Spring Budget 2024: Hunt’s pension reforms could ‘backfire on British business’, AJ Bell warns

Forcing pension funds to disclose how much they invest in the UK companies could “backfire on British business” as savers will shun domestically-heavy schemes due to their lacklustre returns, AJ Bell has warned.

Forcing pension funds to disclose how much they invest in the homegrown companies could “backfire on British business” as savers will shun under-performing UK-focused schemes, AJ Bell has warned.

In a statement today, the investment and pensions platform warned that pre-budget Treasury plans to force pension money managers to disclose the geographic mix of their investments could lead to savers avoiding the schemes altogether.

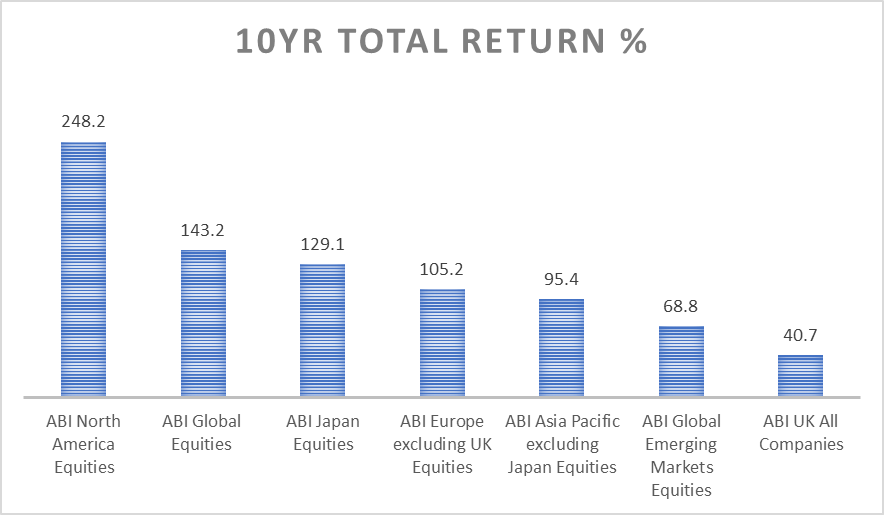

“The chancellor’s pension reforms could well backfire on British business,” said Laith Khalaf, head of investment analysis at AJ Bell. “If league tables for pension fund performance were published right now, they would probably show those with high exposure to UK shares languishing near the bottom.”

Under the plans published by Jeremy Hunt on Saturday, set to come into force from 2027, struggling funds will also be banned from taking on UK members.

However, AJ Bell warned that poorly performing schemes the Chancellor wants to close to new business “could very well be the same ones he wants to champion as exemplary models of investment in UK”.

The average insurance company pension fund investing in UK shares has returned 40.7 per cent over the last 10 years, compared to 143.2 per cent from a more global approach, according to the firm’s analysis.

The warnings play into a heated debate over the extent to which pension funds should back UK-based companies after a slide in domestic equity investment over the past two decades.

Just four per cent of the stock market is now held by domestic pension funds compared to 39 per cent in 2000, according to think tank New Financial.

However, pension industry figures have pushed back against the idea of mandating pension funds to back British companies on the grounds their first responsibility is to deliver returns for scheme members.

One pension boss told City A.M last year that “it doesn’t make any sense to try and wind back to some anachronistic 90s situation where all UK pension funds were investing in UK companies.”

Prior to Hunt’s plans last week, the boss of the UK’s biggest private sector pension scheme, the £73bn Universities Superannuation Scheme (USS), also cautioned ministers over plans for reform.

Carol Young, chief executive of the £73bn Universities Superannuation Scheme, said she would have no problem with disclosures but would have “cause for concern” if ministers were to direct trustees as to where funds should be allocated.

“There’s no question that the primary purpose of [pensions] is to deliver in the members’ best financial interests,” Young told the Financial Times.

The Treasury has been contacted for comment.