SEC’s priorities go haywire as they register “Unicoin” scam whilst suing Uniswap

Back in 2009, Judge Denny Chin sentenced Bernie Madoff to 150 years behind bars. Madoff's estimated $64 billion scam has become known as the largest Ponzi scheme ever. His promises of consistent and above-average returns, and his credibility as Nasdaq chairman, led to investors depositing tens of billions of dollars into his fund. Now deceased, he managed to escape his 150-year sentence early, along with his forced forfeiture of $170 billion.

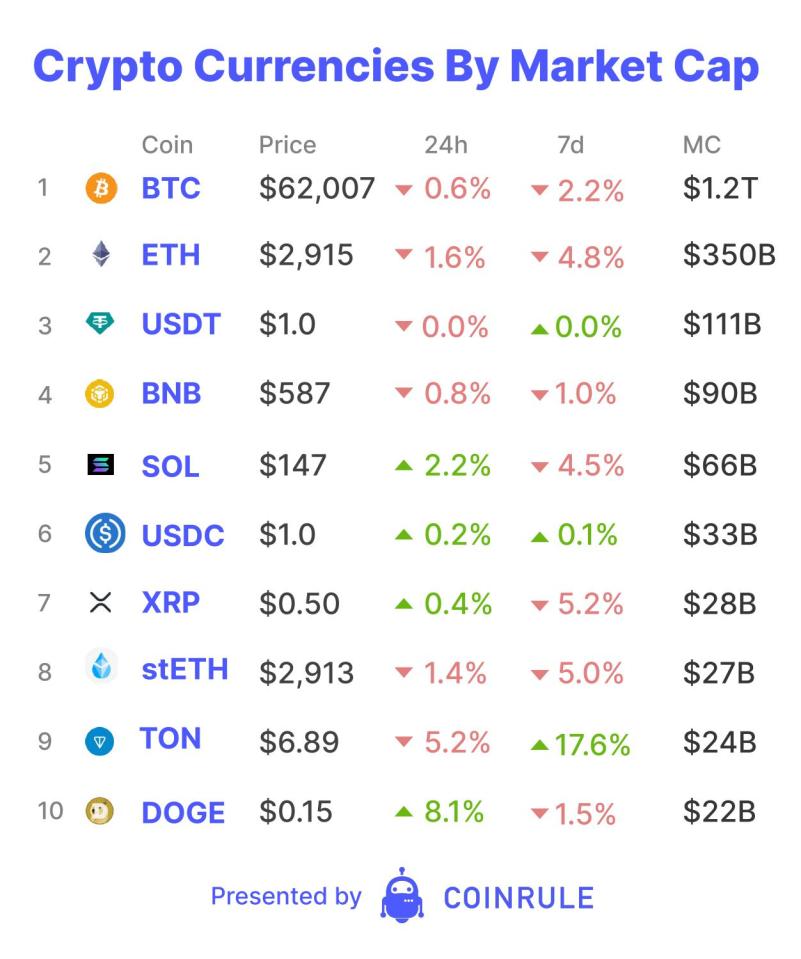

Each day, Coinrule will run through the state of the digital assets market for Blockbeat, your home for news, analysis, opinion and commentary on blockchain and digital assets.

Back in 2009, Judge Denny Chin sentenced Bernie Madoff to 150 years behind bars. Madoff’s estimated $64 billion scam has become known as the largest Ponzi scheme ever. His promises of consistent and above-average returns, and his credibility as Nasdaq chairman, led to investors depositing tens of billions of dollars into his fund. Now deceased, he managed to escape his 150-year sentence early, along with his forced forfeiture of $170 billion.

Today, investors are more wary of specific promises of any returns, or anything that performs exceedingly well. Resultantly, crypto is a victim of its success with market-leading returns. Many investors believe crypto’s “too good to be true” returns must mean the entire sector is a Ponzi. However, now it seems crypto’s arch nemesis – the Securities Exchange Commission (SEC) – has fallen for “too good to be true” returns as well.

On Monday, Hayden Adams, founder of decentralised exchange (DEX) Uniswap, posted on X. His post mentioned “Unicoin.” The coin has appeared in advertisements on New York City taxis and around the city. The branding of “Unicoin” is very similar to Uniswap’s, with it using the same “Uni” prefix along with Unicorn imagery. This tactic has been a common theme of crypto scams over the years. It tricks naive investors into believing this is the successful and legit “Uni” project they have been hearing about. Consequently, investors deposit their hard-earned money into it, with the hope of outperforming the market. However, once deposited, their funds are stolen, whilst they stay invested and believe they are generating significant returns.

Adams’ post about “Unicoin” caused an investigation that revealed its registration with the SEC. Comically, its initial name was “Transparent Business Inc.” Their website claims that Unicoin will outperform Bitcoin’s lifetime returns of 9,000,000%. Deceptively, Unicoin also suggests that its status as “asset-backed” makes it a superior investment compared to the “totally opaque” Bitcoin.

The irony of the SEC’s questionable approach intensifies, as it sues Uniswap – an exchange with over $2 trillion in total trade volume that currently enables 30% of DEX trading volume. Uniswap was the first to scale onchain trading and continues to be the market leader of decentralised finance (DeFi) trading. Conversely, “Unicoin,” a possible scam that solicits investors to buy their token directly on their landing page, is not only operating without public knowledge of an investigation, but has also managed to successfully register with the SEC. It appears that the SEC’s mandate has shifted toward targeting popular and useful tools in the crypto ecosystem that investors use. To actually “protect investors”, the SEC should concentrate on areas where investors are genuinely being misled and defrauded. Unicoin seems to be an obvious place to start.

During Madoff’s multi-decade Ponzi run, the SEC investigated him for 16 years before his ultimate arrest once the house-of-cards had already started falling. Considering the current SEC’s crypto strategy, it seems that they too will ignore the real enemies of the average investor and attack the easy targets – the good guys.