UK economy takes first steps out of recession as growth returns in January

The figures will raise hopes that the UK is already moving out of the shallow recession it fell into in the second half of last year.

The UK took its first steps out of recession after the economy returned to growth in January, raising hopes that last year’s contraction is already over.

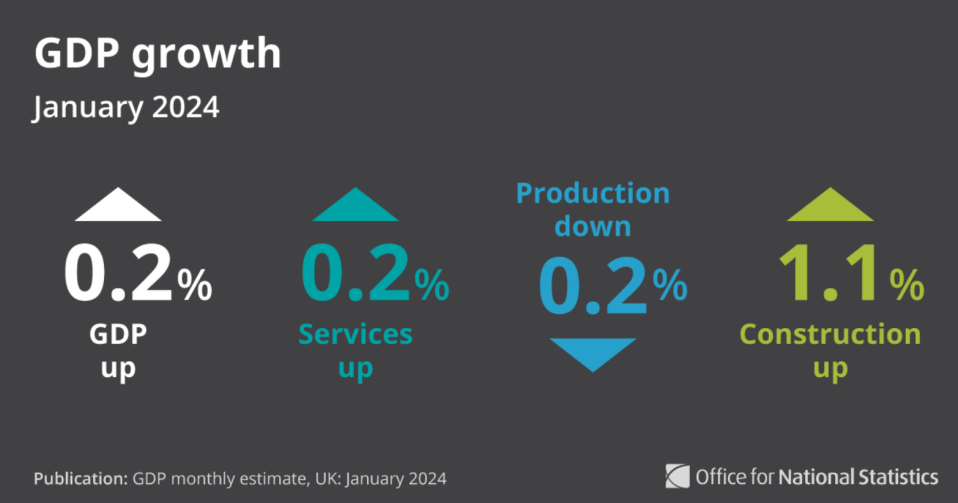

The UK economy grew 0.2 per cent in January, according to figures from the Office for National Statistics (ONS), in line with economists’ expectations. This followed a 0.1 per cent fall in December.

The expansion was driven by a strong performance from the UK’s all-important services sector, which expanded 0.2 per cent helping to offset a 0.2 per cent fall in production.

Within services, retailers posted a strong month after a poor festive period. Human, health and social activity also saw an expansion of 0.6 per cent in January.

Construction meanwhile jumped 1.1 per cent in January as the outlook for housebuilders improved on the back of hopes that interest rates will soon start falling.

“The economy picked up in January with strong growth in retail and wholesaling. Construction also performed well with housebuilders having a good month, having been subdued for much of the last year,” Liz McKeown, director of economic statistics at the ONS said.

“These were partially offset by falls in TV and film production, lawyers and the often-erratic pharmaceutical industry,” she continued.

Yael Selfin, chief economist at KPMG, said that the recovery was “relatively broad-based”. Citing forward looking indicators, such as recent business surveys, Selfin said there would be “a further strengthening of momentum in February”.

The figures will raise hopes that the UK is already moving out of the shallow recession it fell into in the second half of last year. A technical recession is two consecutive quarters of negative growth.

Output dropped 0.3 per cent in the final quarter of last year, bringing to an end a year in which the UK economy was largely stagnant. The economy has slowed down significantly in the face of stubborn inflation and high interest rates.

The benchmark Bank Rate stands at a post-financial crisis high of 5.25 per cent, having been hiked from just 0.1 per cent at the end of 2021. This has sent a chill through the economy as households and businesses struggle under the burden of higher borrowing costs.

However, inflation has fallen sharply from its peaks while the Bank of England is expected to start cutting interest rates later this year.

A number of economists are hopeful that lower inflation and falling interest rates will lay the groundwork for a stronger performance this year.

Analysts at Pantheon Macroeconomics forecast that real disposable income would rebound 2.2 per cent in 2024, which would help consumer spending to rise two per cent in the year.

Economists think the UK will grow 0.4 per cent this year, although the Office for Budget Responsibility (OBR) expect a 0.8 per cent expansion.

“While the last few years have been tough, today’s numbers show we are making progress in growing the economy,” Chancellor Jeremy Hunt said.