Retail sales flat as rainy February puts shoppers off the high street

The figures were actually slightly stronger than expected by analysts, who predicted a 0.4 per cent fall.

Retail sales came in above expectations in February despite record rainfall forcing consumers off the high street, according to new figures.

Data from the Office for National Statistics (ONS) shows sales volumes were flat in February, following an upwardly revised increase of 3.6 per cent in January.

Although sales volumes did not budge, the figures were actually slightly stronger than expected by analysts, who predicted a 0.4 per cent fall. Excluding fuel sales, sales volumes actually increased 0.2 per cent on the month.

Looking over the past three months altogether, which also includes a sharp fall in December, retail sales volumes fell by 0.4 per cent.

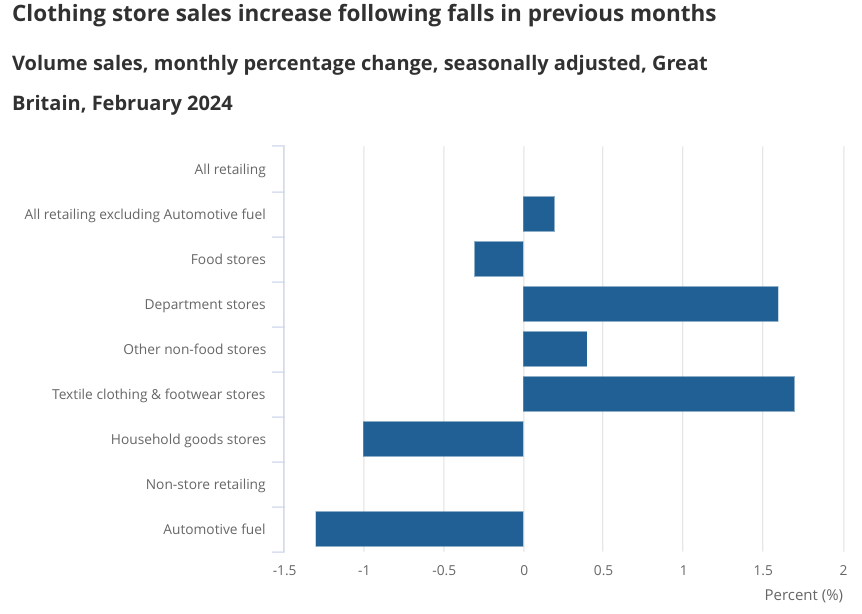

Non-food sales were up 0.7 per cent on the month. Heather Bovill, senior statistician at the ONS, noted that this was largely due to strong growth in clothing sales thanks to new season’s collections”.

But these were offset by falling fuel sales, “possibly affected by rising prices, and a reduction in food sales,” she said.

“Many shops told us that the wet weather hit in store sales, with online instead seeing a boost,” she continued.

Last month was the wettest February on record, with southern England receiving 239 per cent of its average rainfall.

Despite the fact that sales were flat, most economists argued the figures indicated that the economy was continuing to recover.

“Unchanged retail sales volumes in February, as shoppers largely shrugged off the unusually wet weather, provided further evidence that a rebound in retail activity, and perhaps the wider economic recovery is underway,” Alex Kerr, assistant economist at Capital Economics said.

However, looking forward, Aled Patchett, head of retail and consumer goods at Lloyds Bank, warned that consumers might still face higher prices over the coming months.

“Inflation that remains above the Bank of England’s two per cent target and ongoing wage pressures for retailers could both delay any price drops for consumers in the immediate term,” Patchett said.

The figures suggest that the UK consumer might be starting to feel the pinch from higher interest rates.

Figures out today showed that consumer confidence stalled in March, with GfK’s consumer confidence report at -21, unchanged on February’s reading.