UK services sector continues to grow driving fears of ‘sticky’ inflation

Firms in the service sector noted that economic conditions were slowly improving, but flagged household incomes remained constrained due to higher interest rates.

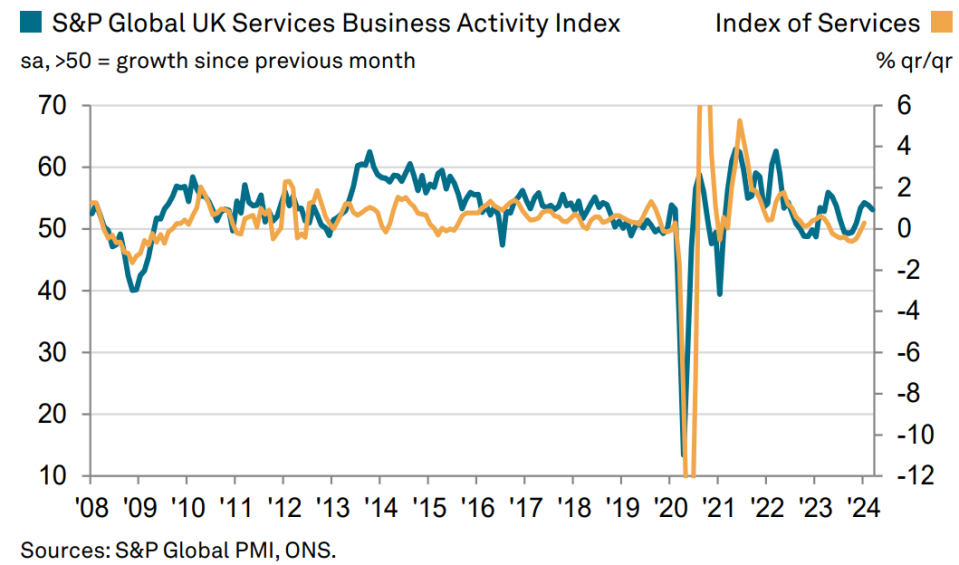

The UK’s all-important services sector lost some momentum in March but its strong start to the year remained broadly intact, according to a closely watched survey.

S&P’s purchasing managers’ index (PMI) for the services sector registered 53.1 in March, down from 53.8 in February and below the earlier 53.4 ‘flash’ estimate.

Although the survey suggested momentum in the services sector was slowing, it still remained comfortably above the 50 no-change mark.

Firms in the service sector noted that economic conditions were slowly improving, but flagged household incomes remained constrained due to higher interest rates.

The slowdown compared to February was driven by a slower increase in new work, which fell to a four-month low.

“The recovery in service sector output lost a little bit of momentum during March, and more so than suggested by the flash PMI results, but the overall picture remains reasonably positive,” Tim Moore, economics director at S&P Global Market Intelligence, said.

“The solid growth rate achieved in March reinforces the view that a rebound in service sector performance is helping the UK economy to pull out of last year’s shallow recession,” Moore continued.

The survey also revealed stubborn inflationary pressures. Input costs continued rising on the back of strong wage growth and higher transport costs.

Cost inflation has broadly held steady over the past six months and remains above the pre-pandemic trend.

The rate of prices charged inflation eased to its lowest level for six months, albeit still at a relatively fast pace. The survey noted that “constrained pricing power” and a need to stimulate demand had prevented firms from being able to fully pass on costs to consumers.

Moore warned that the lack of progress on prices charged was only adding to signs of “sticky inflationary pressures in the domestic economy”.

Looking forward, over half the firms surveyed forecast a rise in output levels with only one-in-ten predicting a decline.

“Anecdotal evidence cited stronger sales pipelines and improving economic conditions, but some firms noted concerns about political uncertainty and greater hesitancy among clients,” the survey noted.

Combined with the revised figures out from the manufacturing sector earlier this week, the final composite PMI came in at 52.8, slightly below the previous estimate of 52.9.

“Growth has eased back from a new year spurt but the economy continues to hum along,” Rob Wood, chief UK economist at Pantheon Macroeconomics said.