the Tikhoretsk Ammo Depot, serves as another discreet location for storing ammunition. Unlike other known sites, Yegorlykskaya lacks prior associations with ammo storage before or during the war; recent operations there are kept discreet. The revetments were constructed on the territory of a military airfield that has been inactive since 2010.

Satellite imagery from early September 2023 shows the emergence of initial revetments, like those observed in Tikhoretsk.

By October, objects resembling crates and containers began to appear in the area. The timeline, discreet location near the railroad, and the appearance of objects resembling containers in revetments strongly indicate that this location is likely associated with North Korean ammo deliveries as well.

What happens with the ammo after arrival?

After arriving at the designated locations, the ammunition is further transported using both civilian and military trucks. The destination includes specific military units or temporary makeshift ammo dumps situated approximately halfway to the intended unit.

The decentralization of ammo storage has become a new standard after a series of successful strikes employing HIMARs, drones, and other long-range weaponry. This approach involves rotating and utilizing temporary storage locations, minimizing the concentration of ammunition at a single site.

It is natural for warring sides to adapt to enemy weaponry and develop their own countermeasures as the war progresses. This is why large, one-time deliveries that can alter the balance of forces are preferable to a series of smaller deliveries spread over time. The latter approach may provide the opponent with opportunities to learn, adapt, and develop countermeasures.

Gap in production and alternative resolutions

Given that Russia produced approximately 2 million 122mm and 152mm artillery rounds in 2023 and received approximately 1.57 million rounds from North Korea, it’s likely that Russia will continue to increase its domestic production while covering current needs through foreign deliveries from Iran and North Korea.

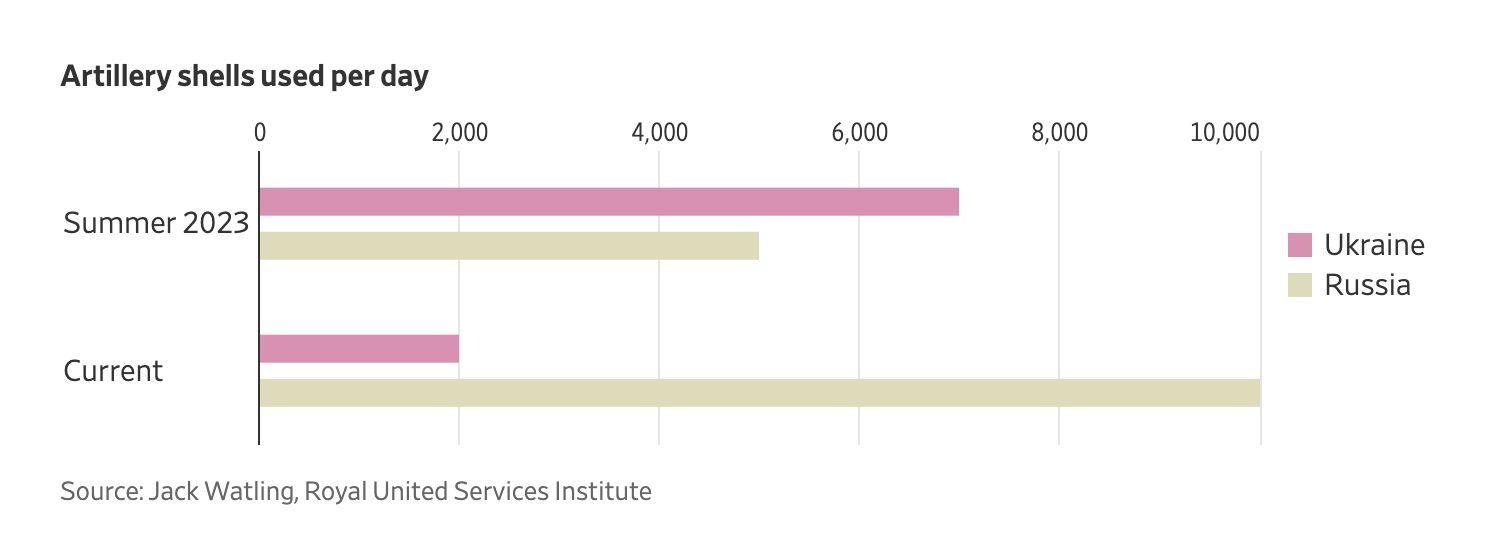

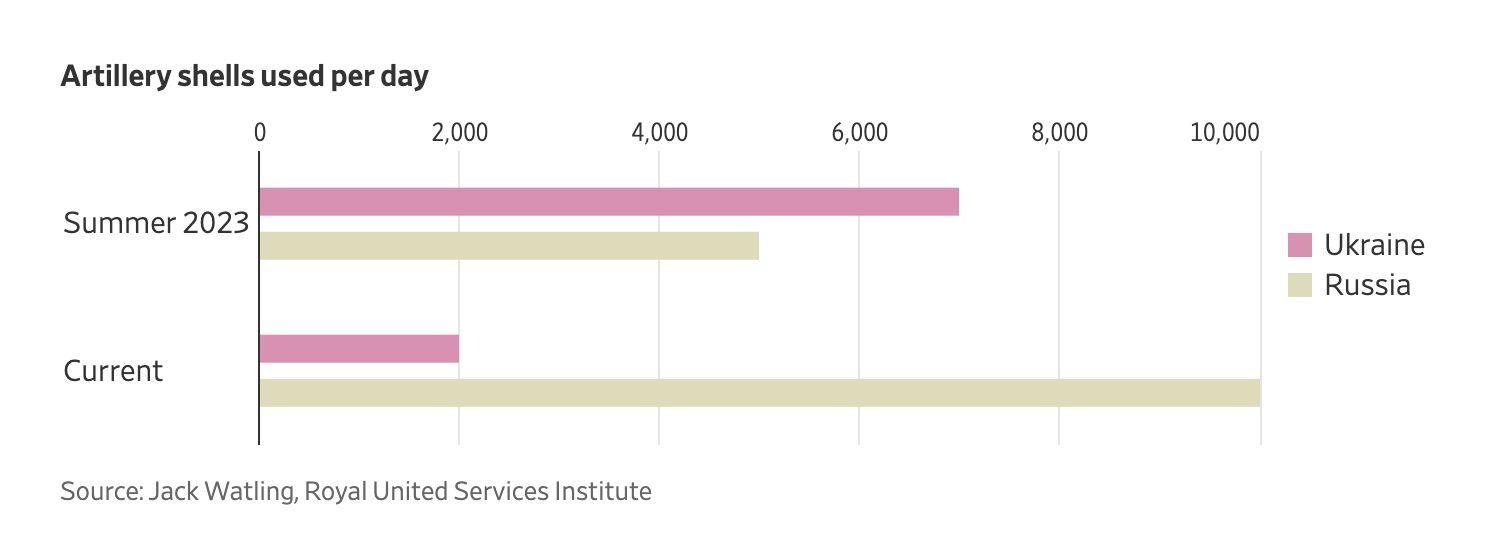

While these numbers may not enable Russia to use artillery as extensively as in 2022, they still provide Russia with an artillery firepower advantage when considering the Ukrainian ammo situation. According to the Royal United Services Institute (RUSI), Russia currently fires 10,000 shells a day – five times more than Ukraine. In the summer of 2023, Ukraine had the upper hand, firing 7,000 a day, compared to Russia’s 5,000.

Although the European Union admitted it is having trouble fulfilling its pledge of 1 million rounds of artillery ammunition by March 2024, the goal could still be achieved if the EU redirects its exports and increases pressure on producers, EU officials say.

Concurrently, the USA, Ukraine’s primary source of artillery ammunition, doubled its production to 28,000 rounds per month in October 2023. As well, Ukraine has increased its ammunition production tenfold in 2023.

However, this all still falls short of meeting current frontline needs and lags behind Russia’s capacities, boosted by North Korea.

While the straightforward solution is to boost production, scaling up artillery ammunition production takes time. In the meantime, what other measures can the West and Ukraine implement to alleviate the effects of artillery ammo shortages?

- FPV Drones: While not a direct replacement for artillery, FPV drones prove effective in both offensive and defensive actions. They can deliver precise strikes on enemy vehicles and soldiers, bridging the gap in situations where ammunition is scarce or severely limited.

- Counter-Battery Systems: Increased delivery of counter-battery radars and GMLRS weaponry may not boost artillery fire rates for Ukraine, but it can significantly diminish enemy artillery fire. This reduction allows forces to achieve parity or even gain an advantage in artillery fire ratio, enhancing the overall tactical situation.

- Mortars: Similar to FPV drones, mortars cannot fully substitute for artillery. However, their mobility and effectiveness make them valuable in both offensive and defensive operations, providing a short-range alternative on a smaller, tactical scale. Increased mortar and its ammo deliveries in 2024 can alleviate the pressure on Ukrainian troops.

- Deep-striking capabilities: Europe and the US should also explore the possibility of providing Ukraine with missiles and permission to strike Russian ammo depots inside Russian territory. Escalatory rhetoric is unlikely to be effective, especially after North Korea supplied Russia with ballistic missiles, which were subsequently used to strike Ukrainian cities.

- Soft power: Finally, the decision by the North Korean dictatorial regime to supply ammunition to Russia for an invasion of a sovereign European country demands a robust response from the West. Despite North Korea’s existing heavy sanctions, its dependence on China opens avenues for influence through diplomatic and economic soft power. Coordinated efforts by Western nations and their Asian partners can be instrumental in addressing this problem.

Deepening ties between authoritarian axis

In summary, Russia’s growing artillery advantage on the battlefield is caused by the deepening connections between Russia, Iran, and North Korea. The situation may get worse if China opts to significantly assist Russia with ammunition—either by providing machinery and specialists to boost production or by directly selling it to Russia through North Korea.

This geostrategic alignment should not be taken lightly, as it has the potential to furnish Russia with a firepower advantage in 2024, leading to multiple tactical and operational successes and fostering the perception that Ukraine is steadily losing territories. Given the ongoing presidential election campaign and the lack of consensus in the US Congress on providing military aid to Ukraine, Europe should explore alternatives to address the Ukrainian ammo problem while simultaneously increasing production.

Even though North Korean ammunition has low quality, resulting in low accuracy, unexploded ordnance, and even barrel bursts, Russia still holds an advantage due to the sheer volume. This advantage enabled Russia to seize the strategic initiative by the end of 2023.

As evident from imagery and analysis provided by Frontelligence Insight, North Korean ammo deliveries can assist Russia in partially meeting its ammo needs, and makeshift logistical hubs have been created to accommodate the ammo. While this creates a vulnerable logistical bottleneck, the West’s prohibition on using its weapons for strikes inside Russian territory stymies Ukraine’s potential for neutralizing the North Korean ammunition lifeline to Russia. It remains to be seen whether Ukraine’s evolving drone capabilities, developed to overcome this Western limitation, are capable of achieving this task.

Calculations:

The approximate distribution of ammo is as follows: 85% (4,250 containers) contain 152mm ammo, and 15% (750 containers) contain 122mm ammo crates.

It was previously established that one 20ft shipping container accommodates approximately 276 crates of 152mm and 264 crates of 122mm.

The number of 152mm shells: 276 * 4,250 = 1,173,000

The number of 122mm shells: 264 * 750 * 2 (each 122mm box contains two pieces) = 396,000

Total number = 1,173,000 + 396,000 = ~1.57 million artillery shells.

A small percentage of containers may be utilized for the delivery of missiles and other ammunition; however, their overall numbers are too limited to make a significant difference in the final count. Therefore, they have been omitted from the calculation.

Related:

- North Korea uses Ukraine “as test site for nuclear-capable missiles,” South Korea says at UN SC meeting

- Russia hits 2 million large-caliber munitions yearly; 500k shortfall covered by North Korea

- North Korea may sell tactical guided missiles to Russia in addition to short-range ballistic missiles, Seoul says

- Ghost ships reveal North Korea’s secret arms trade with Russia, posing threat to Ukraine – Bloomberg

- Ukraine has initial evidence Russia uses North Korean missiles in Ukraine

- North Korean arms transfers to Russia estimated over 500,000 artillery rounds in two months, OSINT group says

The post Mapping North Korea’s discreet artillery ammo route to Russia appeared first on Euromaidan Press.