Recession confirmed for UK after GDP dropped 0.3 per cent in final quarter

The UK has struggled to generate any momentum over the course of 2023 due to the dual impact of rising inflation and high interest rates.

The UK slipped into a recession at the end of last year after a poor performance from the dominant service sector pushed the economy into contraction, new figures show.

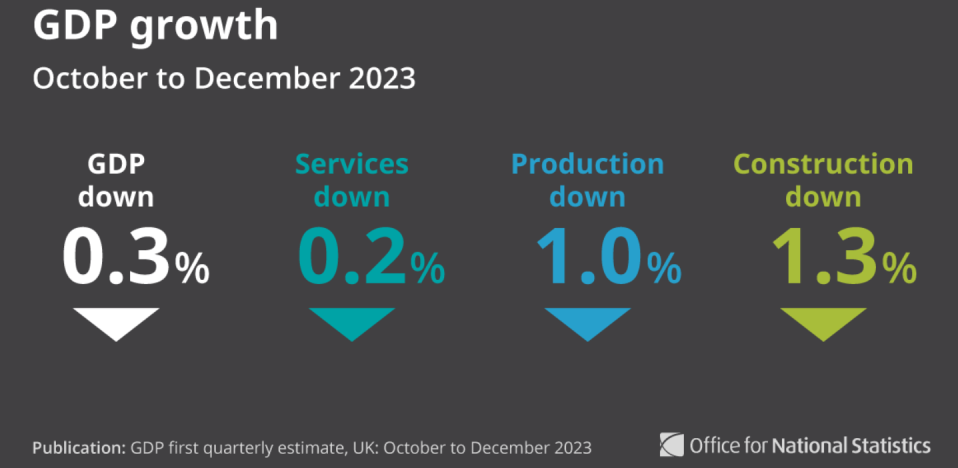

According to the Office for National Statistics (ONS), the UK economy shrunk 0.1 per cent in December meaning it contracted 0.3 per cent over the fourth quarter of last year, a worse performance than economists had expected.

The figures showed that the economy performed less well than initially thought in October and November, with the ONS revising down its estimates for output in both months.

This means the UK fell into a very shallow recession in the second half of last year, after the 0.1 per cent contraction recorded in the third quarter. A technical recession is two consecutive quarters of negative growth.

Looking across the quarter as a whole, all three sectors recorded a fall in output with the all-important services sector contracting 0.2 per cent. This was largely driven by a 0.6 per cent fall in wholesale and retail trade.

Output in production dropped one per cent in the quarter, although it returned to expansion in the month of December, while construction also recorded a relatively sharp drop.

“While it has now shrunk for two consecutive quarters, across 2023 as a whole the economy has been broadly flat,” ONS director of economic statistics Liz McKeown said. Across the year, output grew only 0.4 per cent.

The news of a recession will come as a blow to the Conservative Party, who have made growing the economy one of their key pledges ahead of an autumn election. Chancellor of the Exchequer Jeremy Hunt said that low growth was “not a surprise…while interest rates are high”.

Although the news will disappoint Sunak and Hunt, analysts at Capital Economics said “today’s release is more politically significant than it is economically,” suggesting that the UK will soon return to growth.

The UK has struggled to generate any momentum over the course of 2023 due to the twin impact of rising inflation and high interest rates.

The benchmark Bank Rate stands at a post-financial crisis high of 5.25 per cent, having been hiked from just 0.1 per cent at the end of 2021. This has sent a chill through the economy as households and businesses struggle under the burden of higher borrowing costs.

However, inflation fell fairly rapidly in the second half of last year, fuelling bets that interest rates would start being lowered. Huw Pill, the Bank’s chief economist, has confirmed that rate cuts are a “when rather than an if“.

Lower inflation has also given households a real income boost. Analysts at Deutsche Bank predict that real wages will grow at 1.75 per cent in 2024, making it one of the highest growth rates in the last decade.

All this means that a number of economists think better times are ahead for the UK in 2024.