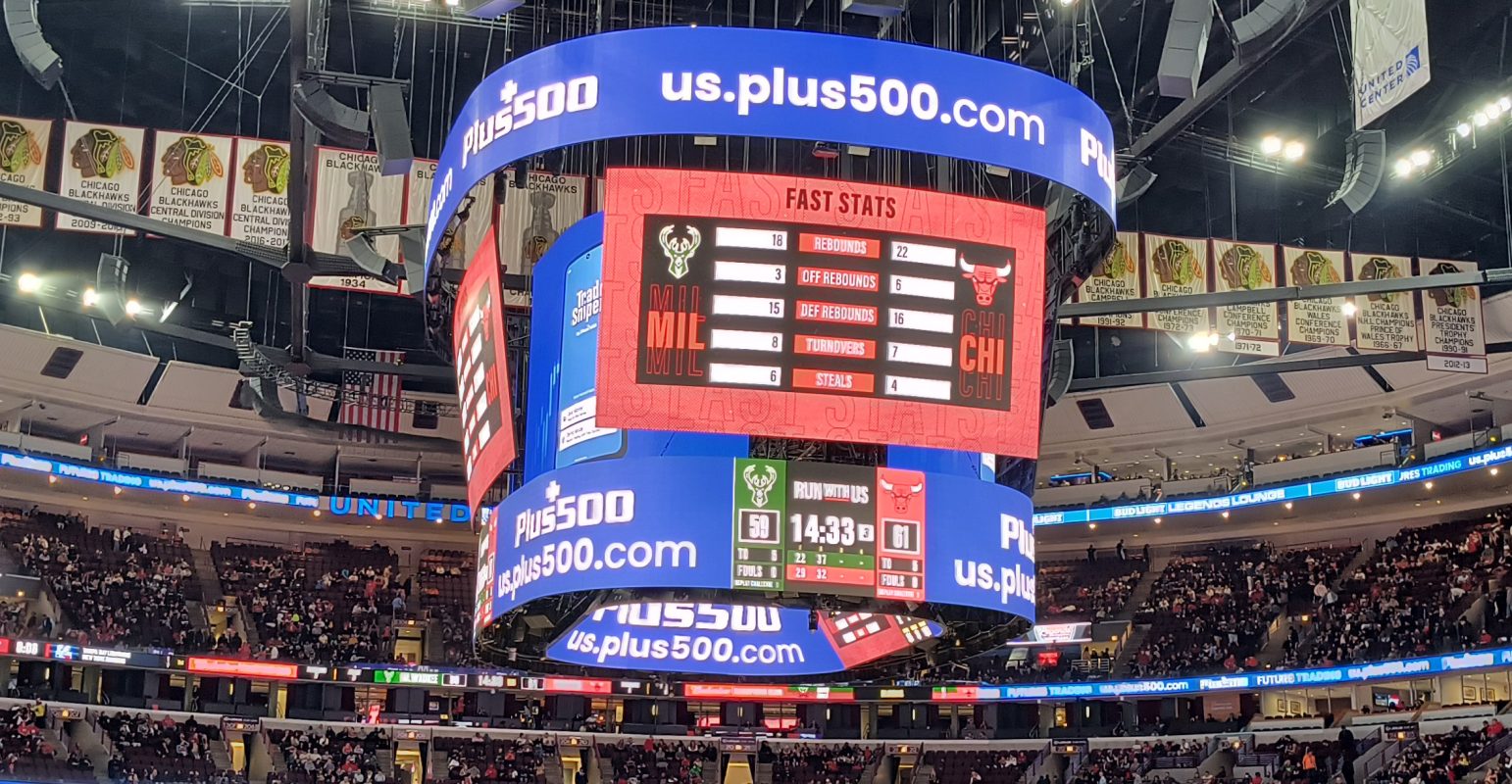

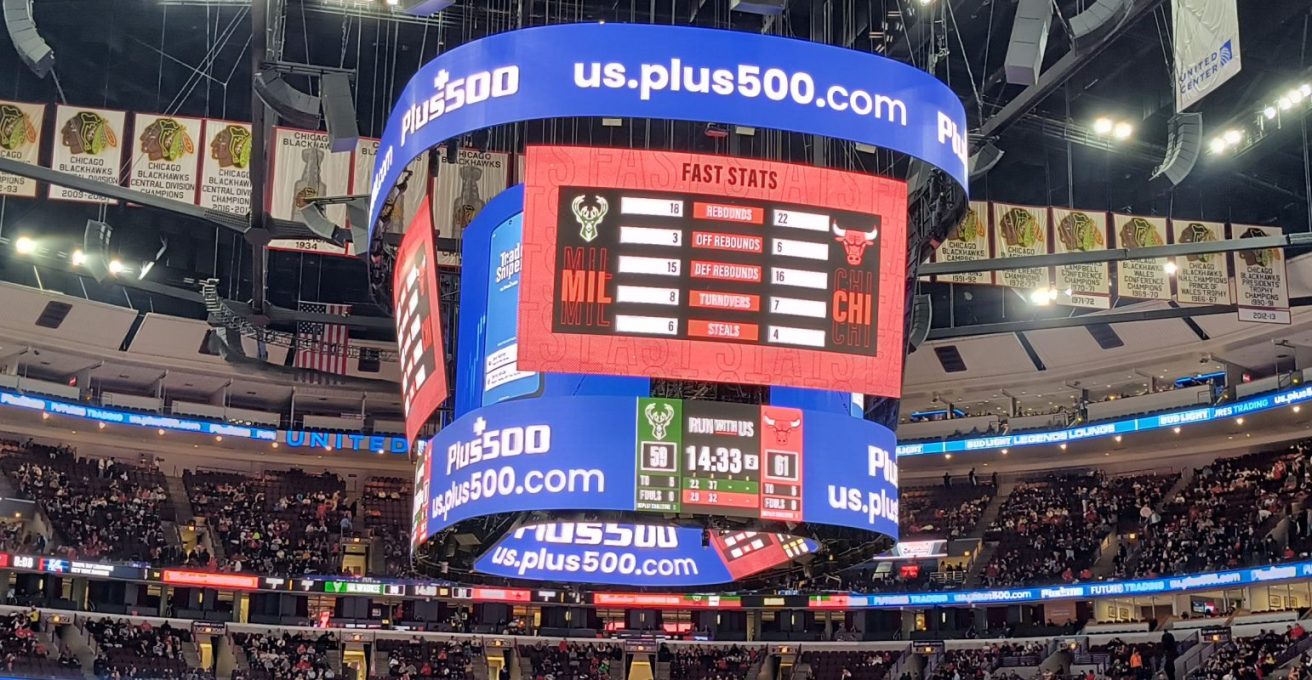

Plus500 expects to outperform market expectations after strong start to 2024

The London-Israeli firm saw a 13 per cent jump in new customers compared to the same quarter last year, although the number of active customers dipped two per cent.

Retail trading platform Plus500 has made a strong start to 2024, telling investors in an update this morning that it will outperform market expectations.

In the first quarter of the year, revenue rose four per cent year-on-year to hit $215.6m (£173m), while earnings before interest, taxation, depreciation and amortisation edged up two per cent to $102.6m (£83m).

The London-Israeli firm saw a 13 per cent jump in new customers compared to the same quarter last year, although the number of active customers dipped two per cent.

The firm flagged its retail business, which has “continued to track ahead of management’s expectations”. It said its contribution to new customers at a group level was already noticeable.

Plus500 has been trying to deepen its customer engagement and focus on higher value customers. It noted that average revenue per user was up five per cent. “Deepening customer engagement remains a key part of the Group’s strategic roadmap,” it said.

The firm said it remains confident about its prospects and expects to perform ahead of current market expectations.

“Thanks to our established competitive advantages, continued strategic progress and robust financial position, Plus500 generated another set of strong operational and financial results during the period,” David Zruia, chief executive at the firm said.

“We continued to deliver against our strategic roadmap; expanding into new markets, developing new products and deepening relationships with our customers,” he continued.

Analysts were impressed with the results. “It is clear that the group’s strategy of diversification and improving customer quality is paying dividends,” Liberum analysts noted.

Plus500 said it remained debt-free with cash balances of over $985m (£792m). This will enable the Group to make “strategic investments as part of its disciplined capital allocation policy”.

It noted that it is “actively targeting” bolt-on acquisitions in selected markets where attractive opportunities exist alongside its organic growth strategy.