Sir Martin Sorrell’s S4Capital hits stormy waters after breakneck growth

Operational earnings before interest, tax, deprecation and amortisation (EBITDA) for the year came in at £93.7m, down 24.6 per cent on a reported basis or 36.6 per cent on a like-for-like basis.

Advertising group S4Capital has reported a decline in revenue and operating profit as “challenging macroeconomic conditions” took their toll on the group in 2023.

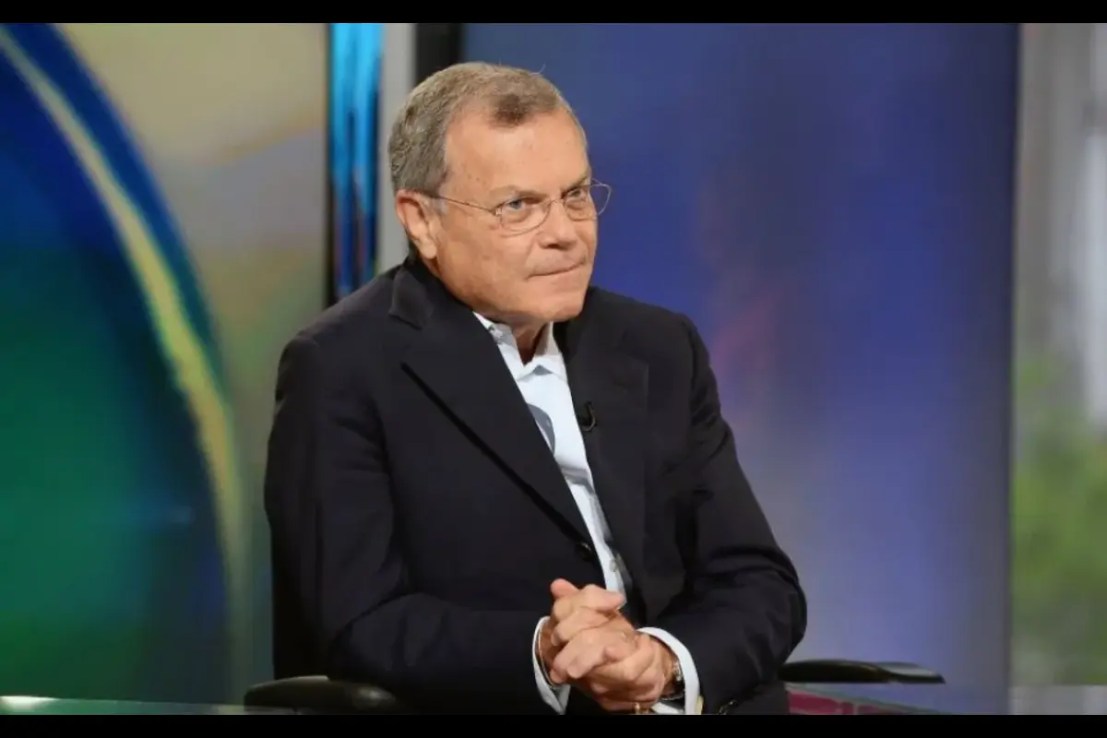

The company, founded by advertising giant Sir Martin Sorrell, was established to try and replicate the success of his former company WPP.

However, the group appears to have hit a stumbling block. While its 2023 results were in line with expectations, the group still reported a 2.1 per cent decline in net revenue or 4.5 per cent on a like-for-like basis.

Operational earnings before interest, tax, deprecation and amortisation (EBITDA) for the year came in at £93.7m, down 24.6 per cent on a reported basis or 36.6 per cent on a like-for-like basis.

The company said it had made good progress in reducing debt for the year, with net debt at the end of 2023 coming in at £180.8m, at the lower end of its targeted range of £180m to £220m.

For the year ahead, S4Capital said it expected to see lower like-for-like revenue growth compared to 2023, with a “broadly similar overall level of operational EBITDA.”

Today’s news followed rumours the group could become an acquisition target after seeing its stock price plunge 75 per cent in a year.

Despite the profit drop, management said the company would consider paying its first dividend this year after the half-year results “if further operational progress has been made.” It completed a share buyback in March in which it repurchased one per cent of its outstanding shares.

Sorrell, executive chairman of S4Capital, said: “After our first four strong net revenue growth years, we had a difficult 2023 reflecting challenging global macroeconomic conditions, fears of recession and high interest rates.

He added: “This resulted in client caution to commit and extended sales cycles, particularly for larger projects, a difficult year for new business, as well as spend reductions from some regional and smaller client relationships.”

We are targeting like-for-like net revenue for 2024 to be down on the prior year, with a broadly similar overall level of profit performance to 2023. As usual, the year is likely to be weighted to the second half, aided by lower interest rates and the impact of our Artificial Intelligence initiatives.”

Sorrell summarised: “We remain confident that our talent, business model, strategy and scaled client relationships position us well for above average growth in the longer term, with an emphasis on deploying free cash flow to boost shareowner returns.”