Take a Cue From Texas: Socialize Energy

Texas Lieutenant Governor Dan Patrick might not seem to have much in common with socialists. After all, he’s made headlines for claiming that Texas has a “constitutional right” to use brutal razor wire along the border. Onstage in Houston earlier this week, though, he proposed a rather socialist-sounding energy policy: If investors didn’t agree to build more natural gas plants in Texas, Patrick said, “then the state will have to build them ourselves.” The goal of mounting a huge, unnecessary new fleet of gas-fired power plants is a bad one. Climate advocates, though, should replicate the way Patrick says Texas could get there: building publicly owned power. Some already have. What Patrick described is broadly similar in spirit to a policy recently passed in New York with the backing of eco-socialist campaigners and elected officials, mandating that the New York Power Authority step in to build renewable energy infrastructure if the private sector isn’t on track to meet the state’s established clean energy targets.Patrick’s anxiety about natural gas has to do with both his generous benefactors in the fossil fuel industry and the deep freeze in 2021 that left parts of the state without power and nearly 250 people dead. The right was quick to try to blame frozen wind turbines; Texas has long generated more wind power than any other state in the country. The core problem, though, according to the manager of the state’s grid, the Electric Reliability Council of Texas, or ERCOT, was unweatherized gas infrastructure that seized up in the cold. Another issue was the state’s isolated grid: Virtually cut off from its neighbors, Texas was unable to get power from places unaffected by the winter storm. These are problems in the increasingly scorching Texas heat too: In August 2023, ERCOT saw its 10 highest days of energy demand ever. State lawmakers have been hell-bent on building more fossil fuels (and gas, in particular) as the response to the state’s grid troubles. Republicans floated a plan in the state legislature to have the state build “peaker” plants to come online during emergencies; thanks in part to an estimated $18 billion price tag, this plan died before coming to a vote. Instead, two-thirds of Texas voters backed a constitutional amendment overwhelmingly directed at expanding fossil fuel generation capacity through financial incentives. The $10 billion Texas Energy Fund primarily offers low-interest loans toward a goal of building 10,000 megawatts of new gas-fired generation capacity. Less than $3 billion of those funds will flow toward building microgrids, backup power, and grid weatherization in portions of Texas not covered by ERCOT. (Some state and federal funds have already gone toward modernizing the ERCOT grid.) Managing the fund and assessing the viability of loan applicants’ projects will be the state’s Public Utility Commission, a regulator that has never undertaken such bank-like functions.Patrick now fears these incentives may not be enough to coax investors to the state. This week’s event—the Texas Power Grid Investment Summit—was meant to rally big pension funds and investors behind a fossil fuel buildout. It was organized in large part by the asset manager Blackrock, which Patrick and other Republicans had previously vowed to ban from the state over the fund’s alleged attempts to “boycott” oil and gas firms. The Summit, according to Patrick, grew out of subsequent meetings between the pair, in which Blackrock CEO Larry Fink assured him and other Texas policymakers that he is very much still interested in financing fossil fuels. Sure enough, Fink appeared onstage alongside Patrick and played auctioneer for the investors gathered. “We estimate in this room there’s $2.2 trillion,” Fink said. “We only have to put $10 billion to work, so can we get it done? Can we start raising hands?” Energy experts are skeptical investors will find Patrick’s pitch attractive. “I don’t think we’ll see any new net additions to the portfolio” of Texas’s gas power plants, energy economist Ed Hirs told KUT. That’s partly due to the abundance of cheap renewable power already on the grid, which already met 26 percent of the state’s electricity demand in 2022. Given that and headwinds like higher interest rates, companies could find it difficult to pay back a state loan along the 30- to 40-year timelines typical of such projects. “Maybe one or two of the generator companies will take old units and scrap them and use some of this money to build new ones, but I don’t expect to see a net gain.”It’d hardly be out of character for Texas to socialize its energy system. For decades, the Texas Railroad Commission—an oil and gas regulator—led a cartel that essentially controlled the global price of oil by strategically throttling production, in some cases enlisting the National Guard to pry men from pumpjacks; the Organization of Petroleum Exporting States was modeled on it. As a Senator, Lyndon Baines Johnson was instrumental

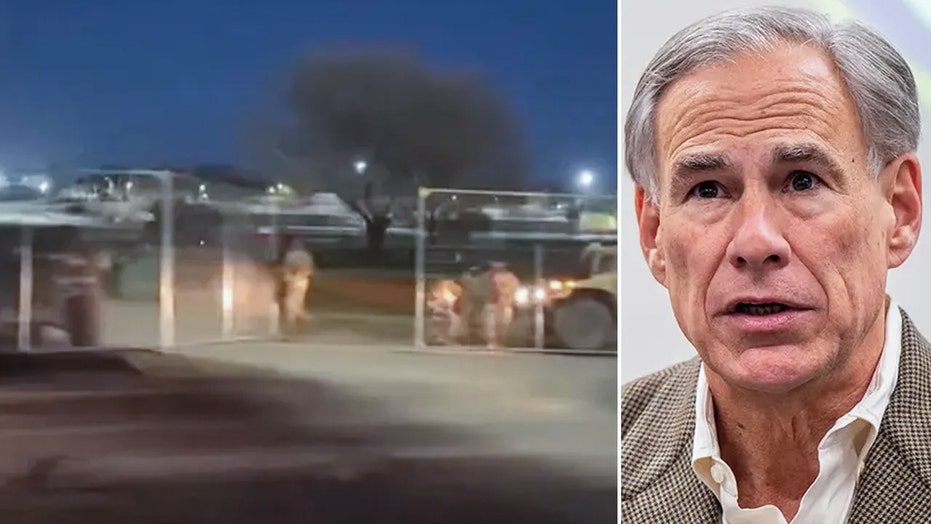

Texas Lieutenant Governor Dan Patrick might not seem to have much in common with socialists. After all, he’s made headlines for claiming that Texas has a “constitutional right” to use brutal razor wire along the border. Onstage in Houston earlier this week, though, he proposed a rather socialist-sounding energy policy: If investors didn’t agree to build more natural gas plants in Texas, Patrick said, “then the state will have to build them ourselves.”

The goal of mounting a huge, unnecessary new fleet of gas-fired power plants is a bad one. Climate advocates, though, should replicate the way Patrick says Texas could get there: building publicly owned power. Some already have. What Patrick described is broadly similar in spirit to a policy recently passed in New York with the backing of eco-socialist campaigners and elected officials, mandating that the New York Power Authority step in to build renewable energy infrastructure if the private sector isn’t on track to meet the state’s established clean energy targets.

Patrick’s anxiety about natural gas has to do with both his generous benefactors in the fossil fuel industry and the deep freeze in 2021 that left parts of the state without power and nearly 250 people dead. The right was quick to try to blame frozen wind turbines; Texas has long generated more wind power than any other state in the country. The core problem, though, according to the manager of the state’s grid, the Electric Reliability Council of Texas, or ERCOT, was unweatherized gas infrastructure that seized up in the cold. Another issue was the state’s isolated grid: Virtually cut off from its neighbors, Texas was unable to get power from places unaffected by the winter storm. These are problems in the increasingly scorching Texas heat too: In August 2023, ERCOT saw its 10 highest days of energy demand ever.

State lawmakers have been hell-bent on building more fossil fuels (and gas, in particular) as the response to the state’s grid troubles. Republicans floated a plan in the state legislature to have the state build “peaker” plants to come online during emergencies; thanks in part to an estimated $18 billion price tag, this plan died before coming to a vote. Instead, two-thirds of Texas voters backed a constitutional amendment overwhelmingly directed at expanding fossil fuel generation capacity through financial incentives. The $10 billion Texas Energy Fund primarily offers low-interest loans toward a goal of building 10,000 megawatts of new gas-fired generation capacity. Less than $3 billion of those funds will flow toward building microgrids, backup power, and grid weatherization in portions of Texas not covered by ERCOT. (Some state and federal funds have already gone toward modernizing the ERCOT grid.) Managing the fund and assessing the viability of loan applicants’ projects will be the state’s Public Utility Commission, a regulator that has never undertaken such bank-like functions.

Patrick now fears these incentives may not be enough to coax investors to the state. This week’s event—the Texas Power Grid Investment Summit—was meant to rally big pension funds and investors behind a fossil fuel buildout. It was organized in large part by the asset manager Blackrock, which Patrick and other Republicans had previously vowed to ban from the state over the fund’s alleged attempts to “boycott” oil and gas firms. The Summit, according to Patrick, grew out of subsequent meetings between the pair, in which Blackrock CEO Larry Fink assured him and other Texas policymakers that he is very much still interested in financing fossil fuels. Sure enough, Fink appeared onstage alongside Patrick and played auctioneer for the investors gathered. “We estimate in this room there’s $2.2 trillion,” Fink said. “We only have to put $10 billion to work, so can we get it done? Can we start raising hands?”

Energy experts are skeptical investors will find Patrick’s pitch attractive. “I don’t think we’ll see any new net additions to the portfolio” of Texas’s gas power plants, energy economist Ed Hirs told KUT. That’s partly due to the abundance of cheap renewable power already on the grid, which already met 26 percent of the state’s electricity demand in 2022. Given that and headwinds like higher interest rates, companies could find it difficult to pay back a state loan along the 30- to 40-year timelines typical of such projects. “Maybe one or two of the generator companies will take old units and scrap them and use some of this money to build new ones, but I don’t expect to see a net gain.”

It’d hardly be out of character for Texas to socialize its energy system. For decades, the Texas Railroad Commission—an oil and gas regulator—led a cartel that essentially controlled the global price of oil by strategically throttling production, in some cases enlisting the National Guard to pry men from pumpjacks; the Organization of Petroleum Exporting States was modeled on it. As a Senator, Lyndon Baines Johnson was instrumental in bringing the New Deal’s rural electrification administration to the Texas Hill Country. As energy secretary under Donald Trump, former Texas Governor Rick Perry proudly proclaimed, “There is no free market in the energy industry.”

While a boom of new gas plants likely won’t fix what ails Texas’s grid, this approach may hold lessons for renewable energy advocates. Not unlike Patrick’s prized gas power plants, offshore wind projects have struggled to take off in the United States, despite a generous suite of federal and state subsidies. Energy developers like the Danish state-owned firm Ørsted have demanded ever-more generous payouts from public coffers so that they can furnish potential investors with the kinds of reliable returns they expect from fossil fuels. Failing that—under pressure from rising interest rates and supply chain woes—Ørsted recently opted to exit several offshore wind markets and lay off hundreds of employees. The basic dilemma is a challenge for private investment–driven approaches to decarbonization like the Inflation Reduction Act. Such policies theorize the energy transition can be powered by turning its necessary inputs into return-generating assets that any investor would be thrilled to finance. Without a continued stream of public subsidies, though, offshore wind probably isn’t going to happen at scale.

As researchers at the U.K.-based think tank Common Wealth have pointed out, this leaves governments that want to stave off climate catastrophe with two options. They can continue to accept the demands of energy developers for increasingly generous disbursements of public funds to satisfy their own investors’ thirst for returns—essentially, a green hostage negotiation. Or they can take a route more similar to the one Texas lawmakers seem open to: Cut out the middle man, and get the job done, allowing the state to itself become an energy developer unencumbered by the profit motive and greedy shareholders. Dan Patrick himself might have put it best onstage this week: “We can’t sit and do nothing.”