Six American anti-Ukraine aid myths that just won’t go away

It's not about logic, it's about emotions.

Since Russia’s full-scale invasion began, the United States has provided nearly $175 bn in military, economic, and humanitarian support to Ukraine, averaging $60 bn annually for the past three fiscal years. This substantial figure surpasses all other US foreign aid recipients, drawing criticism from conservative politicians and many Americans.

Critics argue that this money increases America’s national debt and individual tax burden, suggesting it would be better spent domestically or on border security. But how does the US federal budget actually work? How much in tax dollars are truly going to Ukraine? And why aren’t these funds spent in the US?

This article aims to provide clarity on these questions and address some of the most prevalent myths about US support to Ukraine.

1. Ukraine aid is not the source of the federal deficit

- Myth: Ukraine aid is increasing the federal deficit.

- Reality: aid to Ukraine is not a significant factor in the national debt or rising spending. Popular spending programs and tax cuts are.

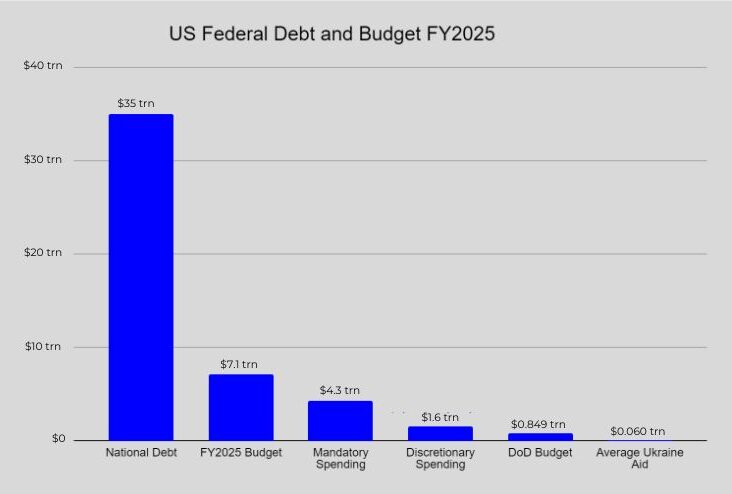

The federal budget comprises three components: mandatory spending, discretionary spending, and interest payments on the national debt, currently estimated at $35.3 trillion.

Mandatory spending, the largest portion at 61%, funds programs like Social Security, Medicare, and Medicaid. These programs face serious financial challenges and could deplete their funds within the next decade.

Biden’s proposed federal budget for next year is $7.1 trillion, with $4.3 trillion (61%) allocated to mandatory spending. The FY25 discretionary budget is $1.6 trillion, of which $849 billion (53%) goes to the Department of Defense – 12% of the total federal budget. Interest payments on the National Debt reached $892 billion last year, exceeding Defense and many other programs.

Ukraine aid is not driving the national debt. The primary culprits are popular mandatory spending programs and the 2017 Trump Tax Cuts, which added an estimated $2.5 trillion to the US debt.

2. Ukraine aid benefits Americans through defense industry investment

- Myth: Ukraine aid provides no benefit to Americans.

- Reality: 70% of Ukraine aid is spent inside the USA.

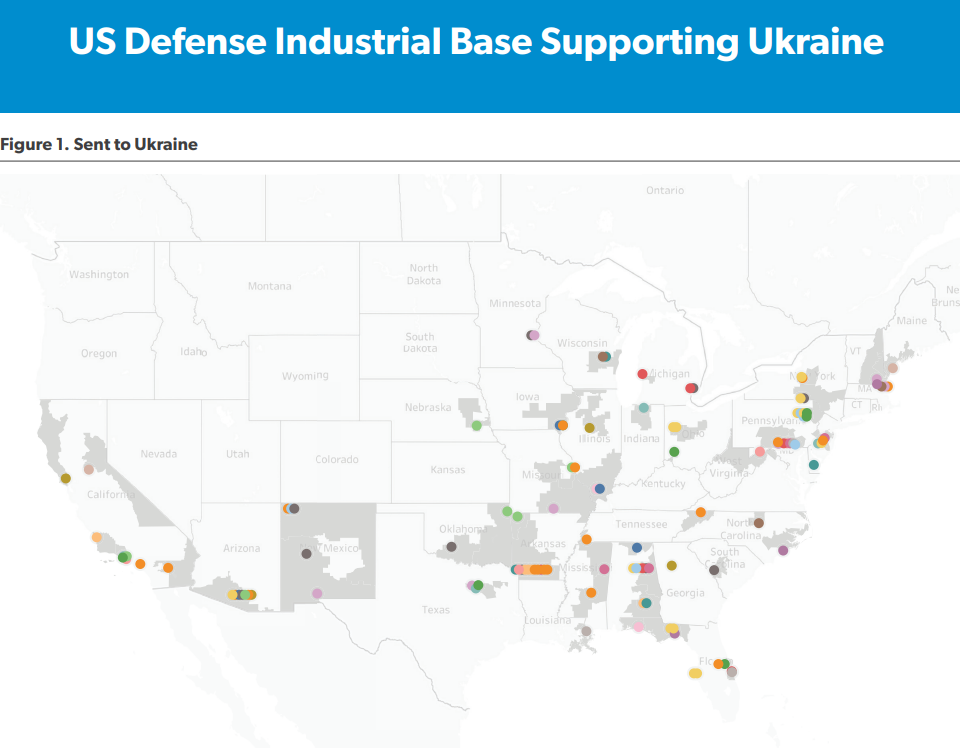

A detailed analysis from the American Enterprise Institute finds that 70% ($120 billion) of the total money allocated to Ukraine since 2022 is spent within the US, supporting the American defense industrial base. This substantial investment in weapons backfill and DoD accounts is revitalizing the Defense Industrial Base and supporting manufacturing in over 70 cities.

Defense Secretary Lloyd Austin notes that this not only stimulates local economies through federal investment and creates jobs, but also enhances America’s Defense Industrial Base. It has helped increase the production of critical munitions necessary for national preparedness.

The US also provides weapons to Ukraine through the Presidential Drawdown Authority (PDA). This allows the President to supply military support from existing US stockpiles and then replace these stockpiles, stimulating new production.

Since February 2022, $33 billion of existing US weapons have been sent to Ukraine under the PDA. However, this authority expired on 30 September without a new supplemental spending bill.

3. Europe contributes significantly to Ukraine’s economic and humanitarian needs

- Myth: Europe isn’t paying its “fair share.”

- Reality: Europe’s aid to Ukraine exceeds the USA’s, and 14 other countries are donating more in terms of GDP percentage.

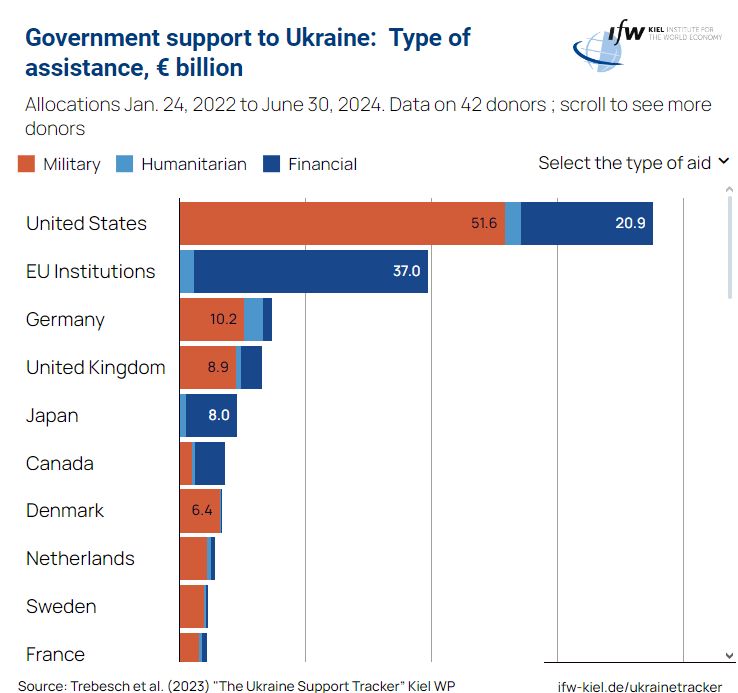

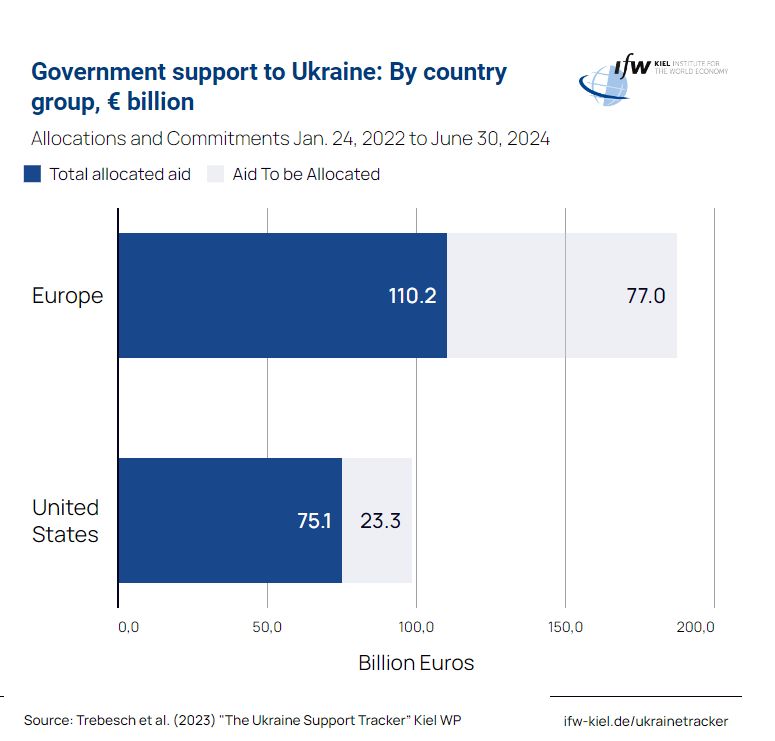

While the United States leads in military assistance, the European Union has provided more economic aid since the start of the full-scale invasion: €187 billion compared to the US’s $33.3 billion.

Two-thirds of US support to Ukraine has been military, with Europe serving as the primary economic and humanitarian aid donor. In general terms, Europe is Ukraine’s top donor.

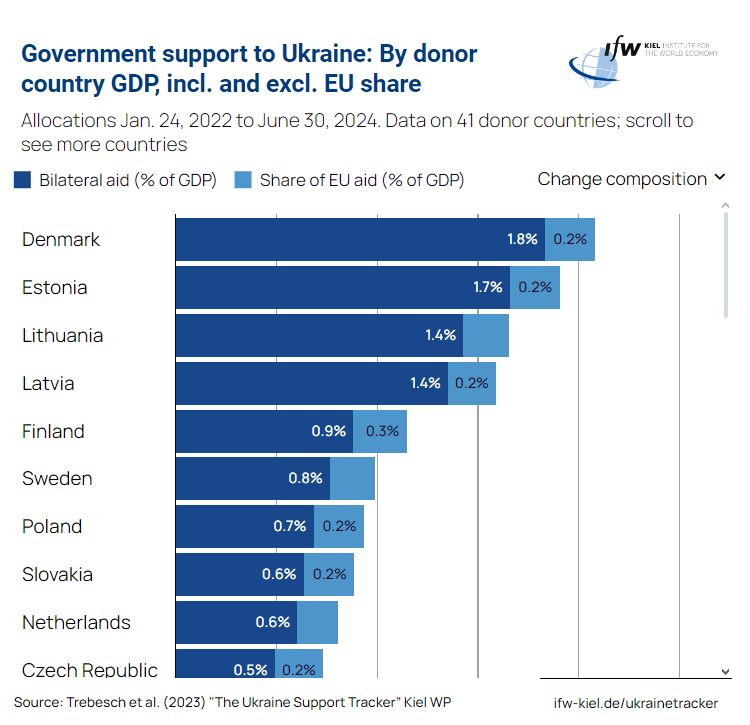

In terms of Ukraine aid as a proportion of GDP, the United States ranks 15th at 0.3%, with Denmark and Estonia contributing much larger proportions (1.9% and 2%, respectively). This allows the US to leverage its advantage as the world’s leading weapons manufacturer, while Europe addresses Ukraine’s other substantial needs, including population support, budget assistance, and reconstruction costs.

4. Ukraine aid has minimal impact on individual income taxes

- Myth: Ukraine Aid is increasing my individual income taxes.

- Reality: only 2% of the average American’s taxes will be spent on aid to Ukraine.

The individual tax burden for continued military support to Ukraine is minimal. IRS data for FY23 shows that 163 million Americans filed federal income taxes, contributing $2.18 trillion in revenues to the federal budget. A full 66% ($1.4 trillion) is paid by people earning over $250,000 annually.

Setting aside other funding sources for the Federal budget, for people making less than a quarter million dollars in income per year, their annual income tax contribution to Ukraine aid would be less than $123 per year, or about $4.70 per bi-weekly paycheck .

Considering that the average taxpayer earning under $250,000 pays $5,850 in taxes annually, Ukraine aid constitutes merely 2% of the total taxes an average American will pay to the federal budget..

The expense of other federal programs, such as mandatory spending and the DoD budget, means that any military or economic support withheld from Ukraine would likely be reallocated to existing programs in the massive federal budget or insignificant interest payments on the national debt. This would provide no real relief to American taxpayers.

5. Ukraine aid does not divert funds from domestic issues

- Myth: we are sending money to Ukraine that could be used to fix problems at home.

- Reality: a reduction in Ukraine aid would not result in a transfer of these funds to local services such as schools, police, roads, and hospitals, as they are mostly funded from local budgets.

While underfunded public services and infrastructure are genuine concerns in America, stopping support for Ukraine’s fight against Russia will not increase funding for these issues. In our highly decentralized federal system, states and localities are responsible for the majority of local government services.

Less than 1/3 of total health spending comes from the federal government. The Federal Government contributes less than 8% of funding for public schools nationally, with local property taxes providing most of the funding. Roads and highways receive less than a quarter of their funding from the federal government, with states and localities making up the rest through various taxes. A decrease in Ukraine funding would not result in better or cheaper local services because these are funded primarily at the local level. Congressional Republicans and other opponents of Ukraine aid are well aware of this as they continue to vote for slashing federal funding to programs while increasing the deficit through tax cuts for the wealthy.

The intentional underfunding of public utilities and services is a decades-long process where the United States has moved away from funding public services in favor of privatization and contracting. The decision to cut public services did not start in February 2022, and the argument that the money “could” be used for local issues does not explain why these issues were not addressed before the full-scale invasion during periods of budget surplus.

6. Border security and Ukraine aid are separate issues

- Myth: We can’t support other countries until we secure our border.

- Reality: building a border wall would have a minimal effect on illegal migration; the outdated asylum system is the primary culprit.

The argument that America can’t support other countries until it secures the border with Mexico was on display when House Republicans refused to consider a supplemental aid package funding military support for Ukraine, Taiwan, and Israel until they could get a border “deal.” In February 2024, Senator Lindsey Graham remarked, “I am insistent that we continue our efforts to secure our own border before we turn to helping other countries.”

However, building a border wall would have little effect on the amount of migration at the border because migrants are primarily claiming asylum through a legal process that cannot be modified without a change in legislation.

Moreover, it is a highly divisive proposal that Trump was unable to implement during his presidency due to challenges related to funding, political opposition, environmental, and legal issues. A wall over the entire border with Mexico would cost tens of billions of dollars — money that critics say is better spent on addressing the underlying factors of migration, overhauling the asylum system, or high-tech solutions for monitoring border crossings.

Over time, the Trump administration itself shifted its priorities regarding border security, focusing on technological enhancements like surveillance towers, drones, and sensors to help secure the border in less accessible areas. This suggests that the construction of the wall is neither an effective nor realistic idea for solving the problem of illegal migration.

Senate Republicans and Congressional Democrats made steps forward to finding a solution when they agreed to a bill to reform the decades-old asylum system. However, House Republicans, backed by Trump, sabotaged the bill, closing the only path to address the immigration question.

Reducing aid for Ukraine will not decrease migration at the border without reforming the asylum system. By choosing to hold Ukraine aid hostage for immigration reforms and then rejecting that deal, former President Trump and House Republicans walked away from the only plausible path to reform immigration.

Politics of resentment: the real cause of Ukraine aid myths

Moral appeals to the righteousness of Ukraine’s fight to defend itself, or abstract concepts such as upholding the principle of non-aggression or supporting our allies, often fall on deaf ears from those who imagine that their hard-earned tax dollars are going to a far-away cause at the expense of Americans.

This is rooted in a deep-seated politics of resentment around social welfare in the United States.

Taxpayer resentment at social transfers and welfare has long been a third rail in American politics. The notion of others getting “something for nothing” stirs an emotional response in many Americans, ironically including many who are themselves poor and reliant on underfunded and inadequate government support.

While this deep-rooted politics of resentment is unlikely to change soon, it is important for those who support Ukraine to arm themselves with economic and fiscal facts, rather than moral appeals or platitudes about justice.

- The money allocated to Ukraine is a fraction of the budget and is mostly spent within the US, stimulating defense manufacturing or offloading old stockpiles of outdated weapons. Most of the money for Ukraine comes from a fraction of the Department of Defense budget, an entirely separate account of the federal discretionary budget which Republicans consistently vote to increase.

- Even if the same politicians who voted for funding for the war in Iraq and Afghanistan for decades, and are actively encouraging brinkmanship with the PRC in the Pacific, had a change of heart and decided that the US should “no longer be the world’s police,” this money would not easily or necessarily be transferred to other programs.

- Similarly, these funds would not have a substantial effect on reducing income taxes or the sizable US national debt when measured against mandatory spending programs.

- Most likely, any money denied to the Ukrainians as they fight for their survival would simply be reallocated to an ever-expanding DoD budget, with enthusiastic Republican votes.

- The argument about funding being needed in local communities, while relevant, betrays a misunderstanding of federal and local budgeting allocations.

- Finally, the argument about a border wall is contradicted by the long record of inaction and opposition to immigration reform by Trump and his allies.

Taken together, an informed look at the US federal budget clearly shows that US financial support for Ukraine has a minimal cost for American taxpayers, is not a substantial contributor to the national debt or individual’s federal income tax burden, and does not come at the expense of local community services or national security.