Tritax Big Box and UK Commercial Property agree to merge creating £6.3bn real estate giant

In a stock exchange notice this morning, Tritax Big Box said the merger, which still needs to be voted on by shareholders, would "bring together complementary logistics-oriented investment portfolios with a shared focus on resilient and growing income."

Two commercial property real estate investment trusts, Tritax Big Box and UK Commercial Property, have reached an agreement on a possible merger.

In a stock exchange notice this morning, Tritax Big Box said the merger, which still needs to be voted on by shareholders, would “bring together complementary logistics-oriented investment portfolios with a shared focus on resilient and growing income.”

The deal would create the fourth largest UK real estate investment trust based on market capitalisation, at £3.9bn with a property portfolio worth £6.3bn. Its size would leave it on the edge of entering the FTSE 100.

The merger would see the entire share capital of UK Commercial Property absorbed into Tritax Big Box at the price of 0.444 Tritax Big Box shares per UKCM share.

This price per share implied a value of 71.1p per share for UK Commercial Property, a 10.8 per cent premium on its price when the deal was agreed last Friday and a 23 per cent premium over its six-month average.

Following the announcement, Tritax Big Box’s shares are down 1.5 per cent this morning, while UK Commercial Property’s shares are up 3.6 per cent.

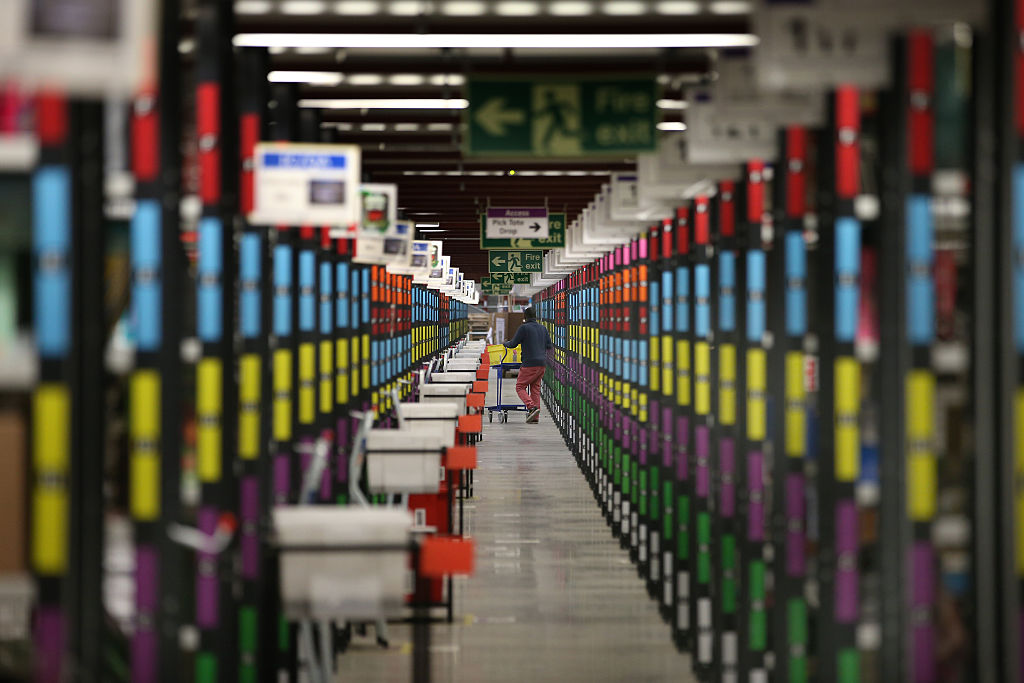

Tritax Big Box owns a range of mega box warehouses, with customers including Amazon, Ocado and Argos.

Meanwhile, UK Commercial Property has fewer large warehouses, instead also possessing hotels, retail parks and offices. However, it is unclear if the combined trust will keep these if the merger is successful.

Last year, UK Commercial Property looked to merge with another trust, Picton Property Income, but was eventually dropped in November after UK Commercial Property’s largest shareholder, Phoenix Life, blocked the deal.

The shareholder was always seen as the “lynchpin” of any potential merger, Numis analyst Andrew Rees said at the time, as it held 43 per cent of UK Commercial Property’s shares.

Tritax Big Box said today it had received non-binding letters of intent from both Phoenix and Investec Wealth & Investment UK, which control 56.5 per cent of UK Commercial Property’s share capital.