UK borrowing totalled £15bn last month as debt nears 100 per cent of GDP

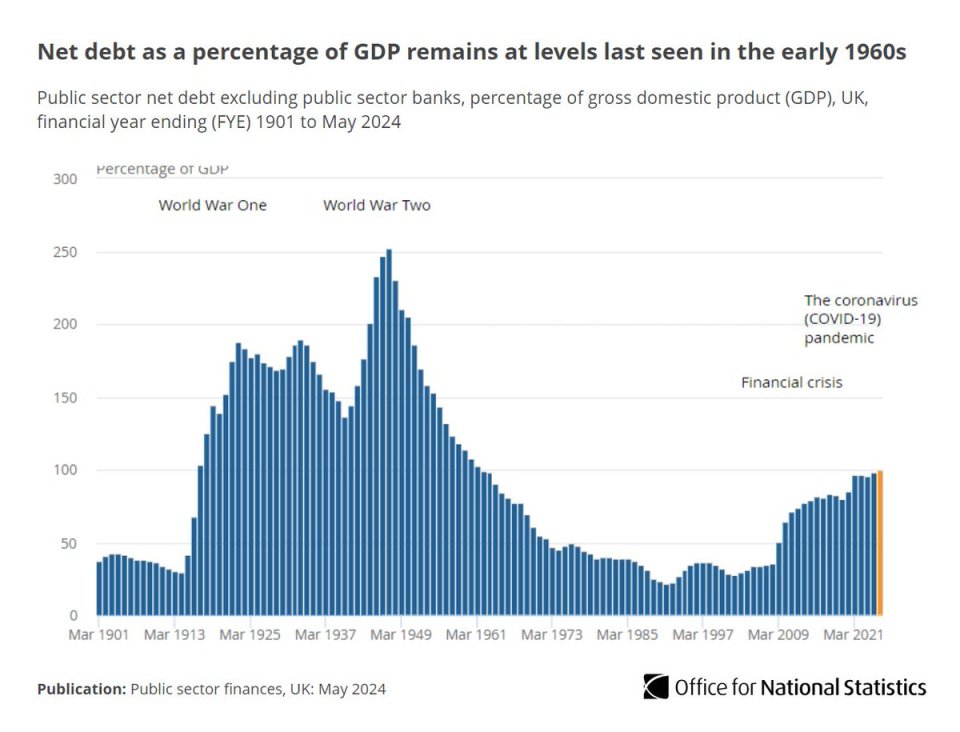

In fresh figures from the ONS, public sector net debt, excluding public sector banks, was just under 100 per cent of total GDP.

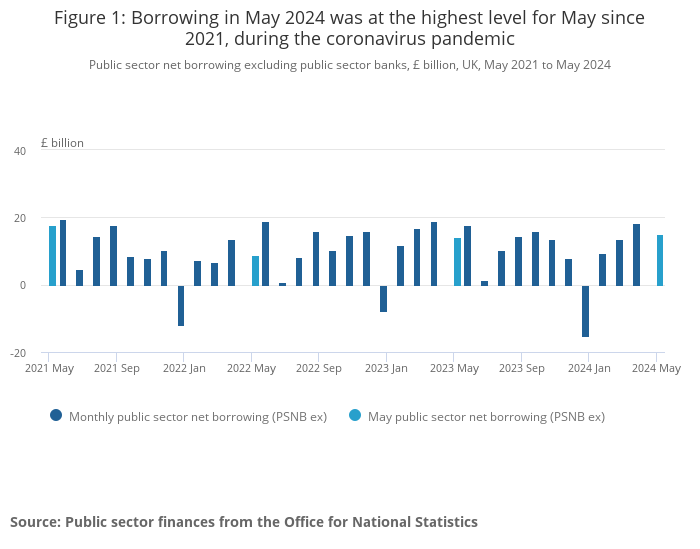

The UK government borrowed £15bn last month, almost a billion pounds more than the previous year and the highest for May since the Covid-19 pandemic.

In fresh figures from the Office for National Statistics released this morning, public sector net debt, excluding public sector banks, was just under 100 per cent of total GDP.

While borrowing for May was six per cent higher than the previous year, it was actually 4.2 per cent lower than forecast by the Office for Budget Responsibility.

Since records began in 1993, May’s borrowing figure was the highest apart from 2020 and 2021, during the pandemic.

Debt was estimated to be sitting at 99.8 per cent of GDP by the end of May, a 3.7 per cent rise on the previous year – reaching levels seen in the 1960s.

The ONS showed also that excluding the Bank of England, debt was 91.3 per cent of GDP, which was 5.3 percentage points more than May 2023 but 8.5 percentage points lower than the wider debt measure.

It has not been at this level since the early 1960s.

The latest figures will highlight a problem for the next government, with Labour way ahead in the polls and Rachel Reeves expected to take over as Chancellor from Jeremy Hunt

Rachel Reeves’ mantra during the election has been not to commit to any unfunded spending as part of its “growth manifesto”.

Its manifesto revealed Labour plans to raise around £7.3bn in revenue from tax, but Reeves has made an “iron-clad commitment” to rule out increases to national insurance, income tax or VAT.

Rishi Sunak has claimed, however, that Labour’s tax rises would lead to families seeing their household bills going up by more than £2,000 – a figure that has been widely questioned.