US inflation back in focus for markets as traders back September rate cut

Prices are expected to increase just 0.1 per cent in June, which would bring the annual rate of inflation down to 3.1 per cent.

US inflation will be the main event for investors this week as markets await further news on when the Federal Reserve might start cutting interest rates.

Prices are expected to increase just 0.1 per cent in June, which would bring the annual rate of inflation down to 3.1 per cent.

Core inflation, which strips out volatile components like food and energy, is expected to increase by 0.2 per cent, leaving the annual rate at 3.4 per cent.

Inflation has edged lower over the past few months, but the Fed has resisted calls to cut rates amid persistent price pressure concerns.

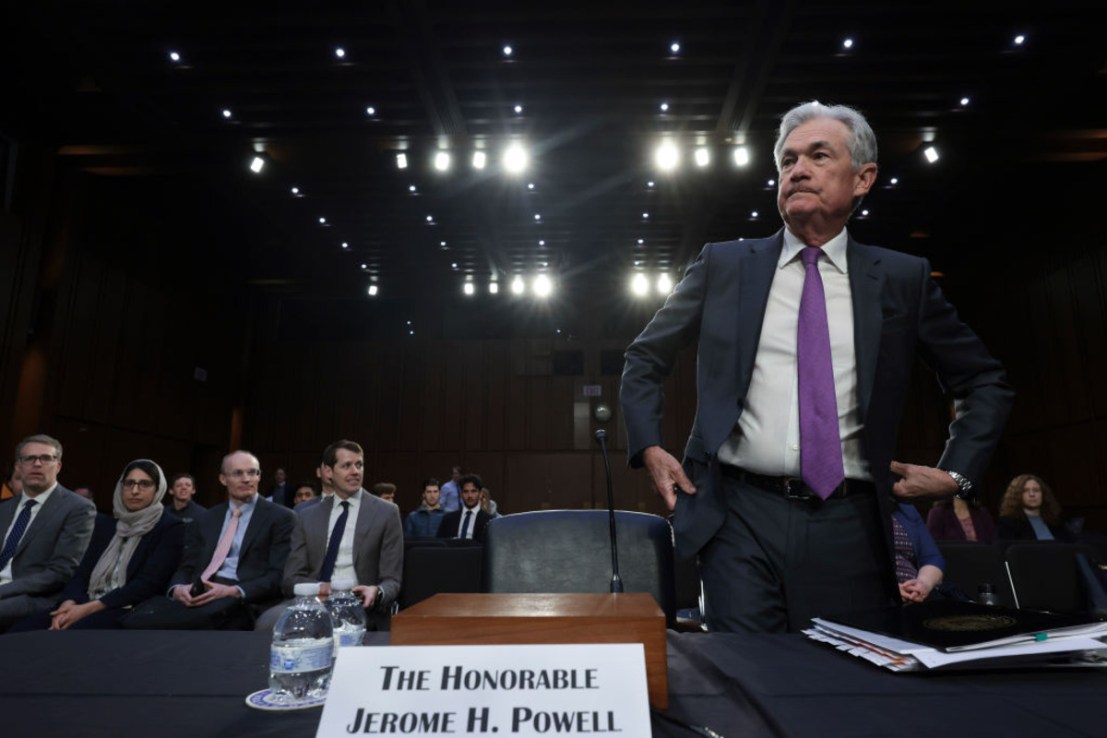

When he spoke at a conference in Portugal last week, Fed Chair Jerome Powell failed to provide guidance on when the central bank might make the first move.

“We just want to understand that the levels that we’re seeing are a true reading on what is actually happening with underlying inflation. We want to be more confident, and frankly, because the US economy is strong … we have the ability to take our time,” he said.

However, the latest jobs report on Friday showed further signs of cooling in the labour market, with job growth weaker than expected and unemployment rising.

According to CME’s Fedwatch, investors think there is a roughly 70 per cent chance that the Fed will lower rates in September.

At the end of the week, the biggest US banks will reveal their latest set of quarterly results. Shares in the big four banks have risen by about 40 per cent over the past year on the back of resilient economic growth and generous shareholder distributions.

AJ Bell’s investment director Russ Mould said: “Investors will head straight to the headline net income and earnings per share (EPS) numbers, along with any guidance for the third quarter”.

“Intriguingly, consensus has aggregate earnings falling year-on-year in Q2 and Q3,” he noted.

In the UK, the focus will be on the latest GDP figures, released on Thursday. The economy is expected to return to growth after stagnating in April.