S&U says Budget and motor finance scandal weighing on performance

S&U said the Budget and a scandal over motor finance commissions have dragged on the specialist lender’s financial performance. Anthony Coombs, a former Conservative MP who has been S&U’s chair for the last 16 years, argued Labour’s first Budget had “curtailed the sector’s growth ambitions and cast doubt over the new government’s plans to ‘Get [...]

S&U said the Budget and a scandal over motor finance commissions have dragged on the specialist lender’s financial performance.

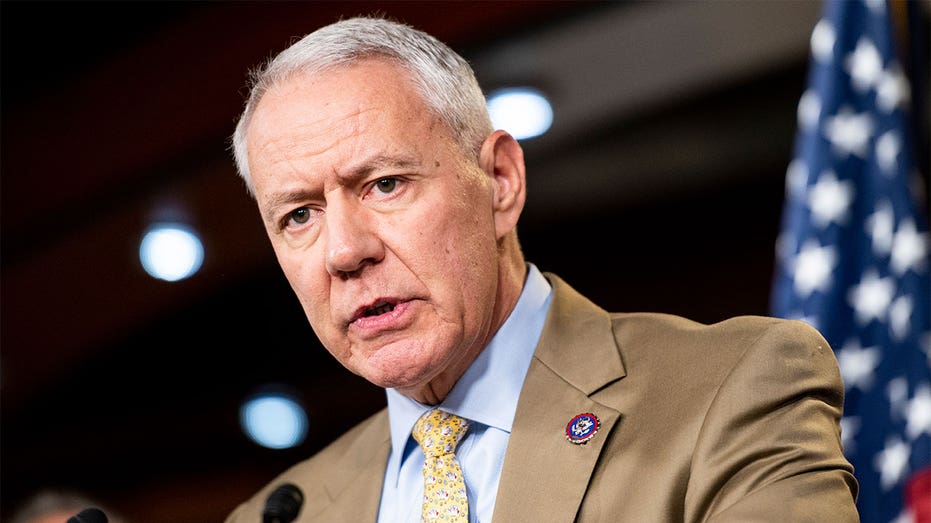

Anthony Coombs, a former Conservative MP who has been S&U’s chair for the last 16 years, argued Labour’s first Budget had “curtailed the sector’s growth ambitions and cast doubt over the new government’s plans to ‘Get Britain Working'”.

He also hit out at “chaotic market conditions” for auto lenders following a Court of Appeal decision in October regarding ‘secret’ motor finance deals.

The industry was rocked and some firms paused lending when senior judges ruled that a lender could not pay commission to a motor finance broker without obtaining the customer’s fully informed consent.

It is now more likely that the Financial Conduct Authority (FCA) will implement a redress scheme as part of its review of the so-called discretionary commission arrangements (DCAs).

S&U previously said it was not exposed to DCAs, which were banned in 2021. But lawyers have argued October’s ruling could set a precedent for other areas of consumer finance beyond car loans.

London-listed S&U said the Budget and motor finance saga had contributed to net receivables at its motor finance arm, Advantage, coming in at £295m as of Tuesday – down 10 per cent from a year earlier.

Advantage’s advances so far this year have fallen 33 per cent compared to last year. The firm said pretax profit at Advantage continued at around half the level of the same period in 2023.

The unit’s performance has also been weighed down this year by restrictions on its collections capabilities after the FCA hit it with a section 166 notice.

The notice, which was lifted in October, required S&U to produce a report by a so-called skilled person tied to the regulator’s Consumer Duty regime and sector-wide Borrowers in Financial Difficulty review.

“These are undoubtedly challenging times for Advantage and for the UK motor finance industry,” Coombs said on Wednesday.

“It is very important that the government, our regulators and the courts collaborate with industry participants to ensure an environment in which S&U and the sector as a whole, can maintain responsible lending and consumer access to fair credit.”

Moody’s analysts have said the fallout could end up costing the industry £30bn. The FCA’s top lawyer told MPs on Tuesday that it may be as big as the payment protection insurance (PPI) mis-selling scandal, which cost UK banks £50bn.

Close Brothers and South African bank FirstRand, the lenders involved in October’s test case, have said they will appeal the ruling to the Supreme Court.

Elsewhere, Coombs hailed the performance of Aspen Finance, S&U’s property lending business, which trades in an unregulated sector and “continues to prosper”.

It helped S&U maintain its overall levels of net receivables at £449m “despite the attentions of our regulator”.