Think you can beat the market? Most active managers can’t

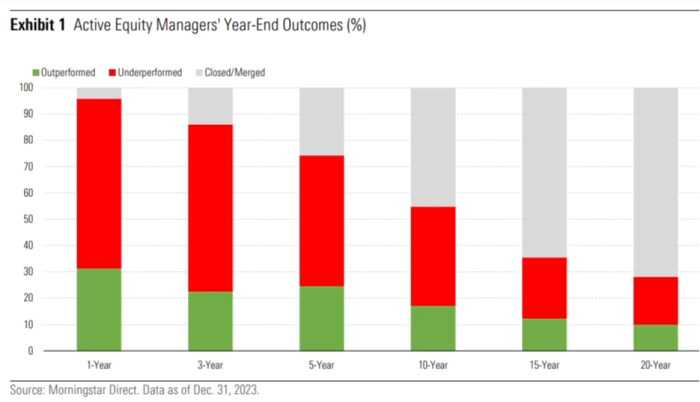

Only 17 per cent of actively managed equity funds beat the index over the last decade, new research revealed.

Only 17 per cent of actively managed equity funds managed to beat the index over the last decade, according to a new report from Morningstar.

Morningstar’s Active/Passive Barometer found that European fund managers are terrible at beating their benchmarks. It analyzed over 26,000 funds.

This success rate did rise when looking only at 2023, but just to 31.2 per cent.

While active managers tend to perform better when focusing on smaller and mid-sized companies, they were especially poor at beating the index for large-cap stocks in the long term.

Importantly, “active funds are more likely to succeed in equity categories where the average passive counterpart exhibits a structural bias toward a particular economic sector or is concentrated on a few individual names,” the report said.

As an example, the recent strength of the ‘Magnificent Seven‘ in the US has left active managers able to beat the market easily by simply holding a higher proportion of those seven stocks.

By just holding Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla, you could have absolutely dominated the wider S&P 500.

Indeed, Morningstar found that 41.9 per cent of large-cap US active managers outperformed their benchmarks last year, though in the long term, passives still won out, beating 93.7 per cent of active managers.

As an example, Morningstar cited Indian equities, where the one-year and 10-year success rates for active managers were 64.3 per cent and 53.5 per cent, respectively.

This is because Indian index funds are mainly focused on the large companies in the country, meaning that active managers are able to beat the market simply by avoiding a few of the long-term failures on the market, such as the Adani group of companies.

China is another key way managers have sought to outperform their benchmark. As it makes up such a large chunk of emerging markets, managers in the sector were able to beat their benchmark 46.3 per cent of the time last year by simply avoiding the country.

However, this strategy doesn’t work in the long term: Over ten years, emerging market active managers still lost out to their benchmark, beating it only 27.4 per cent of the time.

Meanwhile, active bond managers surged back to strength last year, as they “continued to extract value with duration plays”, and beat the benchmark.

The report noted 49.8 per cent of them beat their benchmark in 2023, which was fittingly often dubbed as the ‘year of the bond‘.

Long term, however, bond managers still more closely resembled their equity counterparts, with only 23 per cent beating their passive competitors over the last decade.