Value of mortgages in arrears hits highest level since 2014 – Bank of England

Mortgage holders are continuing to feel the pain from the Bank of England’s efforts to combat inflation, according to new figures. Data released by the Bank showed that the value of outstanding mortgages in arrears hit £21.9bn in the second quarter of this year, the highest figure since 2014. This was a 32 per cent [...]

Mortgage holders are continuing to feel the pain from the Bank of England’s efforts to combat inflation, according to new figures.

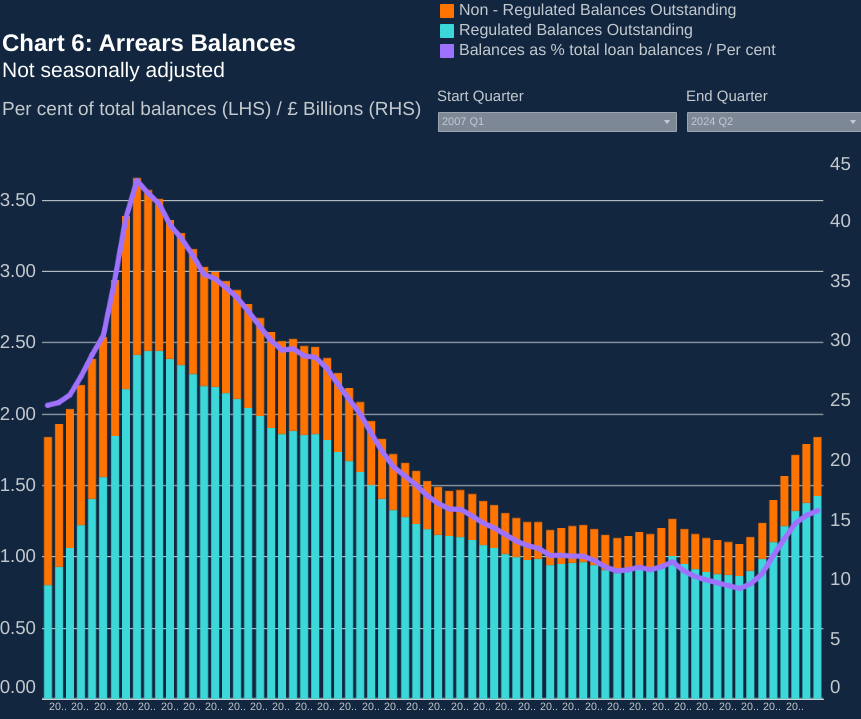

Data released by the Bank showed that the value of outstanding mortgages in arrears hit £21.9bn in the second quarter of this year, the highest figure since 2014. This was a 32 per cent increase on the same period last year.

The proportion of loans with arrears also increased on the quarter, rising to 1.32 per cent from 1.29 per cent previously, the highest share since 2016.

Although the share of homeowners falling behind on payments has increased, it remains well short of its peaks in the financial crisis. In the first quarter of 2009, 3.64 of total loans were in arrears.

Still, the figures reveal the pressures that households have faced as a result of the Bank of England’s aggressive monetary tightening campaign.

Within less than two years, the Bank Rate – which acts as a benchmark for lending in the rest of the economy – was lifted from near zero to a peak 5.25 per cent as policymakers sought to combat inflation.

Mortgage rates rose in response, with many borrowers having to fork out hundreds of pounds a month more. This has led to a steady rise in the share of households falling behind on mortgage payments.

“As more borrowers came off cheap fixed rates over the past couple of years and faced a significant increase in their mortgage payments, it was inevitable that we would see a rise in arrears flowing through the system,” Tom Cuppello, director of risk at Broadstone said.

Although most borrowers have rolled onto more expensive deals, the Bank said in June that over 3m households were still paying rates of less than three per cent.

Many of those deals, which were agreed before the Bank started hiking interest rates, will finish by the end of next year.

According to the Bank, a typical borrower whose fixed-rate deal expires during that period will have to pay £180 more each month, suggesting there may be further pain ahead.

Nevertheless, the data also showed that new arrears cases decreased by 0.5 percentage points compared to the previous quarter.