Moving markets: Five things shaping the FTSE 100 today

Both the Nasdaq Composite and S&P 500 reached record highs, while the Nikkei also hit a new peak. However, China's manufacturing activity slowed for the fifth straight month. Oil prices surged amid Gaza deaths, complicating ceasefire talks. All eyes are on global factory PMI data.

Moving markets today: Nasdaq and S&P 500 reach record peaks, Nikkei surges with Wall Street, China’s manufacturing slows for fifth month, global factory PMIs in focus

Both the S&P 500 and Nasdaq hit record highs fuelled by gains in tech stocks linked to AI. Japan’s Nikkei reached a new peak, while other Asian markets remained subdued amid uncertainties about China’s economy. China’s manufacturing activity slowed for the fifth consecutive month. Oil prices rose after the deaths of over 100 Palestinians awaiting aid complicated discussions of a Gaza ceasefire. Investors should monitor key indicators like ISM Manufacturing PMI, Consumer Sentiment, and Fed policymakers’ commentary later in the session. Here are five key takeaways for your day.

China’s manufacturing sector sees fifth straight month of contraction

China’s manufacturing contracted for the fifth consecutive month, signalling a slowdown in the world’s second-largest economy as Beijing prepares to unveil its annual growth target at the upcoming parliamentary meeting. The official manufacturing Purchasing Managers’ Index (PMI) for February was 49.1, slightly lower than January’s 49.2, indicating a contraction from the previous month. Conversely, the non-manufacturing PMI, covering services and construction, stood at 51.4, up from January’s 50.7.

In Japan, February marked the most significant contraction in over three and a half years, according to a private-sector survey. The final au Jibun Bank Japan Manufacturing Purchasing Managers’ Index (PMI) dropped to 47.2 from January’s 48.0, indicating the ninth consecutive month of contraction and the fastest since August 2020. The index has consistently remained below the growth threshold of 50.0 since June.

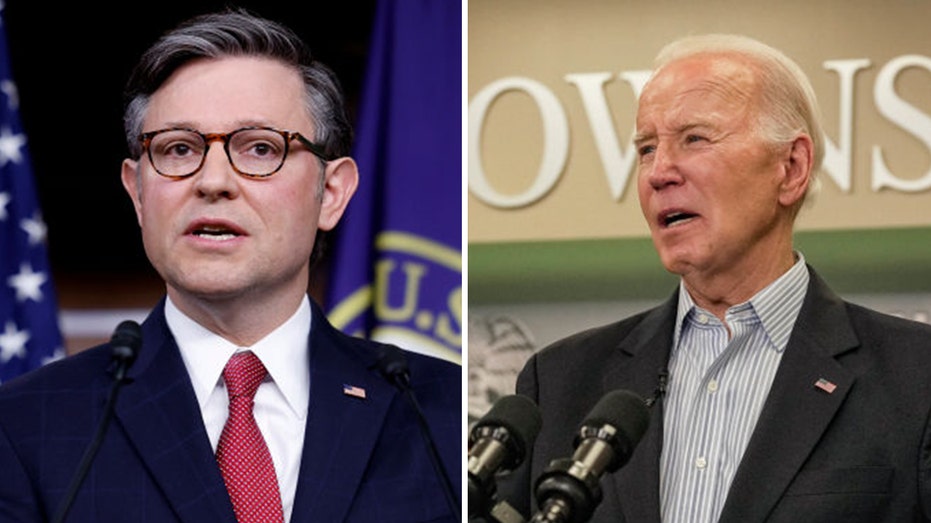

U.S. Senate clears bill to stave off government shutdown

The U.S. Senate, under Democratic leadership, passed a short-term spending bill on Thursday to avert a partial government shutdown. The House of Representatives, controlled by Republicans, had given its approval less than 36 hours before funding was set to expire. The bipartisan bill, endorsed with a 77-13 vote in the Senate, now awaits President Joe Biden’s signature for enactment. It establishes deadlines to fund specific government sectors by March 8 and March 22, respectively.

Oil prices soar following Gaza aid seekers deaths

Oil prices rose as discussions about a potential ceasefire in Gaza grew more complicated following the deaths of more than 100 Palestinians awaiting aid delivery, Reuters reported. Brent futures for April delivery went up by 23 cents, or 0.3%, to $82.14 per barrel, while U.S. West Texas Intermediate (WTI) rose by 16 cents, or 0.2%, to $78.44.

Health authorities in Gaza reported that Israeli forces shot dead more than 100 Palestinians on Thursday as they waited for aid delivery. Israel, however, attributed the deaths to the crowds surrounding aid trucks, stating that victims had been trampled or run over. Palestinian health officials confirmed at least 112 fatalities and over 280 injuries in the incident near Gaza City, Reuters reported.

What’s coming up

As the week wraps up, attention turns to a multitude of reports concerning the manufacturing sector for February worldwide. In London, final evaluations of S&P Global’s factory PMIs for both the eurozone and the UK, covering the same month, will be released. Subsequently, the ISM Institute in the United States will unveil its own factory PMI. investors in the eurozone will be particularly interested in the initial data on consumer price inflation. Moreover, investors will also closely monitor speeches by several influential Federal Reserve officials, including Waller, Bostic, and Daly.

All eyes at the end of the week will be on a raft of factory sector survey results for the month of February due out across the world. During the London session by final readings for S&P Global’s comparable factory PMIs for the euro area and UK referencing the same month. Later in the session, America’s ISM Institute will release its own factory PMI. Investors will also be keeping close tabs on what another batch of top Fed officials might have to say in speeches. Investors in the euro area will also be keeping an eye out for a preliminary reading for consumer price inflation.

Nikkei follows Wall Street’s lead; other Asian markets stay quiet

The Dow Jones Industrial Average edged up by 0.12% to close at 38,996.39. Similarly, the S&P 500 climbed by 0.52% to 5,096.27, while the Nasdaq Composite surged by 0.90% to 16,091.92. Notably, the Nasdaq surpassed its previous record high, while the S&P also set a new closing record. Nvidia, a major chipmaker, played a significant role in boosting both indices, with a 2.08% increase, while Advanced Micro Devices saw a notable surge of 9.06%. Dell Technologies, known for its AI-optimized servers, rose by 1.51% ahead of its post-market report.

In the Asian markets, Japan’s Nikkei hit a fresh record high, soaring by 1.75%, extending its previous month’s surge. Australia’s resource-heavy shares also reached a record high, up by 0.44% for the day. Hong Kong’s Hang Seng index remained relatively flat, while China’s mainland markets showed tentative movements, maintaining their levels on the first day of March. Treasury yields remained stable, with the 10-year Treasury yield at 4.2580% and the two-year Treasury yield at 4.6311%. Spot gold prices saw a slight 0.1% increase, trading at $2,045.29.