UK economy still Europe’s ‘bright spot’ after latest PMI surveys

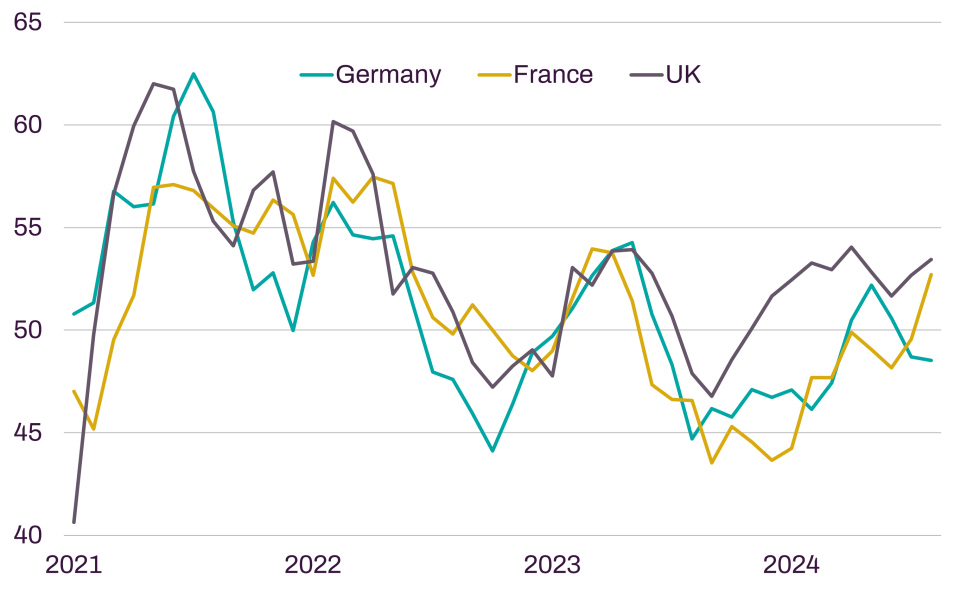

The latest 'flash' purchasing managers' index (PMIs), released yesterday by S&P, showed that the UK maintained its advantage over rivals on the continent in August.

The UK continued to be a “bright spot” among Europe’s major economies with surveys suggesting that the UK’s strong first half of the year will continue.

The latest ‘flash’ purchasing managers’ index (PMIs), released yesterday by S&P, showed that the UK maintained its advantage over rivals on the continent in August.

Kallum Pickering, chief economist at Peel Hunt said the surveys show the UK is still “a relative bright-spot among major European economies amid continued weakness in the Eurozone”.

In the UK, the PMI accelerated to 53.4 in August, up from 52.8 last month, with any measure over 50 indicating that the economy is expanding. Economists suggesting the survey was consistent with quarterly GDP growth of around 0.4 per cent.

The survey showed that the acceleration was largely driven by improving domestic demand as firms grew more and more confident in the UK’s economic revival.

Reflecting this greater confidence, employment growth accelerated to its fastest rate since July last year.

Inflationary pressures also appeared to be fading, with input price inflation easing to its lowest in just over three-and-a-half years.

“This is a goldilocks report for the Bank of England and the ECB is looking on in envy, with economic expansion in a sweet spot and inflationary pressures waning,” Kyle Chapman, FX Markets Analyst at Ballinger Group said.

Although the eurozone also saw an improving picture, with the PMI rising to 51.2 in August from 50.2 last month, this was largely due to a boost to the French services sector from the Olympics.

The services PMI in France jumped to 55.0 in August, up from 50.1 in July and well ahead of expectations, putting it at its highest level in 27 months. Most economists think it will revert back in September now that the Olympics are over.

Bert Colijn, senior sector economist at ING, said the distortion from the Olympics made the PMI “more difficult to interpret than usual”.

Germany meanwhile continued to struggle, with the PMI falling deeper into contractionary territory at 48.5, down from 49.1 in July.

This was largely driven by continued difficulties in the manufacturing sector, which dropped to 42.1 in August from 43.2 in July. The manufacturing sector has now been in decline for 19 consecutive months.

“Germany’s export-and-production-oriented economy continued to struggle as domestic consumer softness and geopolitical uncertainties hurt sentiment,” Pickering said.

The eurozone has grown at a much slower pace than the UK so far this year, notching 0.3 per cent growth in both the first and second quarter. The UK, by contrast, grew 0.7 per cent in the first quarter and 0.6 per cent in the second.