Three pays out £2bn dividend to Hong Kong-listed owner amid concerns over Vodafone UK merger

Three UK has shelled out a record dividend of £2bn to its Hong Kong-listed owner, CK Hutchinson, after selling mobile phone masts.

The parent of telecoms group Three UK has dished out a record dividend of £2bn to its Hong Kong-listed owner, CK Hutchinson the Times reported today.

After reaping the benefits of a lucrative sale of mobile phone masts across Europe, Hutchison 3G, which trades as Three, made its first payout to the multinational conglomerate since its launch in the UK market two decades ago.

Months after paying out the dividend, Three raised some of its contract prices by 14 per cent.

The £2bn was related to CK Hutchison’s €10bn (£8.7bn) sale of about 24,600 telecom towers and sites, including 6,600 in the UK, to telecom company Cellnex.

Three said CK Hutchison had helped support investments in technology to improve customer connectivity, including enhancing 5G coverage. The company’s capital spending has totalled £2.3bn over the past three years.

Three was the UK’s first mainland 3G mobile network provider when it launched in 2003, and CK Hutchison lost money on the enterprise until 2010.

According to accounts filed at Companies House, Three generated revenue of £2.4bn last year, up three per cent year-on-year.

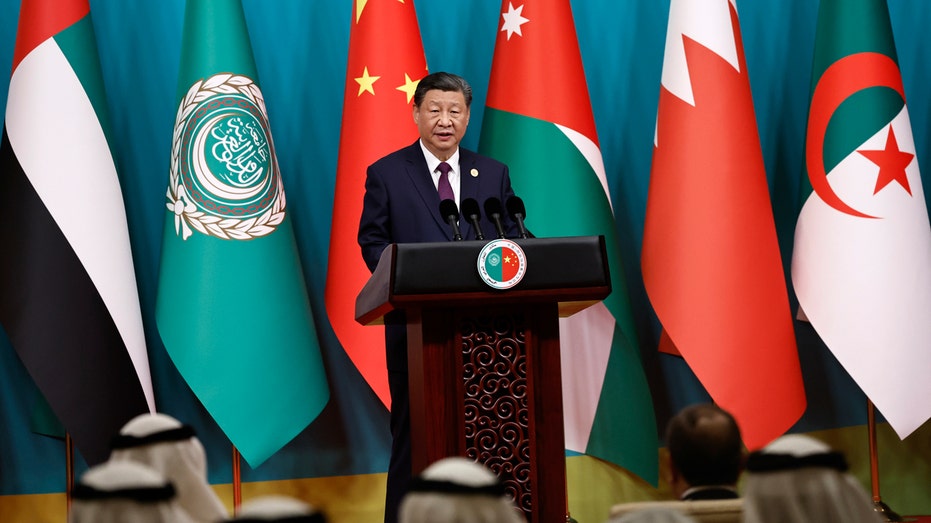

The owner of CK Hutchinson, Li Ka-shing, has previously come under fire for taking large dividends from its other UK assets.

The 95-year-old’s family, holding over 30 per cent of CK Hutchison, will pocket nearly £600m from these dividends. The holding company is registered in the Cayman Islands.

It comes amid an investigation into Three’s proposed tie-up with rival Vodafone’s UK operations, announced over the summer.

Britain’s competition watchdog has concerns about consolidating two of the country’s four major mobile operators. A decision is expected by the end of 2024.

The potential merger has also prompted a union campaign fearing job losses and potential consumer bill hikes.