Russia left out in the cold as US sanctions torpedo LNG project

Russia's Arctic LNG 2 project now needs alternative investors, carriers, and equipment: its partners chose to leave over face the wrath of US third country sanctions The post Russia left out in the cold as US sanctions torpedo LNG project appeared first on Euromaidan Press.

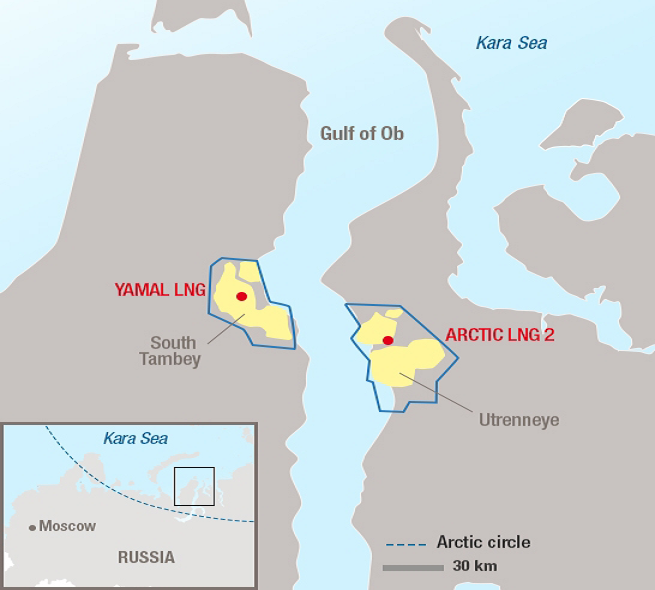

The Arctic LNG 2 project was slated to bolster Russia’s natural gas exports and global energy clout. But ever-expanding US sanctions have sent partners fleeing and thrown the ambitious venture into disarray.

What is the Arctic LNG 2 project?

The Arctic LNG 2 project, led by Russian oligarchs Leonid Mikhelson and Gennady Timchenko, aims to substantially increase Russia’s natural gas exports to global markets. The proprietors of Novatek hold influential positions within the upper echelons of the Russian government and play a significant role in strategic decision-making.

Crucially, this initiative allows Russia to ramp up its LNG production.

In 2022, Novatek’s initial operating terminal, Yamal LNG, exhibited remarkable financial performance, boasting revenues of €8 billion, nearly doubling its profits and revenues year-on-year.

The next phase in the company’s blueprint involves inaugurating and streamlining the operations of Arctic LNG-2. It aims to augment LNG production by an additional 20 million tons per year by 2026.

This venture doesn’t just boost Russia’s cash flow; it holds substantial ramifications for the global energy market, environmental concerns, and geopolitical relations.

Why is it so important to Russia?

By 2030, Russia has set the ambitious goal of expanding its total LNG exports to 100 million tons per year, while also constructing four major new export terminals.

Throughout this timeframe, the LNG export expansion program is of immense strategic importance for Russia. European Union imports of energy resources have reached record levels in the past three years. Notably, in November 2023, Russian LNG deliveries into Europe hit an all-time monthly high of 1.75 million metric tons.

As a pivotal industry player, Novatek sets its sights on doubling its export capacity. The slated launch of the initial phase of the Arctic LNG 2 terminal by the end of 2023 and the outlined plans to achieve nearly 20 million tons of LNG annually by 2026 underscore the strategic prominence of this project.

In 2022, despite sanctions over its invasion of Ukraine, Russia saw an 8% increase in liquefied natural gas output. It expanded LNG exports to Europe and global markets by utilizing European port infrastructure.

Last year, even with sanctions in place, some Western firms still supplied cutting-edge components for Arctic LNG 2’s initial construction phase and offered engineering services. If Russia manages to evade sanctions or secure equipment from China, the project’s final two phases may be completed.

This would allow Arctic LNG 2 to produce 19.8 million tons of LNG per year, nearing the Kremlin’s goal of exporting 100 million tons annually along the Northern Sea Route.

International firms like France’s TotalEnergies, China’s CNPC and CNOOC, and a Japanese consortium of Mitsui and JOGMEC have participated in Arctic LNG 2. However, some companies’ involvement has sparked investigations and concerns.

For example, American company Baker Hughes, which supplied turbines for the initial construction phase, halted Russian operations after appeals from Ukrainian NGOs to the Scottish government. These focused on grant funding for Baker Hughes and requested disclosure of its Russia activities.

Ongoing probes are examining other international entities in the project. German and Austrian media spotlighted Linde, which engaged in Russian joint ventures after the Crimea annexation and provided key natural gas cooling components. Despite escalating sanctions, Linde kept fulfilling Russia contracts after the 2022 invasion of Ukraine, prompting scrutiny.

In another case, engineering company Technip assumed management of Arctic LNG 2 in 2019, violating US sanctions on Russia’s Novatek. Even after these sanctions took effect, Technip kept providing equipment to Russia, skirting restrictions to meet Russian demand.

These examples demonstrate a tangled network of cooperation among firms from various countries, continuing operations and technology transfers despite sanctions and geopolitical constraints.

How the US sanctions were imposed

In September 2023, the United States broadened its sanctions to target entities linked to Arctic LNG 2, including Russian companies, subsidiaries, and new third country firms. For example, sanctions aimed to block entities in the UAE that imported European equipment into Russia, effectively circumventing restrictions.

These sanctions, enacted on September 14, marked an initial move to constrain Russia’s future energy plans. Additionally, the State Department expanded sanctions to directly target individuals involved in owning, operating, or building Arctic LNG 2.

On 2 November 2023, the State Department and Office of Foreign Assets Control imposed direct sanctions on Arctic LNG 2 LLC, the operator of the new LNG terminal.

Partners abandon Arctic LNG 2 after US sanctions

France’s TotalEnergies, which holds 10% direct and 21.5% indirect stakes in Arctic LNG 2, swiftly responded to the sanctions. Total stated it is assessing the impact, after halting new investments and gas reserves for the project since March 2022. The company has already written off billions in impairments and asset value declines related to Russia in 2022.

Japan’s Mitsui & Co, engaged via its joint venture Japan Arctic LNG, followed suit in reviewing its position. Mitsui affirmed it will comply with all regulations while cooperating with the Japanese government. Mitsui’s total LNG investments and loans in Russia amount to €108 million, with €1.5 billion in guarantees. The estimated adverse risk exposure is €1.5 billion after provisions and insurance, within Mitsui’s financial tolerance.

Initially, Mikhelson’s partners took a wait-and-see approach. However, legal maneuvers failed to find sanctions loopholes. Consequently, partners began withdrawing, starting with South Korea’s Samsung.

On 26 December, it emerged that Samsung had halted constructing LNG carriers for Arctic LNG 2 due to US sanctions. Samsung initially had contracts for 15 carriers, but suspended work on 10. Samsung Heavy Industries stopped equipment production for the vessels.

The contracts involved building the carriers at Zvezda shipyard in Russia’s Primorsky Krai. While five carrier hulls were shipped under South Korean government approval, construction was halted on the other 10 due to sanctions.

Dubbed the SN2366 project, these LNG carriers were designed to transport LNG across the Arctic Ocean. With 172,600 cubic meter cargo capacity and robust Arc7 ice class hulls, the ships were optimized for northern waters.

South Korea’s tanker development role is crucial, as Korean icebreakers are virtually irreplaceable. Arctic LNG 2 depends on this fleet, so losing Korean participation poses major challenges. Consequently, other partners began withdrawing.

The new US sanctions prompted TotalEnergies, China’s CNPC and CNOOC, and Japan’s Mitsui-JOGMEC consortium to declare force majeure. This prevents them from fulfilling Arctic LNG 2 financial commitments and supply contracts. Novatek, the primary shareholder, had a 12 million tonne annual allocation, while foreign partners each had 2 million tonnes.

Under these circumstances, Arctic LNG 2 may need to sell gas on the spot market since partners cannot honor their offtake deals due to sanctions.

Notably, Chinese firms CNPC and CNOOC formally petitioned the US Treasury’s Office of Foreign Assets Control for sanctions exemptions, but have yet to receive a response. Japanese companies initiated similar requests, while Spain’s Repsol also declared force majeure.

The situation remains tense: despite sanctions, Arctic LNG 2’s first phase started LNG production in late 2023. With looming long-term contract and storage issues, Novatek may have no option but to sell gas on the spot market at discounts, just to stay operational. This could tempt European and Asian buyers, with 2.6 million tonnes available from the initial phase alone.

The US Treasury has yet to decide on sanctions exemptions for China and Japan. However, consistent decisions are hoped for based on past determinations.

Financial hurdles loom large. Per Kommersant’s June report, Arctic LNG 2’s costs rose approximately 17% to €22 billion due to added equipment needs. Shareholders were slated to cover this, but with TotalEnergies halting Russian investments post-Ukraine, Novatek must find new financing sources.

Rejection of Arctic LNG 2 by foreign shareholders could lead to a lack of long-term contracts, potentially risking default on €8.6 billion in external financing.

The sanctions resulted from collaborative efforts by Ukrainian, American, and European politicians, diplomats, civil society, and journalists.

This highlights the importance of coordinated action to counter Russian aggression and interference in Europe, though identifying all nodes in complex sanctions evasion networks remains an ongoing challenge requiring meticulous attention.

The Ukrainian version of this article was published on Mind

Related:

- Media: Foreign companies exit major Russian LNG project due to sanctions

- FT: US tries to strangle key Russian LNG project with sanctions

- LNG frenzy boosts Russian gas in Europe, not energy security – opinion

- Spain and Belgium increased Russian natural gas imports by up to 50%

The post Russia left out in the cold as US sanctions torpedo LNG project appeared first on Euromaidan Press.