The government’s levelling up cash for Canary Wharf is a step in the right direction for London

A taxpayer loan of over £118m being handed to Canary Wharf to help elevate its life science offering and build news homes has inevitably raised some eyebrows across London.

A taxpayer loan of over £118m is being handed to Canary Wharf to help elevate its life science offering and build new homes, but this handout has inevitably raised some eyebrows across London.

It’s no secret the docklands hub, which is synonymous with skyscrapers and hotshot bankers, has fallen on hard times.

A work-from-home revolution fuelled by the pandemic has shattered the value of one of the Wharf’s main attractions, offices.

This coupled with the departure of star tenants HSBC and magic circle law firm Clifford Chance has also bruised the district.

But do these issues warrant a multi-million-pound handout from the government? After all, the estate is owned by some very wealthy backers.

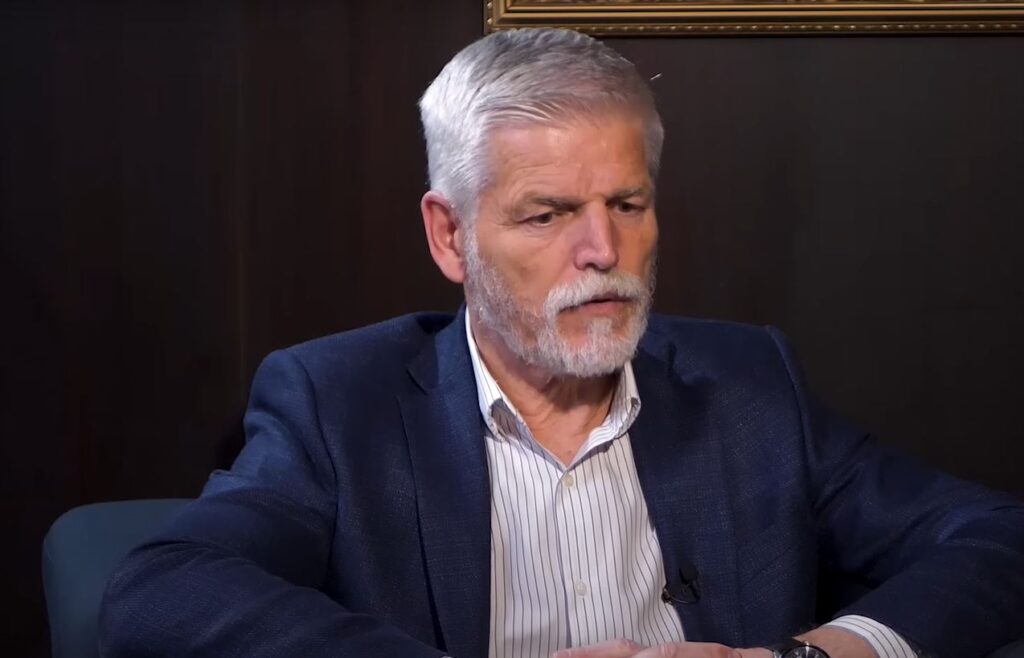

Peter Bill, author of Planet Property, told City A.M. the loan is “symptomatic of some kind of weakness in Canary Wharf”.

“I think that you have to ask, why do they need to ask the government for a loan?” he said.

As part of the Spring Budget, Chancellor Jeremy Hunt said he would allocate £118m to Canary Wharf to help “accelerate delivery of the Canary Wharf scheme.”

“This will deliver a life sciences hub, commercial and retail floor space, a healthcare diagnostic facility and up to 750 homes,” a statement from The Treasury read yesterday.

The Canary Wharf the capital knows today is a relatively new development, with regeneration works starting just shy of 40 years ago.

Before the skyscrapers arrived it was one of the busiest docks in the world. However, the growing popularity of air travel led to the slow demise of the docks.

In 1987, Paul Reichmann’s Olympia & York began building the project, named “Canary Wharf,” believing it could serve as a hub for London’s banking sector. The Conservative government at the time threw its weight behind the project, designed to regenerate one of the capital’s most deprived regions.

After overstretching itself, the company went bust in 1992. However, the Canadian businessman assembled a collection of US and Saudi investors to buy it back from creditors.

It went public in 1999 and several years later, in 2004, Reichmann lost control of the business after an 11-month takeover battle. Canary Wharf was taken over by Songbird Estates, a company that was, in turn, backed by a consortium owned by Morgan Stanley.

Songbird then ran into problems during the financial crisis and was effectively bailed out by the Qatari Investment Authority and private equity and infrastructure group Brookfield.

The two partners ended up with a minority stake following the bailout and launched a full takeover in 2015.

For the last nine years, Canary Wharf Group, which owns and develops most of the area, has been backed by Brookfield Property Partners and the Qatar Investment Authority.

The plan was going well until the pandemic upended global office markets.

The pair injected around £400m into the company back in October to fuel its regeneration and focus on becoming a more residential area.

As part of the district’s evolution, a number of life sciences firms are planning to move into the area.

A leading firm tracking infectious diseases, hVIVO, announced plans to open a new clinical trial facility in Canary Wharf later this year.

Late last year, Canary Wharf Group and Kadans Science Partner were also granted planning permission for a new 23-storey life sciences building in the East London area.

There are also plans for two new primary schools in Canary Wharf, one new nursery and a secondary school in Canary Wharf – the co-ed Mulberry Academy London Dock for 11 to 19-year-olds, which is due to open in September 2024.

These efforts have pushed the area away from offices, towards a more mixed-use location.

Warren McCann, sales director of Chestertons’ Canary Wharf branch, said: “Canary Wharf [is] extremely sought-after by property buyers as well as renters with demand exceeding supply. This has made the local property market extremely competitive.

“The government’s commitment to boosting areas further and providing additional housing is much welcome news and will allow more people to move to the neighbourhood. Canary Wharf, in particular, has always been a hub for business and innovation.

He added: “The Chancellor’s vision to attract life science companies is an exciting announcement that will, without a doubt, elevate the area further.”

This week’s development comes amid a period of tension between Levelling Up frontman and Secretary of State Michael Gove and London Mayor Sadiq Khan.

After he accused Khan of not delivering the new homes London needed Gove launched a review of development in the capital. He also warned the mayor he would intervene where necessary if he was not delivering.

These efforts appear to have paid off.

This week Khan launched a bid to transform the Royal Docks in East London with the mayor believing 36,000 new homes and 55,000 could be created in the area.

He said: “Once the beating heart of global trade, today the Royal Docks is re-emerging as one of the country’s leading areas of opportunity, investment, and innovation.

“Our new five-year plan sets out the vision for unlocking the full potential of this area with a multi-billion-pound regeneration programme that will deliver thousands of new homes and jobs and create a new economic powerhouse for the capital as part of my work to create a better, fairer, greener London for everyone.”

The funding for Canary Warf might not be much in the grand scheme of things, and critics might argue the money could be better used elsewhere, but it’s a step in the right direction for London.