UK economy: Growth continues but budget concerns ‘jangling nerves’

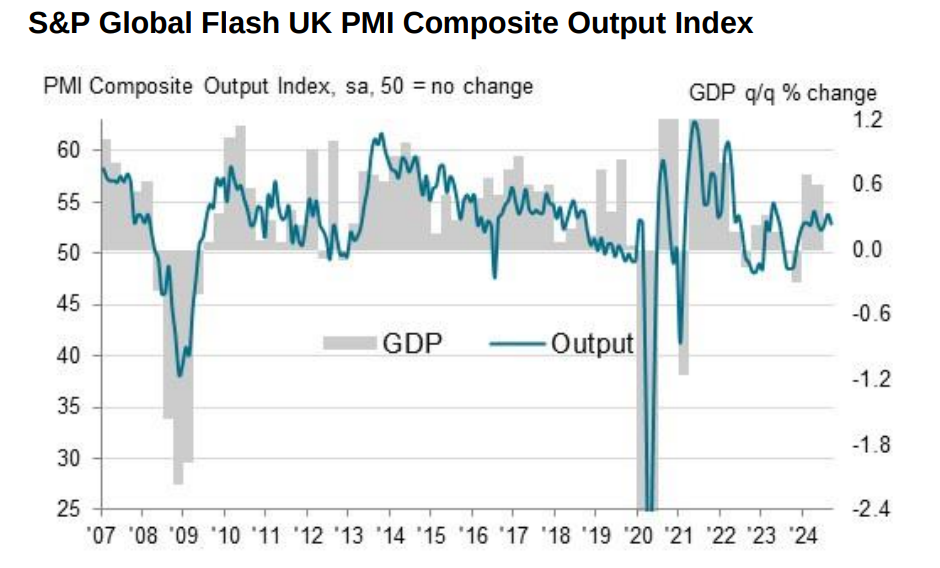

PMIs, which measure business activity in the private sector, are closely watched for clues about the economy’s performance.

Growth looks set to slow in the UK economy, according to a closely watched survey, as businesses await the October budget with a degree of caution.

The latest ‘flash’ purchasing managers’ index (PMI) came in at 52.9, down from last month’s figure of 53.8 and comfortably below expectations. It was the lowest reading for two months.

Nevertheless, the figure was comfortably above the 50 no-change mark and extended the run of expansion to 11 consecutive months.

The survey showed slower growth in both the services and the manufacturing sector, though both remained in expansionary territory.

“Where higher levels of output were reported, survey respondents mostly commented on rising customer demand and improving domestic economic conditions. Meanwhile, fragile client confidence and ongoing inventory cutbacks were cited as headwinds to growth in September,” the survey said.

Despite the slowdown, Chris Williamson, chief business economist at S&P Global Market Intelligence, said the survey “should not be seen as too concerning”.

He noted the survey was consistent with GDP growing at a quarterly rate of 0.3 per cent, in line with the Bank of England’s August forecasts.

The economy survey revealed another robust month for new business, led by strengthening order books across the services sector.

Business confidence also remained high thanks to the steadily improving economic outlook, although Williamson said the upcoming budget was “jangling nerves”.

“Investment plans in particular are reported to have been put on ice pending clarity on the new government’s policies, especially towards taxation. Hiring likewise has been stifled by business uncertainty about the near-term economic outlook ahead of the ‘budget’,” he said.

Clients were also reported to be taking a ‘wait-and-see’ approach to key decisions before the fiscal event.

Most economists thought the survey was consistent with a gradual slowdown in economic growth over the second half of the year after the UK’s surprisingly strong start.

“The fall in September’s composite flash PMI is not a sign that the economy is on the cusp of another downturn, but instead is further evidence that real GDP growth has slowed towards a more normal rate in Q3 after the burst of growth in the first half of the year,” Alex Kerr, UK economist at Capital Economics, said.

The survey also showed that inflationary pressures were moderating, with prices charged inflation falling to a 42-month low. This was largely a reflection of moderating pressures in the services sector, which has been a particular concern for rate-setters.

Many survey respondents suggested that intense competitive pressures had acted as a brake on pricing power.

However, there was a slight increase in input price inflation due to higher shipping costs and rising salary payments. In the manufacturing sector, purchase price inflation was the highest since January 2023.

The UK’s latest survey was released shortly after PMIs for the German economy showed an accelerating downturn, with businesses cutting jobs at the fastest rate in over 15 years outside of the pandemic.

“The downturn in the manufacturing sector has deepened again, evaporating any hope for an early recovery,” Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, said.